On July 29, 2022, the Government issued Decree 49/2022/ND-CP amending Decree 209/2013/ND-CP guiding the Law on Value Added Tax (“Decree 49”).

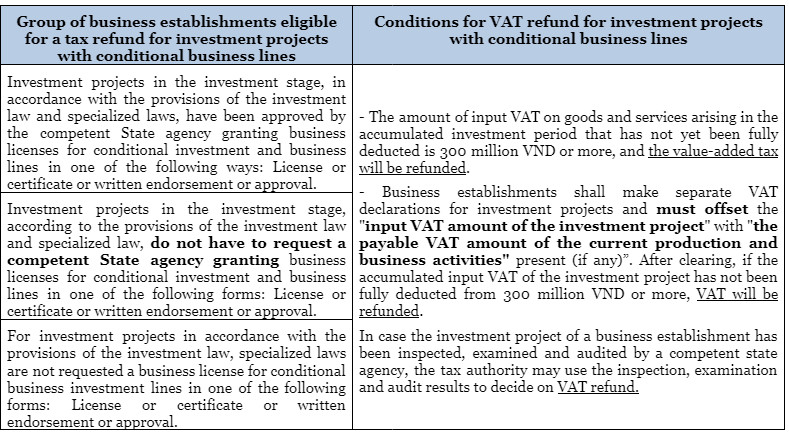

Conditions for VAT refund for “investment projects with conditional business lines” have not been specifically recorded in legal documents before, which creates many difficulties not only for With investors, even policy-implementing agencies face many difficulties in the process of implementing and interpreting the law.

Decree 49 issued by the Government is considered to have made necessary additions and amendments, thereby removing the legal bottlenecks on conditions for VAT refund for investment projects that have conditional lines of business.

Through this article, let’s learn with Bizlawyer the new regulations on conditions for VAT refund for investment projects with conditional business lines under Decree 49.

Above are some studies on conditions for VAT refund for investment projects with conditional business lines under Decree 49.

Decree 49 will take effect from September 12, 2022.

* This newsletter is for informational purposes only on newly issued legal regulations, not for advice or application to specific cases.

I hope the above information is helpful to readers.

Bizlawyer is pleased to accompany readers!