On July 29, 2022, the Government issued Decree 49/2022/ND-CP amending Decree 209/2013/ND-CP guiding the Law on Value Added Tax (“Decree 49”).

The transfer of un-deductible VAT numbers of investment projects that are not eligible for VAT refund are legal issues that are of particular interest to many investors, however, they face many difficulties and obstacles in practice because the previous regulations were not really specific and clear. Decree 49 promulgated by the Government is considered to have made amendments and supplements in a more specific and detailed direction, removing the current bottleneck on the transfer of un-deductible VAT amounts of investment projects that are not eligible for a VAT refund.

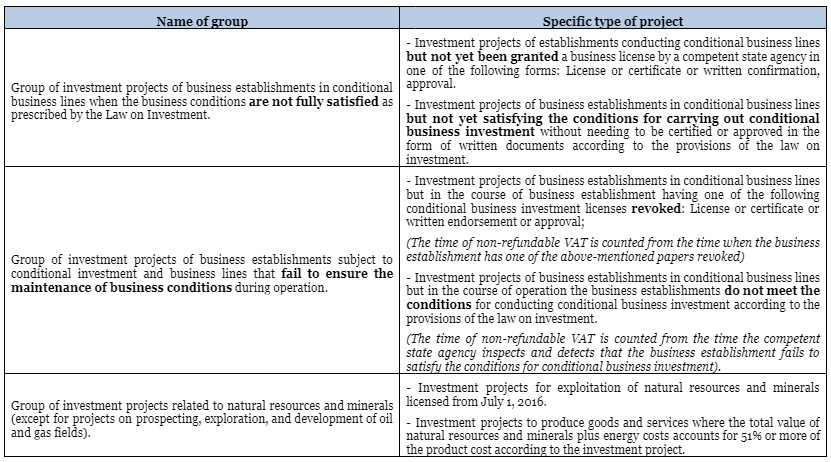

Through this article, let’s find out with Bizlawyer the new regulations on the transfer of unaudited VAT amounts of investment projects that are not eligible for a VAT refund under Decree 49. Investment projects that are not eligible for VAT refund but are transferred to the next period include 2 groups, each group will include a number of specific projects listed by law, here are details.

The above are some studies on investment projects that are not eligible for VAT refund but are carried over to the next period under Decree 49.

Decree 49 will take effect from September 12, 2022.

* This newsletter is for informational purposes only on newly issued legal regulations, not for advice or application to specific cases.

I hope the above information is helpful to readers.

Bizlawyer is pleased to accompany readers!