In order to serve the appraisal of the Ministry of Justice on the Land Law (amended) project, the Ministry of Natural Resources and Environment has recently submitted Report No. 47/TTr-BTTMT to the Government, including the topic: detailed update on new points in the Draft Land Law (amended).

January – February 2023, Ministry of Natural Resources and Environment; Relevant ministries, branches, and People’s Committees of provinces and cities organize conferences, and seminars to collect people’s opinions on the draft Land Law (amended) (according to the plan in Resolution 150/NQ- CP in 2022 issued by the Government).

The issue of land use terms is one of the important contents, having a profound influence on many aspects of society, in the Draft Land Law (amended) has shown a significant adjustment orientation, As follows:

(1) Regarding land used with the definite term: Adding regulations on land allocation, land lease for construction of underground works, land for construction of aerial works, and extension of land use.

(2) Supplementing regulations on land use terms for cases where organizations, households, and individuals have received agricultural land use rights within the use limit of households and individuals through the settlement of land use rights decisions on mortgage contracts for debt settlement, decisions or judgments of the People’s Courts, judgment enforcement decisions of judgment enforcement agencies.

(3) Supplementing regulations on land use terms for the implementation of investment projects; to adjust and extend the project’s land use term.

*** Note: The Draft Land Law (amended) includes 237 articles, of which 48 articles remain unchanged; amending and supplementing 153 articles; added 36 new articles and abolished 8 articles.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

I hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

In order to serve the appraisal of the Ministry of Justice on the Land Law (amended) project, the Ministry of Natural Resources and Environment has recently submitted Report No. 47/TTr-BTTMT to the Government, including the topic: detailed update on new points in the Draft Land Law (amended).

January – February 2023, Ministry of Natural Resources and Environment; Relevant ministries, branches, and People’s Committees of provinces and cities organize conferences, and seminars to collect people’s opinions on the draft Land Law (amended) (according to the plan in Resolution 150/NQ- CP in 2022 issued by the Government).

Supervision and settlement of land disputes is one the important contents, having a profound influence on many aspects of society, the Draft Land Law (amended) has shown a significant adjustment orientation, specifically as follows:

(1) Revising regulations on monitoring and evaluation for land use and management and responsibility for monitoring and evaluation system management.

(2) Supplementing regulations on specialized inspection of the land, which is an activity carried out regularly and continuously by agencies, organizations, units and individuals assigned the task of land management according to the Government’s regulations.

(3) Supplement the content of regulations on the mediation of land disputes for areas where commune-level administrative units are not established under the district-level People’s Committees.

(4) Amending regulations on the competence to settle land disputes in the direction that land disputes, disputes over land and land-attached assets shall be settled by the People’s Courts in accordance with the law on civil procedure. The People’s Committees at all levels are responsible for providing dossiers and documents related to the management and use of land as a basis for the People’s Court to settle according to their competence upon request.

Meaning of amendments in the Draft Land Law (amended)

– Contributing to improving the effectiveness and efficiency of state management;

– Detect, prevent and promptly handle violations in land management and use.

*** Note: The Draft Land Law (amended) includes 237 articles, of which 48 articles remain unchanged; amending and supplementing 153 articles; added 36 new articles and abolished 8 articles.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

I hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

In order to serve the appraisal of the Ministry of Justice on the Land Law (amended) project, the Ministry of Natural Resources and Environment has recently submitted Report No. 47/TTr-BTTMT to the Government, including the topic: detailed update on new points in the Draft Land Law (amended).

January – February 2023, Ministry of Natural Resources and Environment; Relevant ministries, branches, and People’s Committees of provinces and cities organize conferences, and seminars to collect people’s opinions on the draft Land Law (amended) (according to the plan in Resolution 150/NQ- CP in 2022 issued by the Government).

Issue of compensation, support, and resettlement of land when the State recovers land as one of the important contents, having a profound influence on many aspects of society, the Draft Land Law (amended) has shown a significant adjustment orientation, specifically as follows:

(1) Amending and supplementing principles in the direction of diversifying forms of compensation for land for households and individuals whose land is recovered to suit the needs of land users and specific conditions of the land users. For each locality: In addition to compensation for land with the same use purpose, if there is no land, compensation in cash as prescribed in current regulations will be compensated with other land or houses if the locality has land and land users in need. Regulations on approval of compensation, support, and resettlement plans must be done before a decision on land recovery is issued.

(2) Supplementing regulations on the support fund for people with limited working capacity when the State recovers land established by the People’s Committee of the province. The Fund’s financial sources are deducted from local land use levies and land rents; contributions from organizations, individuals, and other sources as prescribed by law.

(3) Supplementing regulations for houses, and daily-life works attached to the land of households and individuals, are usually equal to the value of new construction of houses and works with technical standards. equivalent, regardless of the extent of damage to houses and works, and the responsibility to issue a price list of compensation for actual damage to houses and constructions.

(4) Supplementing regulations on people whose residential land is recovered to implement housing projects, old apartment renovation projects in sync with the system of technical infrastructure, social infrastructure, environmental protection, project relocation of works, production, and business establishments that are subject to relocation due to environmental pollution according to regulations, resettlement projects shall be arranged for on-site resettlement; stipulates the responsibility for investors of the above projects to set aside land and house funds for on-site resettlement.

(5) Supplementing regulations that where necessary, the competent authority to decide the investment policy of the project in accordance with the law on investment considers and decides to separate the contents of compensation, support, and resettlement into a project. separate projects and organize the implementation independently at the same time as approving the project investment policy. This regulation aims to speed up the implementation of investment projects by separating the content of land acquisition and site clearance into separate projects for implementation before the implementation of investment projects.

Meaning of amendments in the Draft Land Law (amended)

– Harmonize interests between the State, land users, and investors;

– Ensure sustainable and better livelihoods for people whose land is acquired;

– Overcoming the status of lawsuits and delays in site clearance for investment projects.

*** Note: The Draft Land Law (amended) includes 237 articles, of which 48 articles remain unchanged; amending and supplementing 153 articles; added 36 new articles and abolished 8 articles.* * This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

I hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

In order to serve the appraisal of the Ministry of Justice on the Land Law (amended) project, the Ministry of Natural Resources and Environment has recently submitted Report No. 47/TTr-BTTMT to the Government, including the topic: detailed update on new points in the Draft Land Law (amended).

January – February 2023, Ministry of Natural Resources and Environment; Relevant ministries, branches, and People’s Committees of provinces and cities organize conferences, and seminars to collect people’s opinions on the draft Land Law (amended) (according to the plan in Resolution 150/NQ- CP in 2022 issued by the Government).

Land finance, land price is one of the important contents, having a profound influence on many aspects of society, in the Draft Land Law (amended) has shown a significant adjustment orientation, as follows:

(1) Additional financial revenues from land include: Collection of annual land use levy when using land in combination with other purposes; Land use levy and land rent increase for projects that are behind schedule and do not put the land into use;

(2) Additional revenues from public land services; Regulations on the time of calculation and collection of land use levy and land rent in case of adjustment of detailed construction planning that causes changes in land use and the determination of land prices as a basis for collection of obligations.

(3) Completing regulations on exemption and reduction of land use levy and land rent in the direction of clarifying regulations on the exemption from land use levy, land rent, reduction of land use levy, and land rent. Supplementing and clarifying cases of exemption or reduction of land use levy and land rent for land for construction of railway infrastructure, iron and railway stations; land for construction of educational, medical, environmental and cultural protection works or land use in mountainous, border and island communes, not in urban development planning areas.

(4) Completing regulations on land pricing principles in line with market principles; perfecting and supplementing the principle of ensuring the independence of professional expertise, honesty, and objectivity of land valuation results between the valuation agency, the appraisal agency, and the deciding agency.

(5) Abolish the Government’s land price bracket regulations, amend regulations on land price lists and specific land prices, and the Land Price Appraisal Council. Provincial People’s Committees are authorized to authorize district-level People’s Committees to decide on specific land prices in case of land recovery within the competence of district-level People’s Committees.

Meaning of amendments in the Draft Land Law (amended)

– Establish a synchronous legal framework to shift from administrative-heavy management to using economic tools for management;

– To continue the land relations, overcome problems in actual implementation;

– Ensuring public and transparent pricing; equity in land use;

– Reducing procedures in the process of determining and approving specific land prices;

– Use land effectively, bring into play land resources;

– Preventing losses, ensuring correct and sufficient revenue for the state budget.

*** Note: The Draft Land Law (amended) includes 237 articles, of which 48 articles remain unchanged; amending and supplementing 153 articles; added 36 new articles and abolished 8 articles.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

I hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

In order to serve the appraisal of the Ministry of Justice on the Land Law (amended) project, the Ministry of Natural Resources and Environment has recently submitted Report No. 47/TTr-BTTMT to the Government, including the topic: detailed update on new points in the Draft Land Law (amended).

January – February 2023, Ministry of Natural Resources and Environment; Relevant ministries, branches, and People’s Committees of provinces and cities organize conferences, and seminars to collect people’s opinions on the draft Land Law (amended) (according to the plan in Resolution 150/NQ- CP in 2022 issued by the Government).

The issue of land use regime is one of the important contents, having a profound influence on many aspects of society. The Draft Land Law (amended) has shown a significant adjustment orientation, as follows:

(1) Regarding the quota for receiving the transfer of agricultural land use rights of households and individuals: The draft stipulates that the extension of this transfer limit does not exceed 15 times the agricultural land allocation quota of households, individuals, and at the same time assign the People’s Councils of provinces on the basis of economic, social, environmental conditions and land capacity to set limits on receipt of a transfer of agricultural land use rights of households and individuals accordingly.

(2) Regarding the recipients of agricultural land transfer: Expand the recipients of agricultural land transfer to economic organizations, households, and individuals not directly engaged in agricultural production.

(3) Supplementing regulations on forms of concentration and accumulation of land for agricultural production, mechanism of land use right contribution, and adjustment of land use rights for agricultural land concentration projects; policies to encourage organizations, households and individuals to concentrate land for agricultural production.

(4) Adding regulations that agricultural land users are allowed to change the structure of crops and livestock, improve the efficiency of agricultural land use according to the planning, and use a proportion of the land to build restoration works, direct service of agricultural production combined with services, but must ensure that it does not affect the planned agricultural land area.

(5) Legalizing a number of provisions in Decree 43/2014/ND-CP and Decree 118/2014/ND-CP of the Government regulating the regime of land use management of agricultural and forestry companies after being rearranged, renewed and developed, to improve operational efficiency.

(6) Supplementing the regime of using concentrated livestock land, land for railways, land for construction of aerial works, adjusting land use rights; amending regulations on the use of production forest land, protection forest land, and special-use forest land to be consistent with the provisions of the law on forestry.

(7) Amending and supplementing the use regime of some types of land to ensure economical and efficient use of land (land for national defense and security; land in industrial parks, export processing zones, industrial clusters, high-tech zones; land for mineral activities; land for airports, civil airports; religious land).

(8) Regarding multi-purpose land use: The Draft Law has stipulated general principles for the use of land in combination with different purposes, the content of combined land use for rice, forestry, land with the water surface, land for national defense and security combined with labor, production, economic construction… This combined use does not change the main land use purpose and does not cause any harm, affecting the conservation of natural ecosystems, biodiversity, and environmental landscapes.

Meaning of amendments in the Draft Land Law (amended)

The amendment and supplementation of the contents as mentioned above aims to:

– Create a legal basis for unified management and organization;

– To effectively exploit and use land resources, contributing to promoting socio-economic development, national defense, and security;

– Ensuring the lawful rights and interests of land users;

– Enhance the State’s responsibility in ensuring the exercise of the rights of land users;

– To embellish and develop urban centers and rural residential areas on the basis of the consensus of land users, contributing to improving living conditions for urban and rural residents;

– Improve land use coefficient, and land use efficiency through the exploitation of underground space and aerial space.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

I hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

In order to serve the appraisal of the Ministry of Justice on the Land Law (amended) project, the Ministry of Natural Resources and Environment has recently submitted Report No. 47/TTr-BTTMT to the Government, including the topic: detailed update on new points in the Draft Land Law (amended).

January – February 2023, Ministry of Natural Resources and Environment; Relevant ministries, branches, and People’s Committees of provinces and cities organize conferences, and seminars to collect people’s opinions on the draft Land Law (amended) (according to the plan in Resolution 150/NQ- CP in 2022 issued by the Government).

Issues of rights and obligations of land users as one of the important contents, having a profound influence on many aspects of society, the Draft Land Law (amended) has shown a significant adjustment orientation, specifically as follows:

(1) Supplementing regulations that organizations, households, and individuals may receive land use rights transfer according to regulations, regardless of the place of residence or head office.

(2) Supplementing the right of land users who rent land with annual rental payments and have advanced compensation and ground clearance money but have not yet fully deducted the payable land rent to mortgage or sell the property their ownership attached to the land and the right to lease land in the land lease contract.

(3) Amending and supplementing regulations allowing foreign-invested economic organizations using land formed by buying shares or contributed capital to have the rights and obligations corresponding to the form of payment. land use levy, land rent.

(4) Additional rights and obligations to use the land for the construction of aerial works.

(5) Amendment and supplementation of conditions for exercising the rights of land users:

– Amendment of regulations on conditions for the exercise of rights of land users in the direction that in case of inheritance of land use rights, conversion of agricultural land, when consolidating land or changing plots, a Certificate is not required;

– Supplementing regulations for urban areas and urban development planning areas, investors in investment projects to build urban areas and residential areas may not transfer land use rights in the form of subdivisions. ;

– Supplementing regulations on the transfer, lease, and sub-lease of land use rights for real estate business projects through the land use rights trading floor in accordance with the Government’s regulations.

*** Note: The Draft Land Law (amended) includes 237 articles, of which 48 articles remain unchanged; amended and supplement 153 articles; added 36 new articles and abolished 8 articles.* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

I hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

In order to serve the appraisal of the Ministry of Justice on the Land Law (amended) project, the Ministry of Natural Resources and Environment has recently submitted Report No. 47/TTr-BTTMT to the Government, including the topic: detailed update on new points in the Draft Land Law (amended).

January – February 2023, Ministry of Natural Resources and Environment; Relevant ministries, branches, and People’s Committees of provinces and cities organize conferences, and seminars to collect people’s opinions on the draft Land Law (amended) (according to the plan in Resolution 150/NQ- CP in 2022 issued by the Government).

The issue of administrative procedures on land is one of the important contents, having a profound influence on many aspects of society, in the Draft Land Law (amended) basically remains as prescribed by the 2013 Land Law, but with the following contents reviewed and supplemented:

– Procedures for land use extension;

– Procedures for recognition of land use rights;

– Procedures for providing information and land data;

The publicity of administrative procedures on land (public content, public form) will be carried out in the electronic environment.

Meaning of amendments in the Draft Land Law (amended)

The amendment and supplementation of the above-mentioned contents aim to create a clearer legal corridor on land administrative procedures, in addition, the application of the electronic environment for administrative procedures on land is expected to make this activity simple, accessible, public, and transparent for all organizations and individuals when carrying out land-related procedures, significantly limit the people’s complaints thereby also reducing the pressure on the State’s administrative apparatus.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

I hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

In order to serve the appraisal of the Ministry of Justice on the Land Law (amended) project, the Ministry of Natural Resources and Environment has recently submitted Report No. 47/TTr-BTTMT to the Government, including the topic: detailed update on new points in the Draft Land Law (amended).

January – February 2023, Ministry of Natural Resources and Environment; Relevant ministries, branches, and People’s Committees of provinces and cities, organize conferences, and seminars to collect people’s opinions on the draft Land Law (amended) (according to the plan in Resolution 150/NQ- CP in 2022 issued by the Government).

Here, let’s take a look at 8 primary contents of the draft Land Law with Bizlawyer:

(1) More specifically stipulates the rights and responsibilities of the State as the representative of the owner, unified management of land, and the rights and obligations of citizens.

(2) Completing synchronously the regulations on building the regulatory system synchronous land use planning at 03 levels, associated with urban planning, construction, and infrastructure to ensure suitability, unity, synchronization, close connection, and mutual promotion of development.

(3) Publicity, transparency, and equality in land allocation and land lease; mainly allocate and lease land through the auction of land use rights, bidding for projects using land in order to increase state budget revenue and mobilize social resources, especially for investment projects has a highlight nature, creates a driving force for development and requires synchronous infrastructure and architecture.

(4) Decentralization of authority for localities in the management and use of land in the area, and at the same time establish central management mechanisms through regulations on a land information system, and database Data on land is centralized, unified, and manages all changes of each land plot.

(5) Regulating the authority to separate investment projects for the agency deciding the investment policy of the project according to the provisions of the law on investment to deal with the delay in project implementation due to the delay in handing over the ground; at the same time, assign responsibility to the provincial People’s Committee to direct the organization of land recovery, compensation, support, and resettlement.

(6) Completing regulations on land prices according to market principles to ensure publicity, transparency, and supervision by the People’s Council; financial, budgetary, and tax policies to regulate income from land, additional rents not brought by the investment by land users, settle speculation, slow land use, and abandoned land.

(7) Continuing to improve the rights of land users, especially the right to transfer and mortgage the lease right in the land lease contract with annual payment; expand the limit, the recipients of agricultural land transfer to promote the commercialization of land use rights, market capitalization, and promote land resources.

(8) Completing regulations on the regime of using multi-purpose land, agricultural land in combination with trade and service; land for national defense and security combined with productive labor, economic construction, religious land combined with other purposes, land with water surface for multi-purpose use, underground and aerial space use, .. . to arouse the potential, bring into full play the land resources, in line with the development trend.

*** Note: The Draft Land Law (amended) includes 237 articles, of which 48 articles remain unchanged; amended and supplement 153 articles; added 36 new articles and abolished 8 articles.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

I hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

Recently, the Ministry of Planning and Investment issued Document No. 5251/BKHĐT-PTDN dated July 29, 2022, to clarify some contents in Decree 31/2022/ND-CP dated May 20, 2022 on conditions for consideration and 2% interest rate support from the State Bank (“Document No. 5251”).

One of the notable contents of Document No. 5251 is the answer to the question that the customer receiving interest rate support must satisfy 02 conditions. Here, let’s find out with Bizlawyer 2 conditions to become the subject of 2% interest rate support from the State Bank.

Customers who are eligible for interest rate support must meet the following conditions:

+ Condition No. 01: Having a registered business line in one of the business lines specified at Point a, Clause 2, Article 2 of Decree No. 31/2022/ND-CP;

+ Condition No. 02: The purpose of using the loan is in one of the registered business lines specified at Point a, Clause 2, Article 2 of Decree No. 31/2022/ND-CP

In which, the business lines specified at Point a, Clause 2, Article 2 of Decree No. 31/2022/ND-CP include:

(1) Aviation, transportation, and warehousing (H);

(2) Tourism (N79);

(3) Accommodation and catering services (I);

(4) Education and training (P);

(5) Agriculture, forestry, and fisheries (A);

(6) Processing and manufacturing industry (C);

(7) Software publishing (J582);

(8) Computer programming and related operations (J-62);

(9) Information service operations (J-63);

(10) Including construction activities directly serving the above-mentioned economic sectors but excluding construction activities for real estate business purposes specified in the economic sector code (L).

The above business lines are determined according to Decision No. 27/2018/QD-TTg.

Above are some studies on the conditions to receive 2% interest rate support from the State Bank according to the guidance in Document 5251.

Document 5251 takes effect from the date of signing and promulgation, which is July 29, 2022.

* This newsletter is for informational purposes only on newly issued legal regulations, not for advice or application to specific cases.

I hope the above information is helpful to readers.

Bizlawyer is pleased to accompany readers!

On July 29, 2022, the Government issued Decree 49/2022/ND-CP amending Decree 209/2013/ND-CP guiding the Law on Value Added Tax (“Decree 49”).

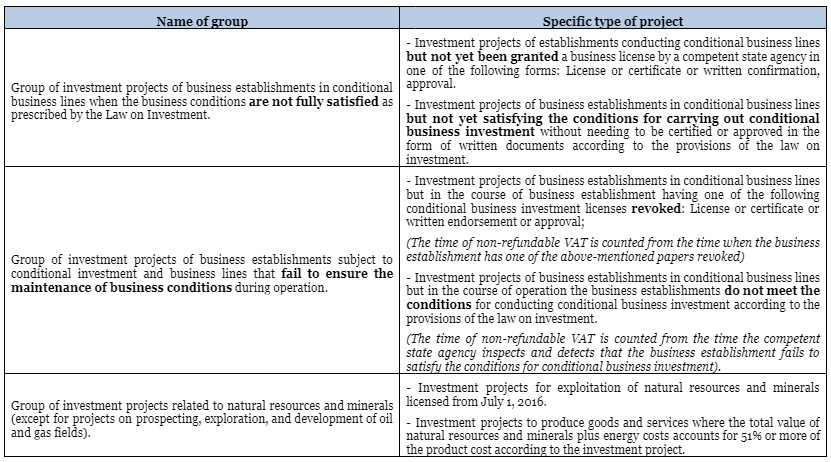

The transfer of un-deductible VAT numbers of investment projects that are not eligible for VAT refund are legal issues that are of particular interest to many investors, however, they face many difficulties and obstacles in practice because the previous regulations were not really specific and clear. Decree 49 promulgated by the Government is considered to have made amendments and supplements in a more specific and detailed direction, removing the current bottleneck on the transfer of un-deductible VAT amounts of investment projects that are not eligible for a VAT refund.

Through this article, let’s find out with Bizlawyer the new regulations on the transfer of unaudited VAT amounts of investment projects that are not eligible for a VAT refund under Decree 49. Investment projects that are not eligible for VAT refund but are transferred to the next period include 2 groups, each group will include a number of specific projects listed by law, here are details.

The above are some studies on investment projects that are not eligible for VAT refund but are carried over to the next period under Decree 49.

Decree 49 will take effect from September 12, 2022.

* This newsletter is for informational purposes only on newly issued legal regulations, not for advice or application to specific cases.

I hope the above information is helpful to readers.

Bizlawyer is pleased to accompany readers!