On July 29, 2022, the Government issued Decree 49/2022/ND-CP amending Decree 209/2013/ND-CP guiding the Law on Value Added Tax (“Decree 49”). Through this article, let’s learn about new guidance with Bizlawyer related to 06 cases of the land price being deducted for calculating value-added tax (“VAT”) under Decree 49.

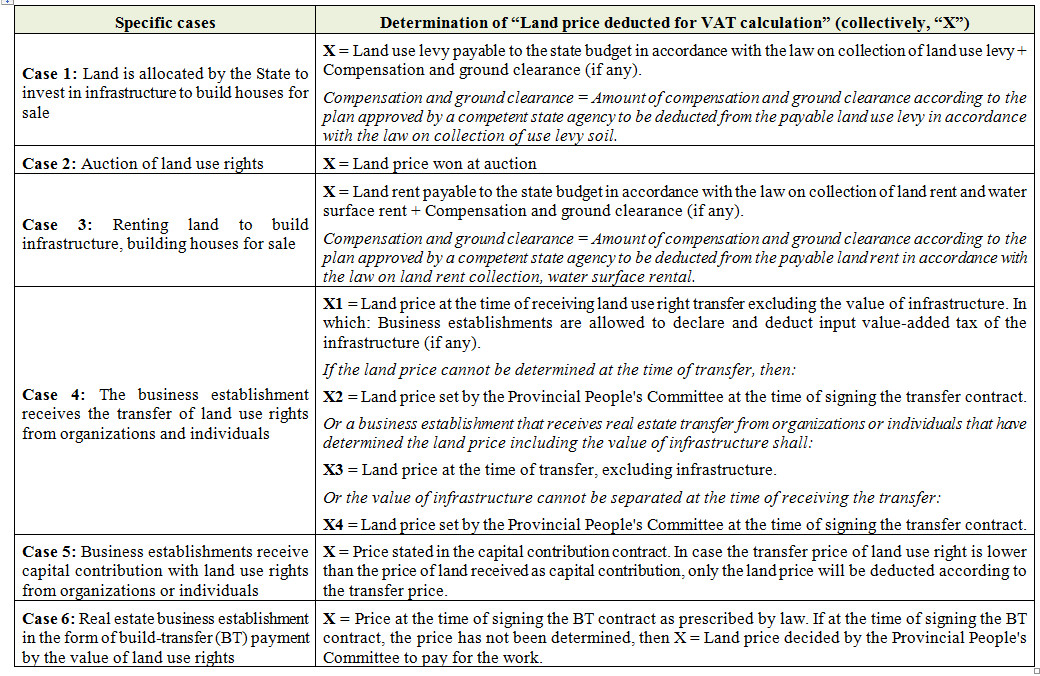

For real estate transfer, VAT calculation price = Real estate transfer price (-) Land price is deducted for VAT calculation. In, the land price to be deducted for VAT calculation is determined by Decree 49 in 06 specific cases as follows:

In addition, in the case of construction, infrastructure business, or construction of houses for sale, transfer or lease, the VAT calculation price is the amount collected according to the project implementation progress/collection schedule stated in the contract (-) The land price is deducted in proportion to the percentage of the collected amount on the total contract value.

Above are some studies on 06 cases where the land price is deducted for VAT calculation under Decree 49.

Decree 49 will take effect from September 12, 2022.

* This newsletter is for informational purposes only on newly issued legal regulations, not for advice or application to specific cases.

Hope the above information is useful to readers.

Bizlawyer is pleased to accompany readers!