On August 26, 2021, the Government issued Decree No. 80/2021/ND-CP detailing and guiding the implementation of a number of articles of the Law on Supporting SMEs (“Decree No. 80”). Decree No. 80 replaces Decree No. 39/2018/ND-CP dated March 11, 2018, of the Government.

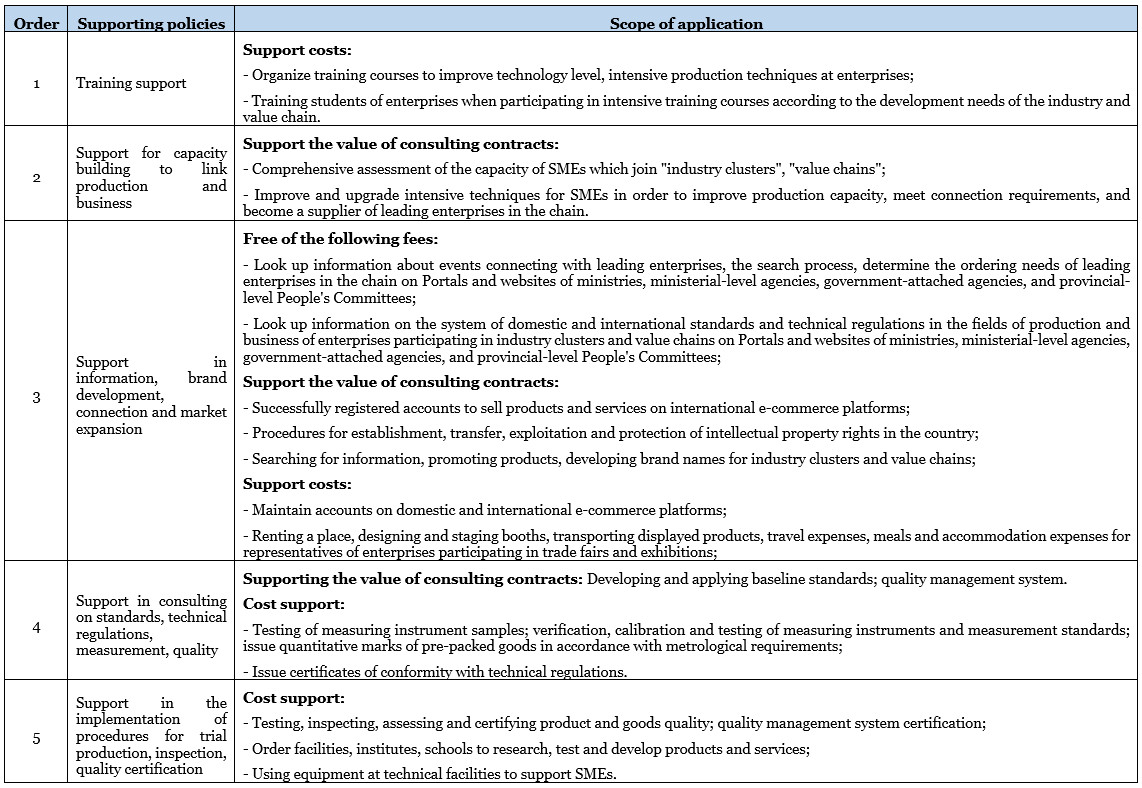

In the following, the article will review support policies “exclusively” for SMEs which join “industry clusters”, “value chains” in Decree No. 80, specifically as follows:

For details: Refer to the provisions from Article 25 of Decree No. 80.

Decree No. 80 takes effect from October 15, 2021.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

On August 26, 2021, the Government issued Decree No. 80/2021/ND-CP detailing and guiding the implementation of a number of articles of the Law on Supporting SMEs (“Decree No. 80”). Decree No. 80 replaces Decree No. 39/2018/ND-CP dated March 11, 2018, of the Government.

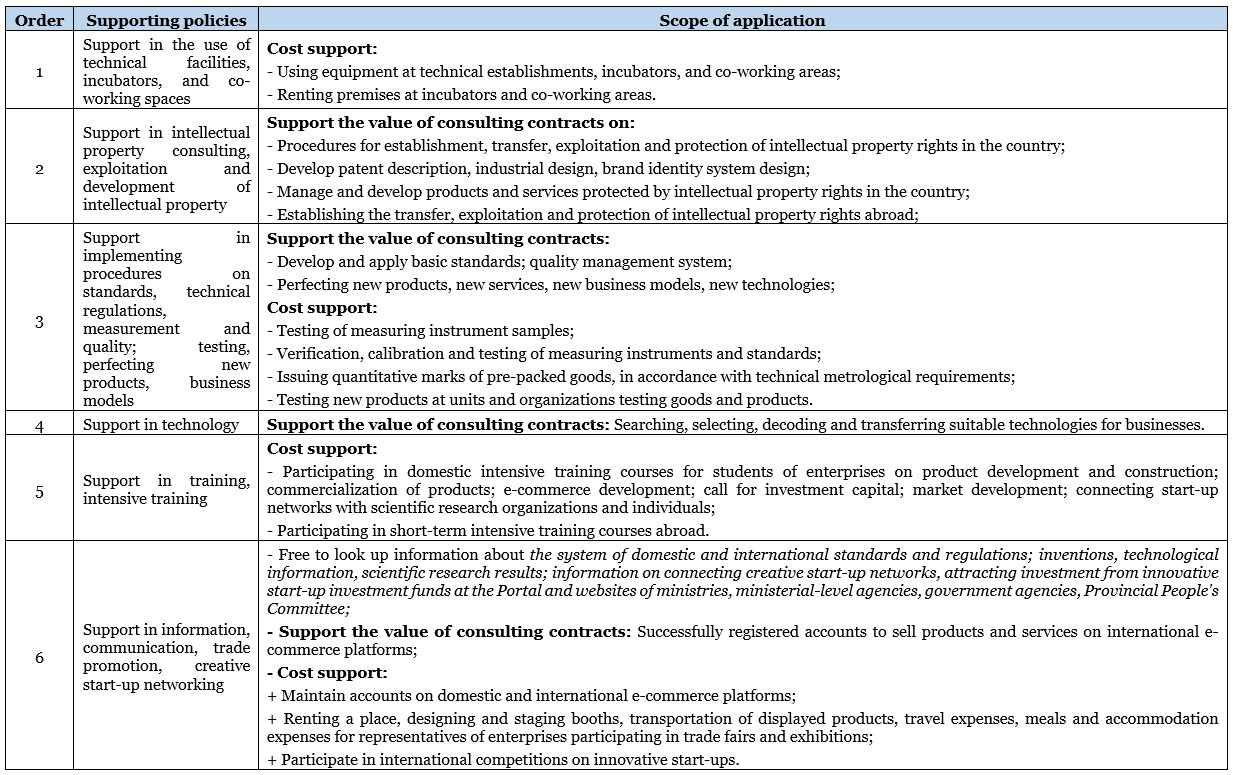

In the following, the article will review support policies “exclusively” for SMEs which are innovative startups in Decree No. 80, specifically as follows:

For details: Refer to the provisions from Article 22 of Decree No. 80.

Decree No. 80 takes effect from October 15, 2021.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

In 2021, the Covid-19 epidemic has greatly affected the export and import activities of enterprises. Faced with that situation, some Customs Departments and the business community have proposed to consider not sanctioning administrative violations for a number of violations occurring in the customs field due to the impact of the Covid-19 epidemic and the Government’s application of social distancing and anti-epidemic measures, including the following cases:

1. Goods are on the list of goods subject to state inspection of quality, but foreign experts cannot come to Vietnam to assemble accessories for inspection of goods quality according to regulations.

2. Imported goods (chemicals) do not have tanks and cannot be consumed, so they must be stored at the port and cannot be declared at customs within the prescribed time limit.

3. The enterprise fails to submit the final settlement report, submits the report on the use of tax-free goods late due to social distancing, and does not have employees.

4. Enterprises cannot arrange financial resources to pay tax for all shipments that have returned to Vietnam within 30 days from the date of arrival at the border gate.

5. The enterprise cannot register the declaration and pick up the goods within 30 days from the date of arrival at the border gate due to the operation in the blocked area.

6. Enterprises cannot carry out re-export of goods under the Decision sanctioning administrative violations due to social distancing and the impact of the Covid-19 epidemic.

7. Enterprises cannot re-export and re-import goods within the prescribed time limit or on time for registration with the customs office due to social distancing and the impact of the Covid-19 epidemic.

8. Some customs units have F0 cases and practice social distancing, so they cannot make records of administrative violations receive dossiers, and exhibits of violations to verify and clarify violations for proper handling prescribed time limit.

Therefore, in order to create favorable conditions for enterprises with export and import activities, on September 15, 2021, the General Department of Customs issued Official Letter 4428/TCHQ-PC in 2021, requesting the customs authorities to review it. The consideration of not sanctioning administrative violations due to the influence of the Covid-19 epidemic and the Government’s application of social distancing and anti-epidemic measures must be based on the provisions of Articles 2 and 11 of the Law on Handling administrative violations in 2012, Article 6 of Decree 128/2020/ND-CP and specific case files to apply regulations related to “force majeure events” to each specific case.

Thus, in order to consider not sanctioning administrative violations due to the influence of the Covid-19 epidemic and to apply the Government’s social distancing and anti-epidemic measures, it is necessary to apply regulations related to “force majeure events” and individuals and organizations must prove that they have applied all necessary and permissible measures, but cannot prevent violations from occurring.

This Official Letter takes effect from September 15, 2021.

On September 16, 2021, the Minister of Health promulgated Circular No. 13/2021/TT-BYT stipulating the issuance of circulation numbers and the import of medical equipment to serve the prevention and control of COVID-19 in case of urgent.

Accordingly, medical equipment may apply the form of fast issuance of free registration numbers if the following conditions are satisfied at the same time:

As medical equipment for the prevention and control of the COVID-19 epidemic, the circulation number is quickly issued on the list of regulations, including Extraction machine; PCR machine, Chemicals (biological products) running the PCR machine for testing SARS-CoV-2; Rapid test kit for antigen/antibody against SARS-CoV-2; High-function ventilators, invasive and non-invasive ventilators, non-invasive ventilators, high-flow oxygen machines, portable ventilators; Continuous dialysis machine; Portable X-ray machine; Color Doppler ultrasound machine ≥ 3 probes; Blood gas meter (measuring electrolytes, lactate, hematocrit); Patient monitor ≥ 5 parameters; Electric injection pump; Infusion machine; Pacemaker defibrillators; ECG machine ≥ 6 channels; Portable ultrasound machine; Coagulation time meter; Hemodynamic meter.

Belongs to one of the following cases:

1. Has been approved for circulation or emergency use by one of the following organizations: US Food and Drug Administration (FDA) – USA; Therapeutic Goods Administration (TGA) – Australia; Health Canada (Health Canada); Japan’s Ministry of Health, Labor, and Welfare (MHLW) or Pharmaceuticals and Medical Devices Agency (PMDA) – Japan;

2. Has been approved by the competent authorities of the European countries for circulation and emergency use;

3. Belongs to the list of SARS-CoV-2 testing products for emergency use announced by the World Health Organization (WHO) on its website at https://extranet.who.int (Coronavirus disease) (COVID-19) Pandemic – Emergency Use Listing Procedure (EUL) open for IVDs | WHO – Prequalification of Medical Products (IVDs, Medicines, Vaccines, and Imm unification Devices, Vector Control);

4. Belongs to the list of popular products for testing for SARS-CoV-2 issued by the European Health Security Committee (EUHSC) published on its website at https:// ec.europa.eu (Technical working group on COVID-19 diagnostic tests | Public Health (europa.eu);

5. Having been granted a commercial import license in Vietnam before the effective date of this Circular (September 16, 2021);

6. Produced domestically in the form of technology transfer for medical equipment in one of the following cases (1), (2), (3), ( 4), (5) above;

7. Produced domestically in the form of processing for medical equipment in one of the following cases (1), (2), (3), (4), (5) above.

This Circular takes effect from September 16, 2021.

On August 25, 2021, the Minister of Construction issued Circular No.10/2021/TT-BXD guiding Decree 06/2021/ND-CP on quality management, construction, and Decree 44/2016/ND-CP on technical inspection of occupational safety.

Accordingly, this Circular details a number of contents on labor safety management, construction quality, and construction maintenance; applicable to domestic agencies, organizations, and individuals, and foreign organizations and individuals related to labor safety management, construction quality, and construction maintenance. Inside, the Circular has detailed instructions on the expenses of ensuring occupational safety and hygiene in the construction of works, including:

– Expenses for setting up and implementing safety measures;

– Expenses for training on occupational safety and health; expenses for technical inspection of occupational safety of machines and equipment; expenses for information and propaganda on occupational safety and health;

– Expenses for providing personal protective equipment and tools for employees;

– Expenses for fire and explosion prevention and fighting;

– Expenses for prevention and control of dangerous and harmful factors and improvement of working conditions; expenses of organizing risk assessment of occupational safety.

This is one of the contents of indirect expenses in the construction expenses of the work construction estimate.

This Circular takes effect from October 15, 2021.

On July 30, 2021, the State Bank of Vietnam (SBV) issued Circular No. 11/2021/TT-NHNN stipulating the classification of assets, the level of deduction, the method of making provision for risks, and the use of the provision to handle risks in the operation of credit institutions, foreign bank branches. This document takes effect from October 1, 2021.

Accordingly, in principle, the circular stipulates that all outstanding debts of a customer at a credit institution or foreign bank branch must be classified into the debt group. Credit institutions classify debt into 5 groups: (i) Group 1: Qualified debt; (ii) Group 2: Debts needing attention; (iii) Group 3: Subprime debt; (iv) Group 4: Doubtful debts; (v) Group 5: Debts likely to lose capital. Specific provisioning rates for each debt group are as follows: (i) Group 1: 0%; (ii) Group 2: 5%; (iii) Group 3: 20%; (iv) Group 4: 50%; (v) Group 5: 100%.

The level of general provision to be deducted is determined at 0.75% of the total balance of debts from group 1 to group 4. Besides, credit institutions use provisions to deal with risks in the following cases: Customers is an organization that is dissolved or goes bankrupt; an individual is dead or missing; Debts are classified into the group of debts that are likely to lose capital.

After a period of at least 5 years from the date of using provisions to deal with risks and after taking all measures to recover but not being able to recover, the credit institution may decide to pay the debt that has already been treated from abroad.

Compared with Circular No. 02/2013/TT-NHNN dated January 21, 2013, Circular 09/2014/TT-NHNN dated March 18, 2014, Circular No. 11/2021/TT-NHNN provided a legal framework for stricter management on debt classification and provisioning in accordance with the outbreak of the epidemic which makes banks’ potential bad debts likely to increase sharply in the next few years.

On August 26, 2021, the Government issued Decree No. 80/2021/ND-CP detailing and guiding the implementation of a number of articles of the Law on Supporting SMEs (“Decree No. 80”). Decree No. 80 replaces Decree No. 39/2018/ND-CP dated March 11, 2018, of the Government.

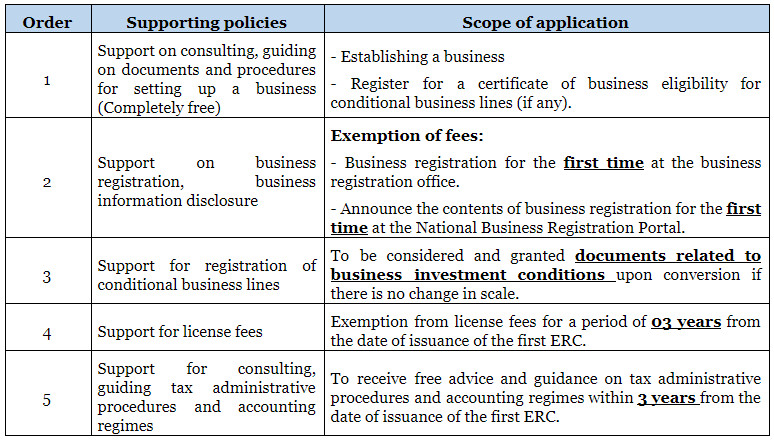

In the following, the article will review the “exclusive” support policies for SMEs converted from business households in Decree No. 80, specifically as follows:

For details: Refer to the provisions from Article 15 to Article 19 of Decree No. 80.

Decree No. 80 takes effect from October 15, 2021.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

On September 24, 2021, the Government issued Resolution No. 116/NQ-CP on policies to support employees and employers affected by the Covid-19 pandemic from The Unemployment Insurance Fund.

Accordingly, this Resolution has set out support policies for employees and employers, specifically as follows:

For employees

– The applicable subjects are employees who are participating in unemployment insurance as of September 30, 2021 (does not apply to employees working at state agencies, political organizations, socio-political organizations, people’s armed forces units, and public non-business units whose recurrent expenditures are guaranteed by the state budget) and Employees who have temporarily stopped participating in unemployment insurance due to the termination of their labor contracts or working contracts for the period from January 1, 2020, to September 30, 2021, have the time to pay unemployment insurance with contribution periods are reserved (except monthly old-age pensioners).

– The support level will be from 1,800,000 VND/person to 3,300,000 VND/person depending on the period of paying unemployment insurance, specifically: (i) paying unemployment insurance premiums for less than 12 months will support 1,800,000 VND/person; (ii) payment of unemployment insurance from full 12 months to less than 60 months, support 2,100,000 VND/person; (iii) pay unemployment insurance from full 60 months to less than 84 months, support 2,400,000 VND/person; (iv) pay unemployment insurance from full 84 months to less than 108 months, support 2,650,000 VND/person; (v) pay unemployment insurance from full 108 months to less than 132 months, support 2,900,000 VND/person; (vi) pay unemployment insurance for 132 months or more, support VND 3,300,000/person.

– The time to implement the support for employees is from October 1, 2021, and will be completed by December 31, 2021, at the latest.

For employers

– Applicable subjects are employers participating in unemployment insurance such as enterprises, cooperatives, households, business households, cooperative groups, other organizations, and individuals that hire and employ employees according to their requirements employment contract or employment contract.

– The support policy is to reduce the contribution to the Unemployment Insurance Fund for employers affected by the Covid pandemic, specifically: Employers are entitled to reduce the contribution rate from 1% to 0% of the monthly salary fund of employees participating in unemployment insurance (defined in Article 43 of the Employment Law)

– The time to reduce the payment is 12 months from October 1, 2021, to the end of September 30, 2022.

It can be seen that the purpose of the issuance of this Resolution is to show State’s concern for employees and employers affected by the Covid pandemic, and at the same time, contribute to supporting employees to overcome difficulties in their lives, help employers reduce costs, maintain production and business, create jobs for employees, on the other hand, also promote the role of unemployment insurance policy as a support for employees and employers.

Resolution No. 116/NQ-CP takes effect from September 24, 2021.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!