On September 25, 2021, the Government issued Decree No.85/2021/ND-CP amending and supplementing a number of articles of Decree No.52/2013/ND-CP dated May 16, 2013, on the e-commerce trading floor. Accordingly, this Decree has added new regulations on operation forms of e-commerce trading floors, including:

1. A website that allows its members to open booths for displaying/promoting their goods or services;

2. A website that allows its members to open accounts to carry out the conclusion of contracts with customers;

3. A website that has specific trading categories or tabs that allow its members to post listings of goods and services;

4. A social network that has one of the forms of activities as mentioned in (1), (2), (3) above and the participants directly or indirectly pay fees for the performance of such activities.

Thus, from January 1, 2022, in addition to operating forms of e-commerce trading floors through websites as before, traders and organizations will be able to conduct e-commerce activities through social networks such as Facebook, Zalo, Instagram… Then, people who directly or indirectly participate in those activities on social networking sites must pay a fee.

This Decree takes effect from January 1, 2022.

On September 20, 2021, the Ministry of Finance issued Official Letter No. 10847/BTC-TCT on coordination in deploying e-invoices in accordance with the provisions of the Law on Tax Administration No. 38/2019/QH14 and Decree No. 123/2020/ND-CP (“Official Letter 10847”), Official Letter 10847 has been sent directly to the Chairman of the People’s Committee of 06 provinces and cities: Hanoi, Ho Chi Minh, Hai Phong, Phu Tho, Quang Ninh, Binh Dinh.

Here are some typical contents of Official Letter 10847:

1. E-invoices and related laws

– Law on Tax Administration 2019;

– Decree 123/2020/ND-CP regulating invoices and documents;

– Circular 78/2021/TT-BTC guiding the implementation of the Law on Tax Administration, Decree 123/2020/ND-CP stipulating invoices and documents issued by the Minister of Finance.

In which: The Ministry of Finance emphasized: “The most important new point of Decree 123/2020/ND-CP is the regulation on management and use of e-invoices: From July 1, 2022, all enterprises, economic organizations, and business individuals make e-invoices (except for some cases where the conditions are not satisfied as prescribed), encouraging agencies, organizations and individuals to satisfy the conditions on information technology infrastructure shall apply regulations on e-invoices before July 1, 2022.”

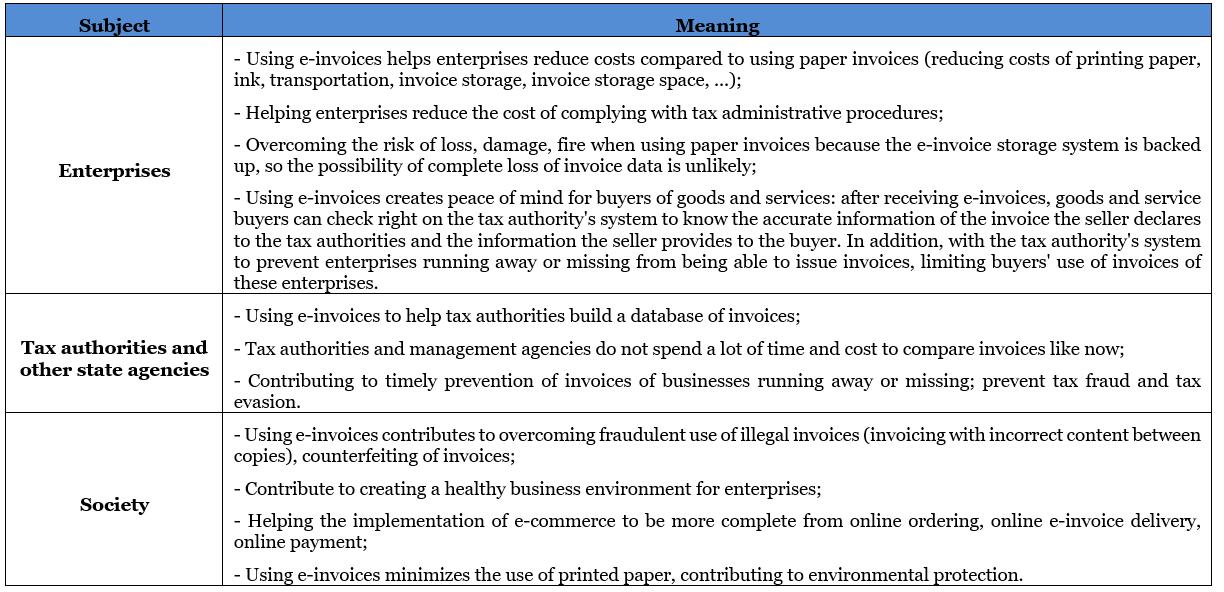

2. Meaning of e-invoices for enterprises, management agencies, and society

3. The Ministry of Finance’s plan to deploy e-invoices

– The Ministry of Finance has planned the implementation in two phases: Phase 1 from November 2021; Phase 2 from April 2022;

– The Ministry of Finance has issued the Decision to deploy e-invoice Phase 1 in six provinces and cities: Hanoi, Ho Chi Minh City, Hai Phong, Phu Tho, Quang Ninh, and Binh Dinh. From now to November 2021, there are only two months left, while the implementation works are still many and complicated, the Ministry of Finance respectfully requests the Chairman of the People’s Committee to pay attention and coordinate in directing some key jobs in the locality when deploying e-invoices according to regulations.

For more detailed information: The Esteemed Readers can refer directly to Official Letter 10847.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

On September 17, 2021, the Ministry of Finance issued Circular 78/2021/TT-BTC guiding the implementation of the Law on Tax Administration, Decree 123/2020/ND-CP regulating invoices and documents (“Circular 78”).

One of the notable new points of Circular 78 is the provision on “Roadmap for implementing e-invoice management system of tax authorities”, here are the details.

For more detailed information: The Esteemed Readers can refer to the provisions of Article 10 of Circular 78 and other relevant provisions. Circular 78 takes effect from July 1, 2022.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

On September 17, 2021, the Ministry of Finance issued Circular 78/2021/TT-BTC guiding the implementation of the Law on Tax Administration, Decree 123/2020/ND-CP regulating invoices and documents (“Circular 78”).

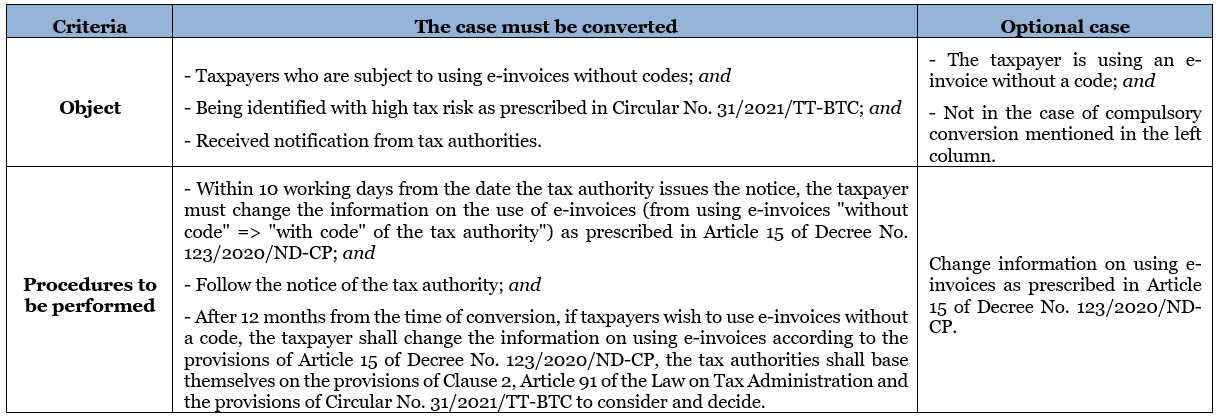

One of the notable new points of Circular 78 is the provision on “Converting to apply e-invoices with tax authority’s code” (From “e-invoice without code” to “e-invoice with tax authority code”), here are the details.

For more detailed information: The Esteemed Readers can refer to the provisions of Article 5 of Circular 78 and other relevant provisions. Circular 78 takes effect from July 1, 2022.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

On September 17, 2021, the Ministry of Finance issued Circular 78/2021/TT-BTC guiding the implementation of the Law on Tax Administration, Decree 123/2020/ND-CP regulating invoices and documents (“Circular 78”).

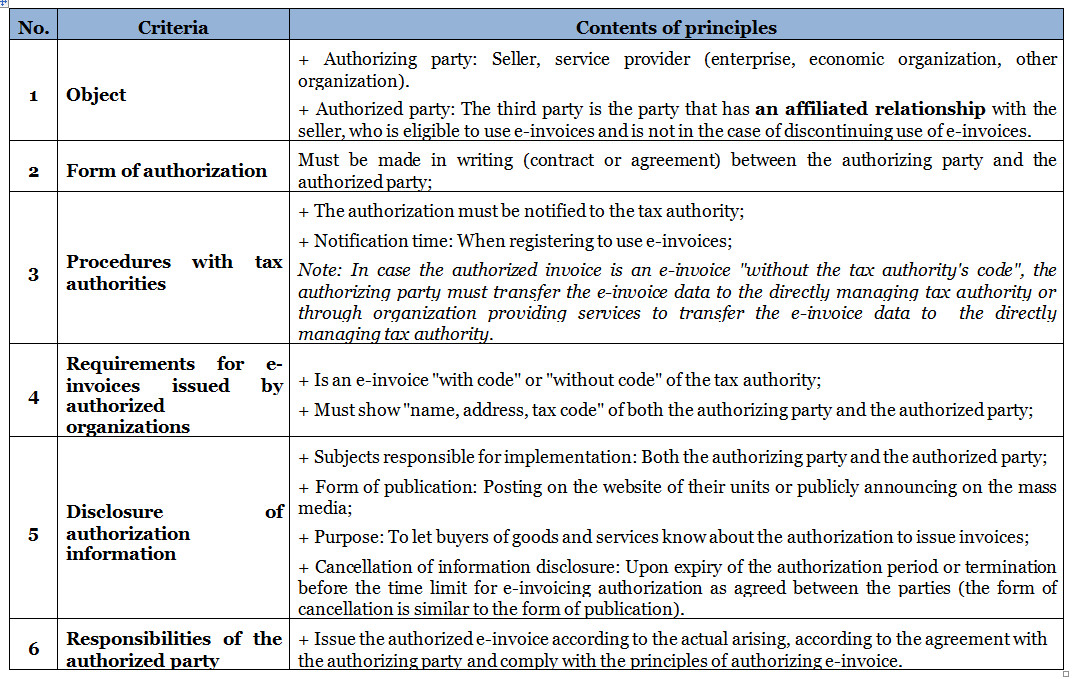

One of the notable new points of Circular 78 is the provision on “Authorization for e-invoicing”: This means that sellers and service providers can authorize a third party to issue e-invoices for their selling goods and services. Here are the details.

1. Principles of authorization for e-invoicing:

2. Authorization contract/Authorization agreement

– Content: Must fully show the following information:

a. Name, address, tax identification number, the ID number of the authorizing party and the authorized party;

b. Authorized e-invoices: invoice type, invoice symbol, invoice model number symbol;

c. Authorization purpose;

d. Authorization term;

e. Authorized invoice payment method (specify the responsibility to pay for goods and services on the authorized invoice);

– The authorizing party and the authorized party are responsible for storing the authorization document and presenting it when the competent authority requests it.

3. Notify the tax authority of the authorization to issue e-invoices

– The authorization is defined as the change of registration information for the use of e-invoices according to the provisions of Article 15 of Decree No. 123/2020/ND-CP. The authorizing party and the authorized party use Form No. 01DKTD/HDDT issued together with Decree No. 123/2020/ND-CP to notify the tax authority of the authorization to issue e-invoices, including the case of termination before the time limit for e-invoicing authorization as agreed between the parties;

– The authorizing party fills in the information of the authorized party, the authorized party fills in the information of the authorizing party in Form No. 01DKTD/HDDT issued together with Decree No. 123/2020/ND-CP.

Regulations on authorization to issue e-invoices have not been recorded in previous legal documents (Circular 119/2014/TT-BTC; Circular 26/2015/TT-BTC).

For more detailed information: The Esteemed Readers can refer to the provisions of Article 3 of Circular 78 and other relevant provisions. Circular 78 takes effect from July 1, 2022.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

On October 20, 2021, the General Department of Customs issued Official Letter No. 4948/TCHQ-TXNK to give opinions on tax treatment for imported goods entrusted for export production. As follows:

– For goods imported for production and export:

(i) Raw materials, supplies (including those for the manufacture of packages of exports), components, semi-finished products imported incorporated into the exports or used during the manufacture of exports without being incorporated into the exports.

(ii) Finished products that are imported for packaging, labeling, or attaching to exports or packaging with exports as a whole.

(iii) Components and parts imported for the repair of exports under warranty.

(iv) Goods imported as samples that are not traded or used.

(v) Goods imported for manufacture of domestic exports but are permitted to be destroyed in Vietnam and have been destroyed in reality.

(According to the provisions of Clause 7 Article 16 of the Law on Import Tax and Export Tax No.107/2016/QH13, Article 12 of Decree No.134/2016/ND-CP dated September 1, 2016, as amended and supplemented at Clause 6 Article 1 of Decree No.18/2021/ND-CP)

Organizations and individuals that are eligible for import tax exemption for goods imported for production and export mentioned above but entrust other organizations and individuals (referred to as entrusted organizations or individuals) to import goods for export goods to be supplied to organizations or individuals entrusting the production of export goods, the goods imported by the entrusting organizations or individuals for the production of export goods shall be exempt from import tax provided that the supply of the prices of the goods are under the entrustment contract does not include import tax.

– Entrusting organizations and individuals are responsible for making announcements to production facilities and final settlement reports in accordance with the law.

– The inspection of production facilities shall be carried out by the customs authority for entrusting organizations and individuals.

This Official Letter takes effect from October 20, 2021.

On October 19, 2021, the National Assembly Standing Committee issued Resolution 406/NQ-UBTVQH15 in 2021 on a number of solutions to support enterprises and people affected by the COVID-19 epidemic. In particular, mention is made of tax exemption and reduction solutions for enterprises affected by the Covid-19 epidemic, specifically as follows:

(1) A reduction of 30% in the payable corporate income tax amount of 2021:

This tax reduction policy only applies to taxpayers under the provisions of the Law on Corporate Income Tax whose revenue in 2021 is not more than 200 billion VND and the revenue in 2021 is lower than the revenue in 2019.

* Note: The decrease in revenue in 2021 compared to the revenue in 2019 will not prevail as a criterion for reduction of paying corporate income tax if the taxpayer has just been established, engaged in consolidation, merger, partial division, or full division in the tax period of 2020 or 2021.

(2) Exemption of late payment interest incurred in 2020 and 2021 on debts of taxes, land use levies, and land rents to enterprises and organizations (including affiliated entities, places of business) that incur losses in 2020.

* Note: This provision does not apply to a case where the late payment interest has been paid.

(3) Apply reduction of value-added tax from November 1, 2021, to the end of December 31, 2021

– This policy applies to the following goods and services:

(i) Transport services (railway transport, water transport, aviation transport, other road transport); accommodation services; food and drink services; services of travel agencies, tour operators and support services, related to promotion and organization of tours;

(ii) Publishing products and services; cinematographic services, production of the television programs, sound recording and music publishing; works of art and services for composing, arts, and entertainment; services of libraries, archives, museums, and other cultural activities; sports, recreation, and entertainment services.

The goods and services mentioned in category (ii) do not include publishing software, and goods and services provided in the online form.

– The value-added tax reduction for the above cases is applied as follows:

(i) If the credit method is used, the enterprise will be eligible for a reduction of 30% in VAT rate;

(ii) If the direct method (payable VAT amount equals given rate multiplied by revenue) is used, the enterprise will be eligible for a reduction of 30% in the rate for direct VAT calculation.

This Resolution takes effect from October 19, 2021.

On October 8, 2021, the Government issued Resolution 126/NQ-CP in 2021 amending and supplementing Resolution 68/NQ-CP on a number of policies to support employees and employers who encounter difficulties due to the COVID-19 pandemic. Accordingly, the Resolution has amended regulations on the temporary suspension of contributions to the employer’s retirement and survivorship fund, specifically as follows:

– Regarding employers who have fully paid social insurance premiums or are temporarily suspending contributions to the retirement and survivorship fund until the end of January 2021 but have been affected by the COVID-19 pandemic, resulting in a downsizing of at least 10% of employees who have contributed to social insurance compared to January 2021 (including employees who stop working, suspend the performance of labor contracts and agreements on unpaid leave), the employees and the employers are entitled to a 6-month suspension of payment to the retirement and survivorship fund from the date of application submission.

– As for a case on the payment suspension under the Resolution No. 42/NQ-CP of April 9, 2020, and Resolution No.154/NQ-CP of October 19, 2020, of the Government, if the applicant is still qualified, the application will be approved as long as the suspension period does not exceed 12 months.

Thus, compared with the provisions of Resolution 68/NQ-CP, the amendments in this Resolution have extended the time limit for fully paying social insurance premiums or temporarily suspending payment to the retirement and survivorship fund of the employer (previously it was regulated until the end of April 2021) and the rate of reduction of employees participating in social insurance (previously it was regulated to decrease from 10% compared to April 2021).

This Resolution takes effect from October 8, 2021.

On October 8, 2021, the Government issued Resolution 126/NQ-CP in 2021 amending and supplementing Resolution 68/NQ-CP on a number of policies to support employees and employers who encounter difficulties due to the COVID-19 pandemic. Accordingly, the Resolution has amended and supplemented additional regulations for cases receiving support due to the impact of the Covid-19 pandemic, specifically as follows;

I. Expanding the beneficiaries of support upon the termination of labor contracts:

+ Employees working under labor contracts, participating in compulsory social insurance, must terminate labor contracts during the period from May 1, 2021, to the end of December 31, 2021, but not enough be eligible for unemployment benefits and fall under one of the following cases:

+ Must be in medical isolation, in blocked areas, or unable to go to the workplace due to the request of competent state agencies to prevent and control the COVID-19 epidemic;Due to the employer’s temporary suspension of operations at the request of a competent state agency for the prevention and control of the COVID-19 epidemic, or the head office, branch, representative office, production location, businesses in the area implement measures to prevent and control the epidemic according to the principles of Directive No. 16/CT-TTg or redeploy production and labor to prevent and control the COVID-19 epidemic.

II. Expanding the beneficiaries of support due to temporary suspension of labor contracts, unpaid leave:

Employees working under labor contracts, participating in compulsory social insurance up to the time immediately before suspending the performance of labor contracts, taking unpaid leave; there is a period of temporary suspension of the performance of the labor contract, taking unpaid leave within the term of the labor contract from 15 consecutive days or more from May 1, 2021, to the end of December 31, 2021, and The starting point of temporary suspension of performance of labor contracts, unpaid leave from May 1, 2021, to the end of December 31, 2021, and fall under one of the following cases:

+ Must be treated for COVID-19, medical isolation, in blocked areas, cannot go to the workplace due to the request of a competent state agency to prevent and control the COVID-19 epidemic;

+ Due to the employer’s temporary suspension of operations at the request of a competent state agency for the prevention and control of the COVID-19 epidemic, or the head office, branch, representative office, production location, businesses in the area to take measures to prevent and control the epidemic according to the principles of Directive No. 16/CT-TTg or redeploy production and labor to prevent and control the COVID-19 epidemic.

III. Expanding the beneficiaries of support due to job cessation:

Employees working under labor contracts who are terminated for reasons specified in Clause 3, Article 99 of the Labor Code; are participating in compulsory social insurance up to the time immediately before stopping work and fall under one of the following cases:

+ Having to be treated for COVID-19, medical isolation, in blocked or impossible areas to the working place at the request of a competent state agency according to the principles of Directive No.16/CT-TTg for 14 consecutive days or more during the period from May 1, 2021, to the end of December 31, 2021;

+ Due to the employer has to suspend operations at the request of a competent state agency or has a head office, branch, representative office, production or business location in the area to perform the following tasks: Measures to prevent and control the epidemic according to the principles of Directive No. 16/CT-TTg or redeploy production and labor to prevent and control the COVID-19 epidemic for 14 consecutive days or more during the period from May 1, 2021, to the end of December 31, 2021.

The level of support for the above subjects is applied as prescribed in Resolution 68/NQ-CP.

This Resolution takes effect from October 8, 2021.