On June 30, 2021, the Ministry of Finance issued Circular 51/2021/TT-BTC guiding the obligations of organizations and individuals in foreign investment activities on the Vietnamese stock market, issued by the Minister of Finance (“Circular 51”). Circular 51 replaces Circular No. 123/2015/TT-BTC dated August 18, 2015, of the Minister of Finance guiding foreign investment activities on the Vietnamese stock market (“Circular 123”).

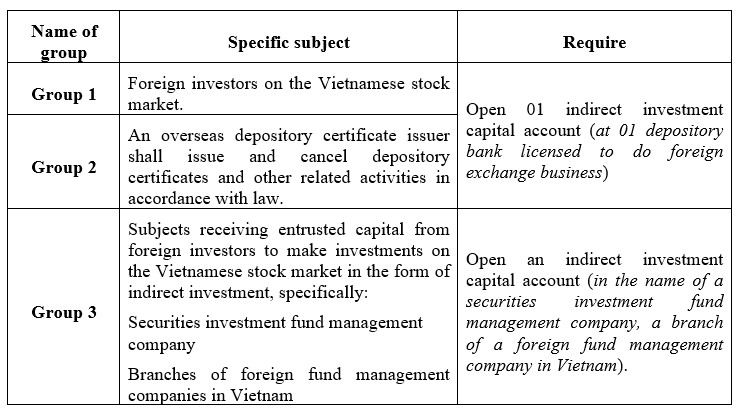

In addition to continuing to record the previous regulations in Circular 123 related to indirect investment accounts, Circular 51 has regulations to provide more detailed instructions on the groups of subjects that must open Indirect investment capital account when participating in and operating on the stock market, specifically includes the following 03 groups:

Note:

• All money transfer activities for carrying out transactions, investments, and other payments related to securities investment activities of foreign investors and activities of depository certificate issuers in foreign countries, receipt and use of dividends, distributed profits, purchase of foreign currency to transfer abroad (if any) and other related transactions must be done through the indirect investment capital account.

• The opening, closing, use, and management of indirect investment capital accounts comply with the law on foreign exchange management.

Circular 51 takes effect from August 16, 2021.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!