On November 16, 2021, the Governor of the State Bank of Vietnam issued Circular 17/2021/TT-NHNN amending Circular 19/2016/TT-NHNN on bankcard activities.

Accordingly, the card issuer can issue debit, credit, and prepaid cards for cardholders who are individuals electronically.

To implement the above content, the card issuer must develop, issue, and publicize the process and procedures for issuing cards of individuals by electronic means by regulations necessary before entering into a card issuance and use contract with a customer to identify the customer and determine the card’s transaction limit by regulations;

– Check, compare and verify customer identification information;

– Warn customers about actions not to be taken in the process of opening and using cards issued by electronic means;

– Provide customers with card issuance and use contracts and enter into card issuance and use contracts with customers to ensure the provisions of the law on electronic transactions;

– Notify the name of the card issuer, the name or trademark of the card, the card number, the validity period of the card, the name of the cardholder, the scope and function, and the prohibitions according to regulations when using the card for customers row.

Implementation of Resolution No. 63/NQ-CP dated June 29, 2021, of the Government on key tasks and solutions to promote economic growth, disbursement of public investment, and sustainable exports in the last months of 2021 and early 2022; direction of the Prime Minister in Official Dispatch No. 8374/VPCP-KTTH dated November 15, 2021, on reviewing and reducing fees to remove difficulties for opponents affected by Covid 19, accordingly, on On December 24, 2021, the Ministry of Finance issued a Circular stipulating the rate of collection of several fees to support and remove difficulties for those affected by the Covid pandemic from January 1, 2022.

In which, there are a total of 37 fees, which are reduced from 50% to 90% compared with the fee schedule prescribed by law corresponding to each fee. Highlights of the following fees:

– Airport and aerodrome franchising fee: The fee is equal to 90% of the fee rate specified in Article 4 of Circular No. 247/2016/TT-BTC dated 11 November 2016 of the Minister of Finance stipulating the collection rate, mode of collection, payment, management and use of fees for franchising the operation of airports and aerodromes.

– Secured transaction registration fee: With a rate equal to 80% of the fee rate specified at Points a, b and d, Section 1, Fee schedule in Article 4 of Circular No. 202/2016/TT-BTC dated 09 November 2016 of the Minister of Finance stipulating the rate, collection, payment, management and use of fees in the field of secured transaction registration; and equal to 80% of the toll rate specified at Points c and dd, Section 1 of the Fee Schedule in Article 1 of Circular No. 113/2017/TT-BTC dated October 20, 2017, of the Minister of Finance amending and supplementing several articles of Circular No. 202/2016/TT-BTC.

– Fees for issuance of operation permits to send workers to work abroad for a definite term: with a rate equal to 50% of the fee rate specified in Section 1 of the fee schedule in Article 4 of Circular No. 259/2016/TT-BTC dated November 11, 2016, of the Minister of Finance stipulating the collection rate, mode of collection, payment, management and use of fees for verification of documents, fees for granting operation permits to bring workers going to work abroad for a limited time.

There are many other fees reduced to support and remove for those affected by Covid – 19 in many different fields. It can be seen that these policies have partly shown the attention and support of the Government, thereby, contributing to creating motivation for individuals, organizations, enterprises, … to soon stabilize their lives and production, and economic development.

On October 11, 2021, the Prime Minister issued Decision No. 31/2021/QD-TTg promulgating the Regulation on management, operation, and exploitation of the National Service Portal (“The Decision 31”). The Decision 31 consists of 8 chapters and 64 articles detailing principles, powers, responsibilities, methods of management, operation and exploitation of the National Public Service Portal.

Through this article, let’s learn together with Bizlawyer about new guidelines for organizations and individuals wishing to submit their complaints and petitions directly on the National Service Portal (Refer to Chapter 6 of Decision 31).

1. Ways to send complaints and petitions on the National Public Service Portal: 02 ways

– Access the National Public Service Portal, address: https://dichvucong.gov.vn, section complaints and petitions to send complaints and petitions.

– Submit complaints and petitions during the implementation of online public services on the National Public Service Portal.

2. Values of complaints and petitions

– Contents of complaints and petitions of organizations and individuals and replies of competent state agencies on the National Public Service Portal are as valid as paper documents.

– Activities and contents of receiving, coordinating, and handling complaints and petitions of receiving and handling agencies on the National Public Service Portal are as valid as paper documents.

3. Time limit for handling and responding to complaints and petitions

– The time limit for handling and replying to complaints and petitions is 15 working days from the date of receipt of complaints or petitions. Ministries, branches, and localities update the handling situation into the information system for receiving and responding to complaints and petitions for responding to organizations and individuals.

– For complaints and petitions with handling results, within 02 working days, ministries, branches, and localities shall update the results into the information system for receiving and responding to complaints and petitions for responding to organizations and individuals.

The issuance of Decision 31 has proven the efforts of the government in reforming administrative procedures and public services today. In addition, the application of modern science and technology in public administration is expected not only to improve the quality of management activities of state agencies but also to positively improve the life and work of all individuals and organizations in society.

Decision 31 will take effect from December 9, 2021.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

On October 11, 2021, the Prime Minister issued Decision No. 31/2021/QD-TTg promulgating the Regulation on management, operation, and exploitation of the National Service Portal (“The Decision 31”). The Decision 31 consists of 8 chapters and 64 articles detailing principles, powers, responsibilities, methods of management, operation, and exploitation of the National Public Service Portal.

Through this article, let’s learn together with Bizlawyer about 05 principles of management, operation, and exploitation of the National Public Service Portal under The Decision 31:

– Principle 01: The management, operation, and exploitation of the National Public Service Portal must comply with the provisions of the law on control of administrative procedures, implement the one-stop mechanism, an interconnecting door, electronic transactions, information safety, security, protection of State secrets and other relevant regulations, ensuring that the implementation of administrative procedures in the electronic environment and online public services is smooth, economical, safe and effective.

– Principle 02: The organization of information on the National Public Service Portal is user-centered. The information provided on the National Public Service Portal is accurate, clear, continuously updated, and timely in accordance with current regulations. The information is presented scientifically, accessible to users, and can be accessed and exploited at all times.

– Principle 03: The National Public Service Portal is connected smoothly and continuously with the Public Service Portal, an Electronic one-stop information system at the ministerial and provincial level, Guaranteed 24-hour operation every day of the week.

– Principle 04: Participation in the management, operation, and exploitation of the National Public Service Portal ensure proper authority and responsibility in accordance with current law provisions.

– Principle 05: The exploitation and reuse of information of organizations and individuals in performing administrative procedures and online public services must comply with the provisions of the law on information protection, personal data.

The issuance of Decision 31 has proven the efforts of the government in reforming administrative procedures and public services today. In addition, the application of modern science and technology in public administration is expected not only to improve the quality of management activities of state agencies but also to positively improve life and work. of all individuals and organizations in society.

Decision 31 will take effect from December 9, 2021.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

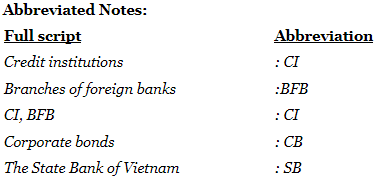

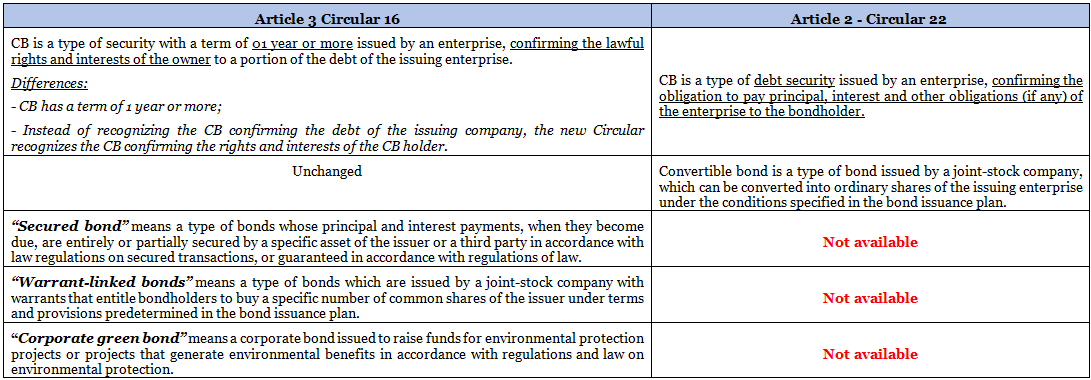

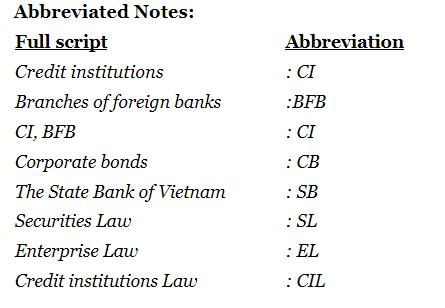

On November 10, 2021, the Governor of the State Bank of Vietnam issued Circular 16/2021/TT-NHNN on the purchase and sale of corporate bonds by credit institutions and foreign bank branches (“Circulars 16”), accordingly, Circular 16 replaces Circular No. 22/2016/TT-NHNN (“Circular 22”) and Circular No. 15/2018/TT-NHNN (“Circular 15”).

Through this article, readers, please join Bizlawyer to learn about the new point in Circular 16 compared to the previous regulations. Specifically: New terms in the purchase and sale of corporate bonds of credit institutions. Details as in the comparison table below.

The above are Bizlawyer’s updates on New terms in the purchase and sale of corporate bonds of credit institutions.

Circular 16 will take effect from January 15, 2022.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

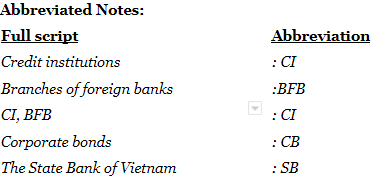

On November 10, 2021, the Governor of the State Bank of Vietnam issued Circular 16/2021/TT-NHNN on the purchase and sale of corporate bonds by credit institutions and foreign bank branches (“Circulars 16”), accordingly, Circular 16 replaces Circular No. 22/2016/TT-NHNN (“Circular 22”) and Circular No. 15/2018/TT-NHNN (“Circular 15”).

Through this article, readers, please join Bizlawyer to learn about the new point in Circular 16 compared to the previous regulations. Specifically: New adjustments on the responsibilities of CIs when buying CBs according to the new Circular. Details as in the comparison table below.

The above are Bizlawyer’s updates on New adjustments on the responsibilities of CIs when buying CBs according to the new Circular.

Circular 16 will take effect from January 15, 2022.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

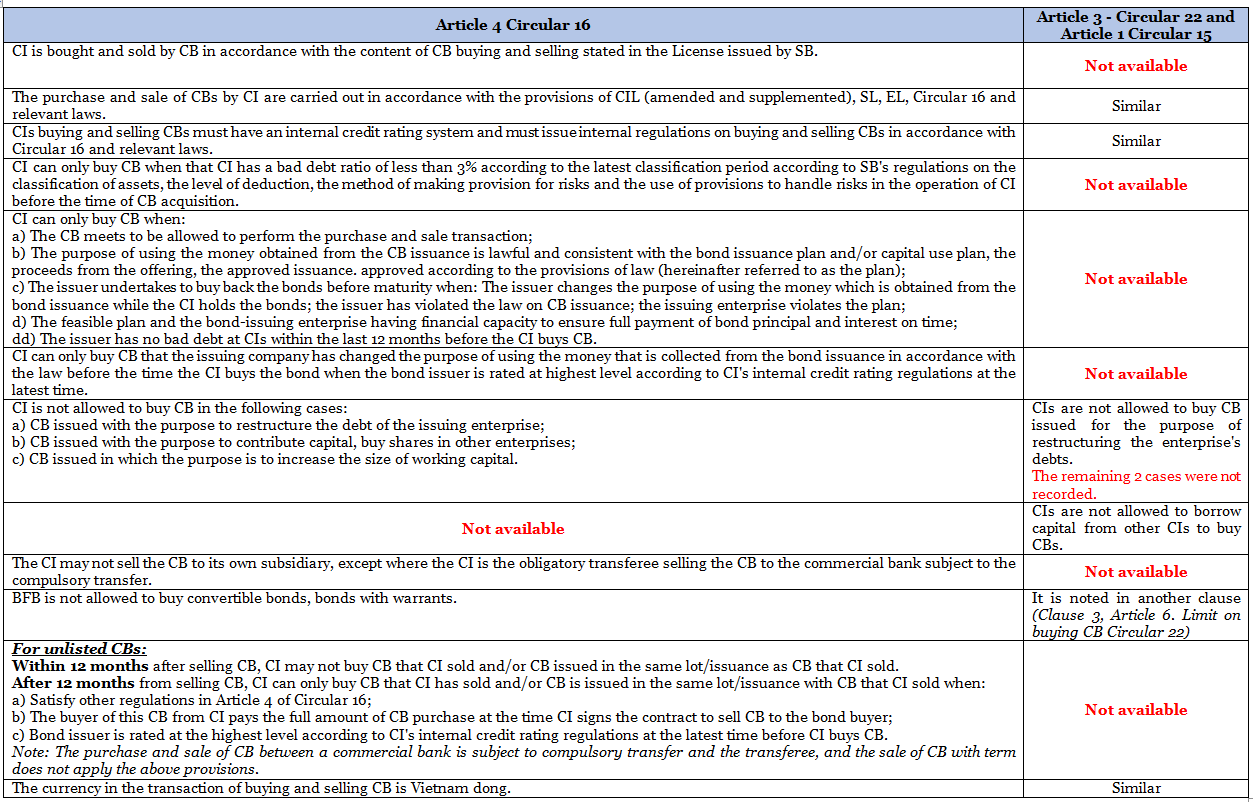

On November 10, 2021, the Governor of the State Bank of Vietnam issued Circular 16/2021/TT-NHNN on the purchase and sale of corporate bonds by credit institutions and foreign bank branches (“Circulars 16”), accordingly, Circular 16 replaces Circular No. 22/2016/TT-NHNN (“Circular 22”) and Circular No. 15/2018/TT-NHNN (“Circular 15”).

Through this article, readers, please join Bizlawyer to learn about the new point in Circular 16 compared to the previous regulations. Specifically: New principles in buying and selling CBs of CIs. Details as in the comparison table below:

The above are Bizlawyer’s updates on the new principles in buying and selling CB of CIs in Circular 16 compared to Circular 22 and Circular 15.

Circular 16 will take effect from January 15, 2022.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

On September 25, 2021, the Government issued Decree No.85/2021/ND-CP amending and supplementing a number of articles of Decree No.52/2013/ND-CP dated May 16, 2013, on the e-commerce trading floor. As for regulations on information on goods and services introduced on sales e-commerce websites, in this Decree, a number of new regulations have been added, including:

Compared with Decree No. 52/2013/ND-CP, Decree No. 85/2021/ND-CP has added conditions (2) and (3) for information about goods and services introduced on the website. Therefore, traders, organizations, and individuals with e-commerce activities need to do the following:

This Decree takes effect from January 1, 2022.

On September 25, 2021, the Government issued Decree No.85/2021/ND-CP amending and supplementing a number of articles of Decree No.52/2013/ND-CP dated May 16, 2013, on the e-commerce trading floor. Accordingly, this Decree has added new regulations on e-commerce activities of foreign traders and organizations, especially regulations on market access conditions of foreign investors in the service sector of e-commerce. Market access conditions include:

In which, a foreign investor is considered to be dominant in an enterprise providing e-commerce services according to the above regulations when it falls into one of the following cases:

(For determining the group of 05 leading enterprises in the market, it is based on the criteria of the number of visits, the number of sellers, the number of transactions, the total transaction value).

Thus, the provision of e-commerce services is a conditional market access industry for foreign investors. When foreign investors conduct investment activities in Vietnam, they must comply with the above regulations on market access conditions.

This Decree takes effect from January 1, 2022.