On June 30, 2021, the Ministry of Finance issued Circular 51/2021/TT-BTC guiding the obligations of organizations and individuals in foreign investment activities on the Vietnamese stock market, issued by the Minister of Finance (“Circular 51”). Circular 51 replaces Circular No. 123/2015/TT-BTC dated August 18, 2015 of the Minister of Finance guiding foreign investment activities on the Vietnamese stock market (“Circular 123”).

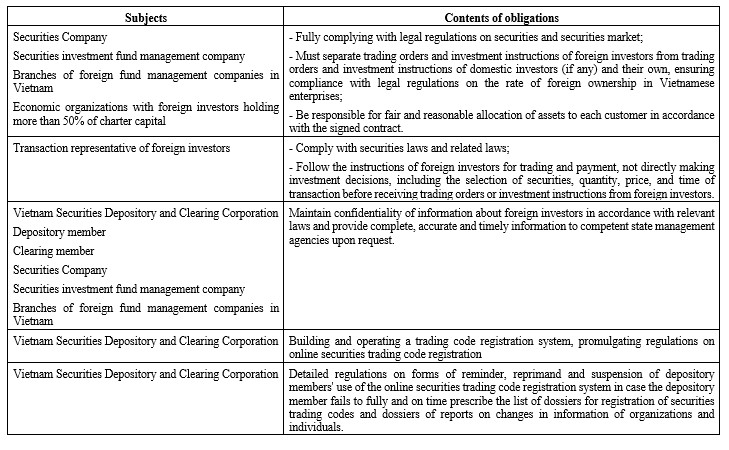

Circular 51 has introduced new reforms on obligations in providing services to foreign investors compared to the previous provisions in Circular 123. The following are highlights:

Circular 51 takes effect from August 16, 2021.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany with The Esteemed Readers!

On June 30, 2021, the Ministry of Finance issued Circular 51/2021/TT-BTC guiding the obligations of organizations and individuals in foreign investment activities on the Vietnamese stock market, issued by the Minister of Finance (“Circular 51”). Circular 51 replaces Circular No. 123/2015/TT-BTC dated August 18, 2015, of the Minister of Finance guiding foreign investment activities on the Vietnamese stock market (“Circular 123”).

Circular 51 has introduced new reforms on the reporting regime of entities in foreign investment activities on Vietnam’s stock market compared to the previous regulations in Circular 123. The following are highlights:

Note:

• Report recipient: State Securities Commission.

• At the request of the State Securities Commission, the subjects directly report and provide the list, data, and other documents related to the activities of foreign investors.

• Newspapers are presented in the form of paper documents attached to electronic data files or on the foreign investor activity management system of the State Securities Commission and must be archived for a minimum 5-year period of time.

Circular 51 takes effect from August 16, 2021.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

On June 30, 2021, the Ministry of Finance issued Circular 51/2021/TT-BTC guiding the obligations of organizations and individuals in foreign investment activities on the Vietnamese stock market, issued by the Minister of Finance (“Circular 51”). Circular 51 replaces Circular No. 123/2015/TT-BTC dated August 18, 2015, of the Minister of Finance guiding foreign investment activities on the Vietnamese stock market (“Circular 123”).

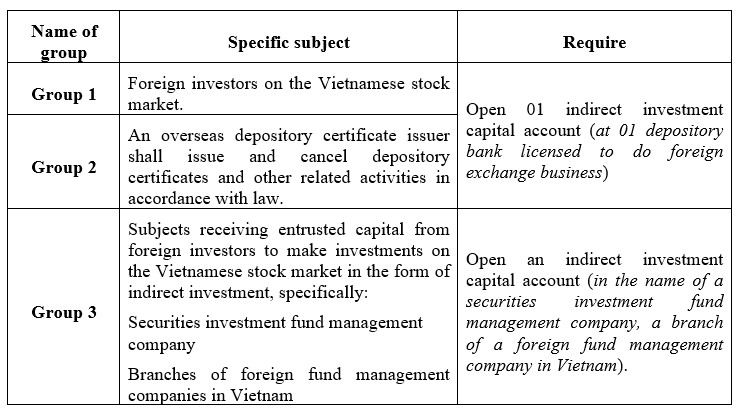

In addition to continuing to record the previous regulations in Circular 123 related to indirect investment accounts, Circular 51 has regulations to provide more detailed instructions on the groups of subjects that must open Indirect investment capital account when participating in and operating on the stock market, specifically includes the following 03 groups:

Note:

• All money transfer activities for carrying out transactions, investments, and other payments related to securities investment activities of foreign investors and activities of depository certificate issuers in foreign countries, receipt and use of dividends, distributed profits, purchase of foreign currency to transfer abroad (if any) and other related transactions must be done through the indirect investment capital account.

• The opening, closing, use, and management of indirect investment capital accounts comply with the law on foreign exchange management.

Circular 51 takes effect from August 16, 2021.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

On July 7, 2021, the Minister of Labor, War Invalids and Social Affairs issued Circular No. 06/2021/TT-BLDTBXH amending and supplementing some articles of Circular No. 59/2015/TT-BLDTBXH regulating detailing and guiding the implementation of some articles of the Law on Social Insurance regarding compulsory social insurance. Accordingly, one of the outstanding contents in this Circular is the addition of regulations on determining the monthly salary on which compulsory social insurance premiums are based, excluding other regimes and benefits such as:

– Bonus (Is the amount of money or property or in other forms that the employer rewards the employee based on the production and business results, the level of successful completion of workers’ work);

– Initiative bonus;

– Mid-shift meal;

– Support for petrol, phone, travel, housing, child care, and child-rearing;

– Support when employees have dead relatives, employees have married relatives, employees’ birthdays, allowances for employees in difficult circumstances when suffering from occupational accidents, occupational diseases, and other allowances and allowances recorded in a separate item in the labor contract.

Basically, this regulation continues to inherit the content of the previous regulation, but there are updates to the contents citing the corresponding provisions in the new Labor Code (2020) and the new guiding Circular (Circular Circular No. 10/2020/TT-BLDTBXH).

This Circular takes effect from September 1, 2021.

On June 30, 2021, the Minister of Construction issued Circular No. 06/2021/TT-BXD stipulating the classification of construction works and guiding their application in the management of construction investment activities (“Circular No. 06”). Circular 06 stipulates the principles of applying work grades to classify the construction activity capacity of organizations and individuals for the issuance of capacity certificates and practice certificates in the construction field. Specifically including 04 groups:

1. Independent works

– Apply the work grade which is the highest grade determined according to Appendix I and Appendix II of Circular 06 to such works.

– In case the independent works are not specified in Appendix I of this Circular, the grade of works shall be determined according to the provisions of Appendix II of this Circular and vice versa.

2. Some works under construction investment projects

– Apply work grade which is the highest grade determined according to Appendix I and Appendix II of Circular 06 to each considered work.

– In case the independent works are not specified in Appendix I of this Circular, the grade of works shall be determined according to the provisions of Appendix II of this Circular and vice versa.

3. An entire complex of works or an entire technological line consisting of many items

– In case there are many items specified in Appendix I of this Circular, the grade of works shall be determined according to Appendix I of this Circular.

– In case there are many items not specified in Appendix I of this Circular, the grade of works shall be determined according to the grade of the main work (belonging to a complex of works or technological lines) with the highest grade.

4. A work, some works, or all of the works under the construction investment project along the route

– Apply the work grade which is the highest grade determined according to Appendix I and Appendix II of this Circular to each work of the route.

This Circular takes effect from August 15, 2021, and replaces Circulars No. 03/2016/TT-BXD dated March 10, 2016, and Circular No. 07/2019/TT-BXD dated November 7, 2019, of the Minister of Construction.

On June 23, 2021, the Ministry of Finance issued Circular No. 46/2021/TT-BTC guiding on financial handling and enterprise valuation when converting a State-owned enterprise/one-member limited liability company with 100% charter capital invested by the State-owned enterprise into a Joint Stock Company (“Circular 46”). Circular 46 replaces Circular 41/2018/TT-BTC.

Accordingly, the financial handling when implementing equitization has some changes compared to Circular 41/2018/TT-BTC and must ensure the following principles:

– For enterprises in which 100% charter capital is held by the State: Must proactively handle financial problems according to current regulations.

– For the land area that the enterprise is not allowed to keep, continue to use but is actually monitoring and using and has no plan to recover it: Report and explanation must be made as a basis for handing over to the competent authority when officially switching to operate under the Joint Stock Company model.

– Not adjust the data in the accounting books and financial statements at the time of enterprise valuation according to the enterprise valuation results decided by the owner’s representative agency and published.

– In case, after having financial treatment and re-determining the enterprise value, the actual value of the enterprise is lower than the payables, the settlement shall be handled according to the guidance of the law.

– When the equitized enterprise is granted the certificate of Joint Stock Company registration for the first time, the enterprise shall prepare financial statements and handle financial matters under relevant laws.

– The process of financial handling and valuation of equitized enterprises must comply with market principles, publicity, transparency, strict assurance, and compliance with State regulations.

– If it is discovered that the inventory is lacking or omitted, leading to a decrease in the value of the enterprise and the state capital in the equitized enterprise, it shall be handled according to regulations.

– The owner’s representative agency is responsible for settling and handling financial issues during the equitization process and arising financial problems (if any) related to the equitization process after officially being transformed into a Joint Stock Company.

– Enterprise valuation consulting organizations: Must determine enterprise value by asset method, and at the same time may choose at least one other enterprise valuation method according to the provisions of the law on prices and appraise the price for submission to the owner’s representative agency for consideration and decision.

– Equitized enterprises must explain and provide information to investors in the equitization plan and prospectus of information on existing assets at the enterprise (infrastructure assets; other assets under management and use; assets being investment works in progress) invested with public investment capital and identified as public assets.

Circular 46 takes effect from August 7, 2021.

June 1, 2021, The Ministry of Finance promulgates Circular No. 40/2021/TT-BTC provide guidance on value-added tax (VAT), personal income tax (PIT), and tax administration for business households and individuals. This Circular takes effect from August 1, 2021. Accordingly, the principles for calculating VAT and PIT of business households and individuals are determined as follows:

First, the tax calculation principles for business households and individuals comply with the provisions of the current law on VAT, PIT, and relevant legal documents.

Second, business households and individuals with turnover from production and business activities in the calendar year of 100 million VND or less are not having to pay VAT and PIT as prescribed by Law on VAT and PIT. Business households and individuals are responsible for making accurate, truthful, and complete tax declarations and submitting tax dossiers on time; take responsibility before law for the accuracy, truthfulness, and completeness of tax records as prescribed.

Third, business households and individuals doing business in the form of groups of individuals or households must have a turnover of 100 million VND/year or less to determine that individuals are not required to pay VAT and cannot pay PIT determined for one (01) sole representative of a group of individuals or households in the tax year.

At the same time, according to this Circular, the tax calculation method is calculated according to the following formula:

Amount of VAT payable = Revenue subject to VAT x VAT rate

Amount of PIT payable = Revenue subject to PIT x PIT rate

In there:

– Revenue subject to VAT and revenue subject to PIT for business households and individuals is the tax-inclusive revenue (in taxable cases) of all sales, processing, and commissions, money for service provision arising in the tax period from the production and trading of goods and services, including bonuses, sales support, sales promotion, trade discount, discount payment or support in cash or non-cash; price subsidies, surcharges, extras, and additional fees are entitled to according to regulations; compensation for breach of contract and other compensations (only included in the revenue subject to PIT); other revenues that business households and individuals are entitled to, regardless of whether money has been collected or not.

– Tax rate on sales

• The tax rate calculated on turnover includes the VAT rate and the PIT rate applied in detail to each field and industry according to the guidance in Appendix I issued together with Circular 40/2021/TT-BTC.

• In case business households and individuals operate in many fields and lines of business, business households and individuals shall declare and calculate tax at the rate of tax calculated on turnover applicable to each field or industry. In case business households and individuals cannot determine the taxable turnover of each field or line or determine that it is not suitable with the reality of business, the tax authority shall determine the taxable revenue of each business line, the field in accordance with the law on tax administration.

On June 11, 2021, the Minister of Finance issued Circular No. 43/2021/TT-BTC amending and supplementing Clause 11 Article 10 of Circular No. 219/2013/TT-BTC dated December 31, 2013, of the Ministry of Finance, guiding the implementation of the Law on Value-Added Tax and the Government’s Decree No. 209/2013/ND-CP dated December 18, 2013, detailing and guiding the implementation of several articles of the Law on Value-Added Tax (“Circular No. 43”).

Accordingly, Circular No.43 has added and more detailed regulations on the subject to 5% VAT rate being medical equipment and instruments when having one of the following documents:

– Import license or;

– Certificate of circulating registration or;

– Receipt of application for publication of standards under the law on health or;

– According to the List of medical equipment subject to the specialized management of the Ministry of Health, goods codes are determined according to the List of exported and imported goods of Vietnam promulgated together with Circular No. 14/2018/TT – BYT dated May 15, 2018, of the Minister of Health and amendments and supplements (if any).

Previously, Circular No. 219/2013/TT-BTC only provided general guidance that: Other specialized medical tools and equipment as certified by the Ministry of Health are subject to the VAT rate of 5%. The addition and detailing in Circular 43 has made it easier to determine what is subject to VAT at the rate of 5%.

Therefore, from the effective date of Circular No.43 (August 1, 2021), medical equipment and instruments with one of the above documents are subject to a 5% VAT rate.

On June 24, 2021, the Minister of Finance issued Circular No. 47/2021/TT-BTC stipulating the rate of collection of a number of fees and charges in order to support and remove difficulties for those affected by the Covid-19 pandemic. Accordingly, from July 1, 2021, to the end of December 31, 2021, there are 30 reduced rates of some fees and charges. In which, typical fees and charges are reduced directly related to the operation of the enterprise, the collection rates are as follows:

– Fees for granting certificates of capacity for construction activities to organizations: Equal to 50% of the fee rates prescribed in Clause 1, Article 4 of Circular No. 172/2016/TT-BTC;

– Fees for appraisal of construction investment projects: Equal to 50% of the fee rates specified in Section 1 of the Schedule of fees for appraisal of construction investment projects, fees for appraisal of basic designs promulgated together with Circular No. 209/2016/TT-BTC;

– Fee for appraisal of basic design: Equal to 50% of the fee rate specified in Section 2 of the schedule of fees for appraisal of construction investment projects, fee for appraisal of basic designs promulgated together with Circular No. 209/2016/TT-BTC;

– Fees for appraisal of technical designs and fees for appraisal of construction estimates: Equal to 50% of the fee rates specified in the fee schedule attached to Circular No. 210/2016/TT-BTC;

– Fee for appraisal and grant of international travel service business license, domestic travel service business license: Equal to 50% of the fee rate specified in Clause 1, Article 4 of Circular No. 33/2018/TT-BTC;

– Fees and charges in the securities sector: Equal to 50% of the fees and charges specified in the Schedule of fees and charges in the securities sector promulgated together with Circular No.272/2016/TT-BTC (except for the fee for new issuance, renewal, and re-issuance of securities practice certificates (certificates) for individuals practicing securities at securities companies, securities investment fund management companies, and security investment companies; Fees for supervision of security activities);

– Intellectual property fees: Equal to 50% of the fee rates specified in Section A of the Schedule of intellectual property fees and charges promulgated together with Circular No. 263/2016/TT-BTC;

– Fee for issuance of operation license to send workers to work abroad for a definite time: Equal to 50% of the fee rate specified in Section 1 of the fee schedule in Article 4 of Circular No. 259/2016/TT-BTC;

– Fees for granting protection titles and certificates of registration of intellectual property rights transfer contracts; Fee for filing an application for protection of intellectual property rights: Equal to 50% of the fee rate specified in Circular No.207/2016/TT-BTC;

– Fees in the medical field: Equal to 70% of the fee rate specified in Article 1 of Circular No. 11/2020/TT-BTC.

This Circular takes effect from July 1, 2021.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany with The Esteemed Readers!