On November 10, 2021, the Governor of the State Bank of Vietnam issued Circular 16/2021/TT-NHNN on the purchase and sale of corporate bonds by credit institutions and foreign bank branches (“Circulars 16”), accordingly, Circular 16 replaces Circular No. 22/2016/TT-NHNN (“Circular 22”) and Circular No. 15/2018/TT-NHNN (“Circular 15”).

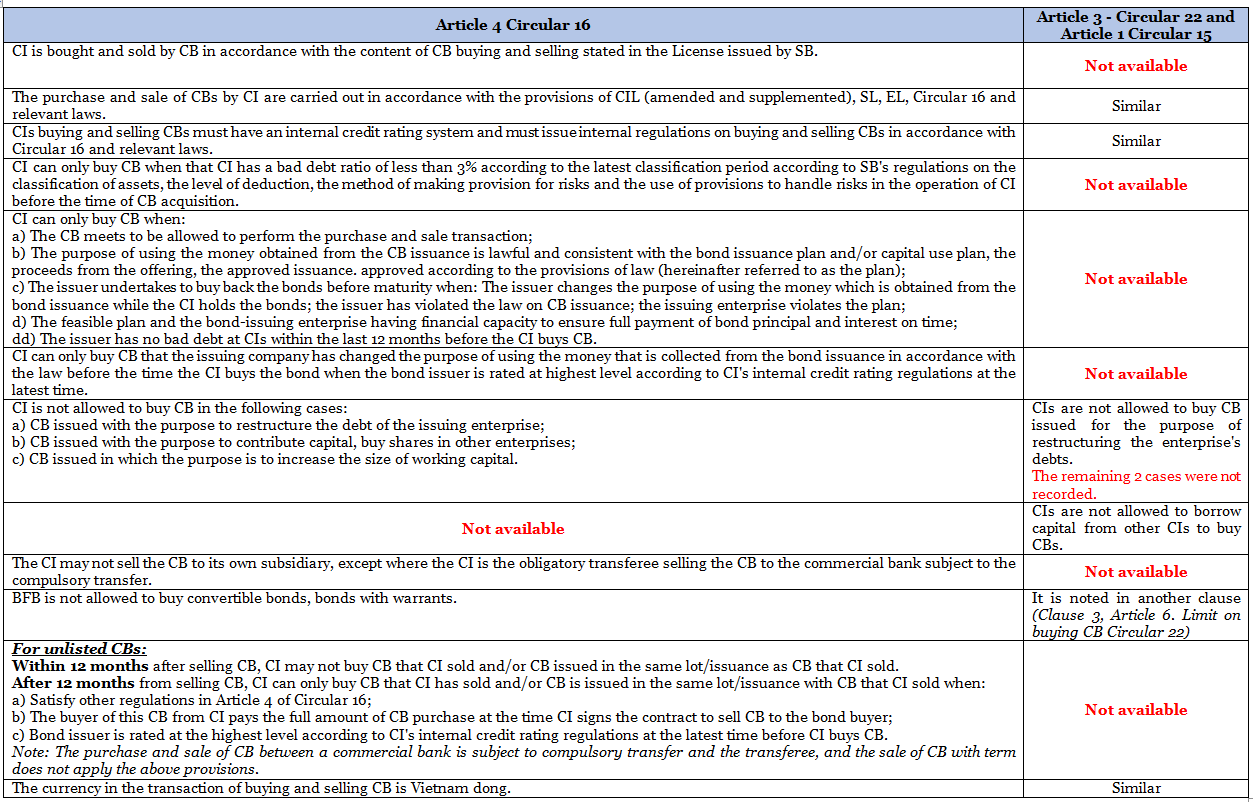

Through this article, readers, please join Bizlawyer to learn about the new point in Circular 16 compared to the previous regulations. Specifically: New principles in buying and selling CBs of CIs. Details as in the comparison table below:

The above are Bizlawyer’s updates on the new principles in buying and selling CB of CIs in Circular 16 compared to Circular 22 and Circular 15.

Circular 16 will take effect from January 15, 2022.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!