On March 28, 2022, the Prime Minister issued Decision No. 08/2022/QD-TTG, in which regulations on the implementation of policies to support rent for employees returning to the labor market. As follows:

1. Objects of support: Employees who are working in enterprises, cooperatives, business households with business registration in industrial parks, export processing zones, or key economic areas.

Conditions of support: Employees in the above categories are supported when they fully meet the following conditions:

– Renting, and lodging in the period from April 1, 2022, to June 30, 2022.

– Have an indefinite-term labor contract or a definite-term labor contract of 01 month or more signed and performed between April 1, 2022, and June 30, 2022 (except for the labor contract concluded in the continuation of the labor contract signed and performed previously).

– Being participating in compulsory social insurance (named on the list of participating in compulsory social insurance of the social insurance agency) in the month immediately preceding the time the employer prepares the list of proposed employees offering rent assistance.

– In case: (i) the employee is not subject to compulsory social insurance (as prescribed in Clause 4, Article 2 of Decree No. 115/2015/ND-CP dated November 11, 2015, of the Government); (ii) newly recruited employees who have entered into a labor contract but are not on the list of compulsory social insurance participation of the social insurance agency: they must be on the employer’s salary list of the month preceding the time the employer makes a list of employees requesting rent support.

2. Support level: 1,000,000 VND/person/month.

3. Support period: Up to 03 months.

4. Payment method: Monthly

5. Dossier to request support:

– List of employees who request rent support certified by the social insurance agency (made according to the form).

– A copy of the salary list of the month immediately preceding the time the enterprise makes a list of employees requesting housing rent support (In case there are employees on the list who are not subject to the compulsory social insurance participation; newly recruited employees who have entered into labor contracts but are not on the list of compulsory social insurance participation by the social insurance agency).

This Decision takes effect from March 28, 2022.

On March 28, 2022, the Prime Minister issued Decision No. 08/2022/QD-TTG, in which regulations on the implementation of policies to support rent for employees working at the enterprise. As follows:

1. Objects of support: Employees who are working in enterprises in industrial parks, export processing zones, or key economic areas.

Conditions of support: Employees in the above categories are supported when they fully meet the following conditions:

– Renting, and lodging in a motel during the period from February 1, 2022, to June 30, 2022.

– Have an indefinite-term labor contract or a definite-term labor contract of 1 month or more signed and commenced before April 1, 2022.

– Being participating in compulsory social insurance (named on the list of participating in compulsory social insurance of the social insurance agency) in the month preceding the time the enterprise prepares the list of employees requesting support house rent.

– In case the employee is not subject to compulsory social insurance (as prescribed in Clause 4, Article 2 of Decree No. 115/2015/ND-CP dated November 11, 2015, of the Government): they must have their name on the enterprise’s salary list of the month preceding the time the enterprise makes a list of employees requesting rent support.

2. Support level: 500,000 VND/person/month.

3. Support period: Up to 03 months.

4. Payment method: Monthly

5. Dossier to request support:

6. List of employees who request rent support certified by the social insurance agency (made according to the form).

– A copy of the salary list of the month immediately preceding the time the enterprise makes a list of employees requesting housing rent support (In case there are employees on the list who are not subject to compulsory social insurance participation).

This Decision takes effect from March 28, 2022.

The State Bank has issued Circular No. 24/2021/TT-NHNN providing for an independent audit of credit institutions and foreign bank branches (“Circular 24”), whereby Circular 24 will come into effect on April 15, 2022.

The main contents of Circular 24 related to independent audit contents are as follows:

Firstly: Regarding the independent audit of financial statements of credit institutions and foreign bank branches, the following audit contents must be included:

a) Balance sheet;

b) Report on business results;

c) Cash flow statement;

d) Notes to the financial statements.

Secondly: Regarding the independent audit of the operation of the internal control system of the credit institution or foreign bank’s branch, it must include at least the following contents:

a) Auditing the internal control system of the credit institution, and foreign bank branch (including internal mechanisms, policies, processes, and regulations) in compliance with current laws. and regulations of the State Bank on the internal control system of credit institutions and foreign bank branches. For the contents of the internal control system that have been audited for compliance without any change, such content is not required to be re-audited;

b) Auditing the operation of the internal control system for the preparation and presentation of financial statements;

c) In addition to the audit contents specified at Points a and b of this Clause, the commercial bank or foreign bank branch must audit the operation of the internal control system for the content of the internal assessment on the sufficient capital level of commercial banks and foreign bank branches in accordance with the State Bank’s regulations on the internal control system.

Circular 24 takes effect from April 15, 2022.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

On March 23, 2022, the Ministry of Finance issued Official Letter No. 2688/BTC-TCT on value-added tax in Decree No. 15/2022/ND-CP. Accordingly, this Official Letter has detailed instructions on making invoices for the following specific cases:

1. In case a business establishment signs a service provision contract with a collection of money before or during service provision has issued an invoice at the time of collection before February 1, 2022, at the tax rate of 10% but Services completed during the period from February 1, 2022, to the end of December 31, 2022:

– For the amount billed before February 1, 2022, it is not eligible for discount policy VAT;

– For the remaining unpaid amount, invoiced from February 1, 2022, to the end of December 31, 2022, according to the provisions of law, the VAT reduction policy will be applied.

2. In case the business establishment provides goods and services subject to the tax rate of 10% in January 2022, it is not until February 2022 that the business establishment issues an invoice for the revenue from the sale of goods and services. The cases arising in January 2022 are in the case of making invoices at the wrong time and not being eligible for VAT reduction.

3. For invoices made before February 1, 2022, with the VAT rate of 10%, after February 1, 2022, there are errors that need to be adjusted in terms of goods, VAT, or payment. If the goods are returned, the adjusted invoice and the goods return invoice are made with the VAT rate of 10%.

4. For the provision of specific goods and services such as electricity, business establishments are entitled to VAT reduction according to regulations for invoices made from February 1, 2022, to the end of December 31, 2022.

This Official Letter takes effect from March 23, 2022.

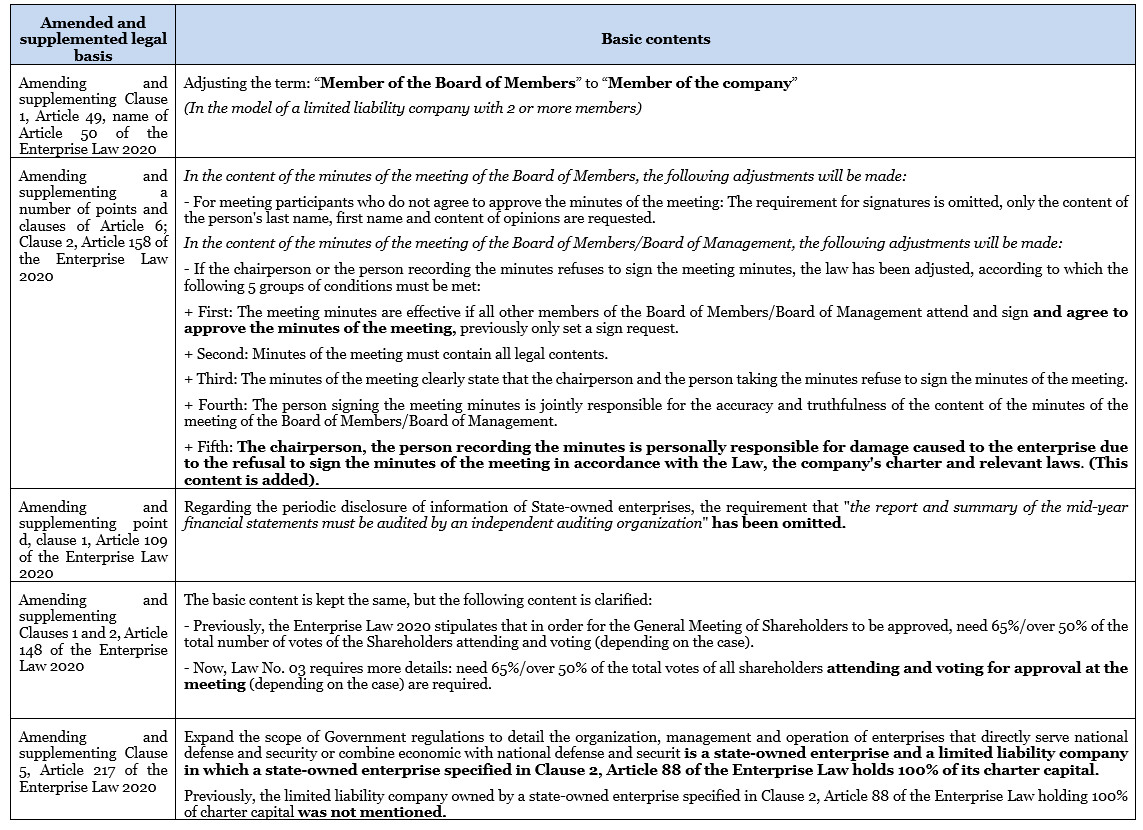

On January 11, 2022, the National Assembly promulgated Law No. 03/2022/QH15 to amend a number of provisions in the Enterprise Law 2020 and other related Laws (“Law No. 03”).

Let’s take a look at some new adjustments to the Enterprise Law 2020 with Bizlawyer.

Law No. 03 will officially take effect from March 1, 2022.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

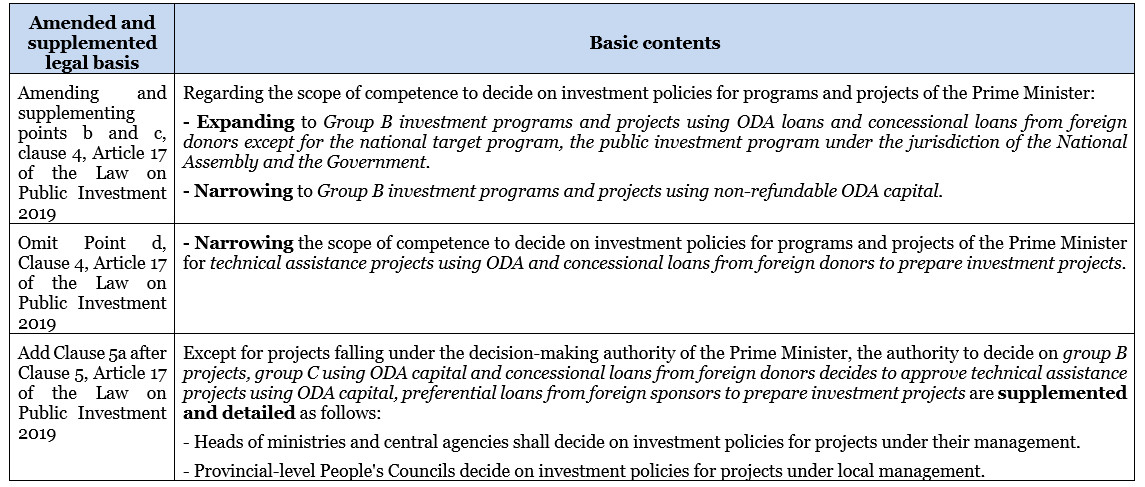

On January 11, 2022, the National Assembly promulgated Law No. 03/2022/QH15 to amend a number of provisions in the Law on Public Investment 2019 and other relevant Laws (“Law No. 03”).

Let’s review with Bizlawyer some new adjustments to the Law on Public Investment 2019.

Law No. 03 will officially take effect from March 1, 2022.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

On February 24, 2022, the Minister of Finance issued Decision 206/QD-BTC in 2022 implementing the application of e-invoices in 57 central cities and provinces (“Decision 206”).

Let’s take a look at the main content of Decision 206 with Bizlawyer.

– From April 2022: E-invoices will be required to be applied simultaneously to enterprises, economic organizations, business households, and business individuals in 57 provinces and cities (except for some cases where the conditions are not satisfied) (Previously, from November 2021, in 6 provinces and cities that have applied e-invoices: Hanoi, Ho Chi Minh City, Hai Phong, Phu Tho, Quang Ninh, Binh Dinh).

– The application of e-invoices in 57 provinces and cities must comply with regulations on e-invoices in relevant legal documents.

Decision 206 takes effect from the date of signing.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

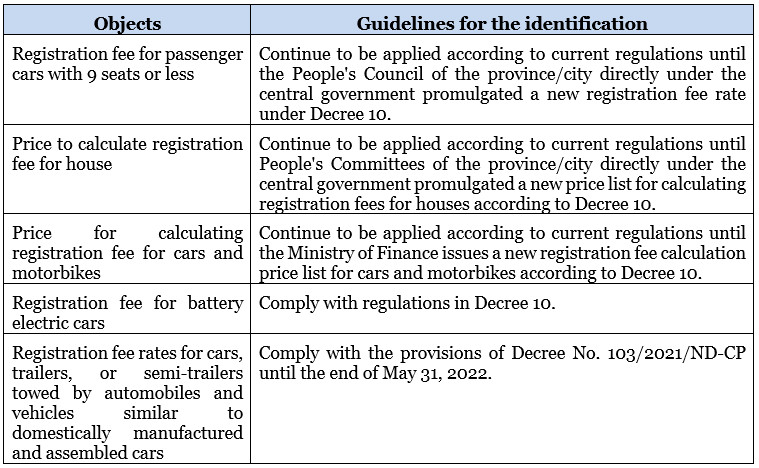

On January 15, 2022, the Government of Vietnam issued Decree 10/2022/ND-CP regulating registration fees (“Decree 10”).

The following are the notable points of Decree 10.

– Effective date: March 1, 2022.

– Documents to be replaced by Decree 10:

+ Decree No. 140/2016/ND-CP on registration fees;

+ Decree No. 20/2019/ND-CP amending and supplementing a number of articles of Decree No. 140/2016/ND-CP.

– Guidances on applying new regulations on registration fees:

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

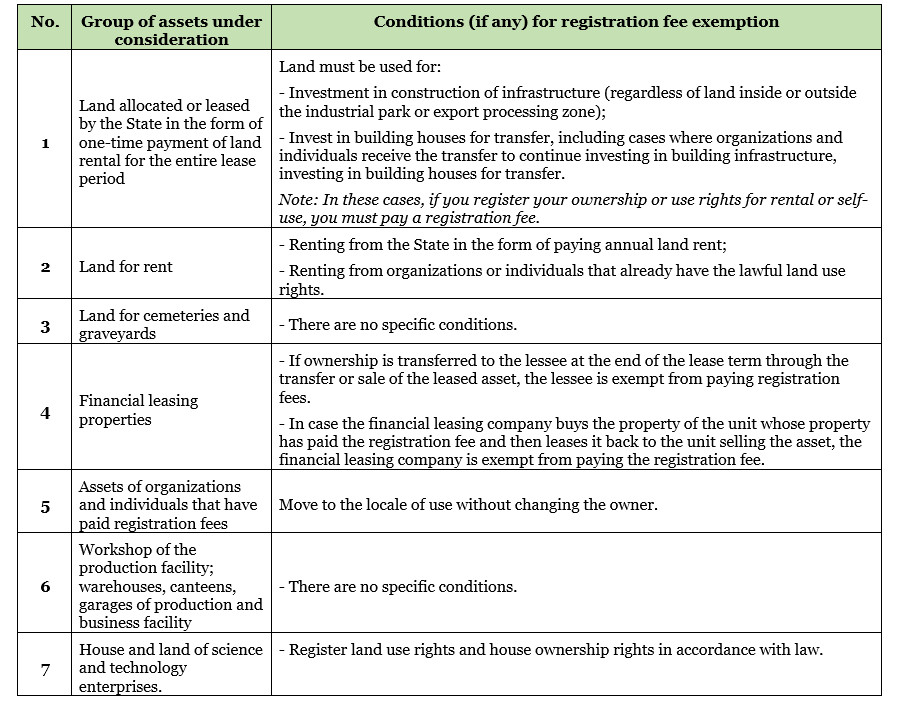

On January 15, 2022, the Government of Vietnam issued Decree 10/2022/ND-CP regulating registration fees (“ND 10”). NĐ 10 provides for 31 cases of registration fee exemption, here are 07 cases that enterprises and investors may be interested in:

NĐ 10 takes effect from March 1, 2022.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!