On April 8th, 2019, the Prime Minister issued Decision No. 17/2019/QD-TTg on a number of bidding packages and procurement contents in order to maintain regular activities of selecting contractors. in special cases as stipulated in Article 26 of the Bidding Law. This decision takes effect from May 22nd, 2019.

Accordingly, Decision No. 17/2019/QD-TTg has specified a number of bidding packages, procurement contents in order to maintain the regular operation of the application of teacher selection in special cases. in which, there are 6 bidding packages, the following contents:

Select a lawyer to provide legal services to protect the rights and interests of the Government or Vietnamese government agencies at foreign or international judges when Vietnam is a defendant in international lawsuits;

Thereby, it was found that, 06 packages, outstanding contents List of more than 20 bidding packages, procurement contents in order to maintain the regular activities applied the form of contractor selection in special cases will take effect. from May 22nd, 2019 under Decision No. 17/2019/QD-TTg. This regulation has helped to implement a transparent and transparent school owner in selecting and appointing contractors, as well as developing a specific legal framework to contribute to improving the quality of management of state agencies in Select contractors in special cases.

On 02/05/2019, the Ministry of Industry and Trade issued Official Letter No.3006/BCT-TTTN on the management of petroleum business. This official letter is effective from 16:00 on 02/05/2019.

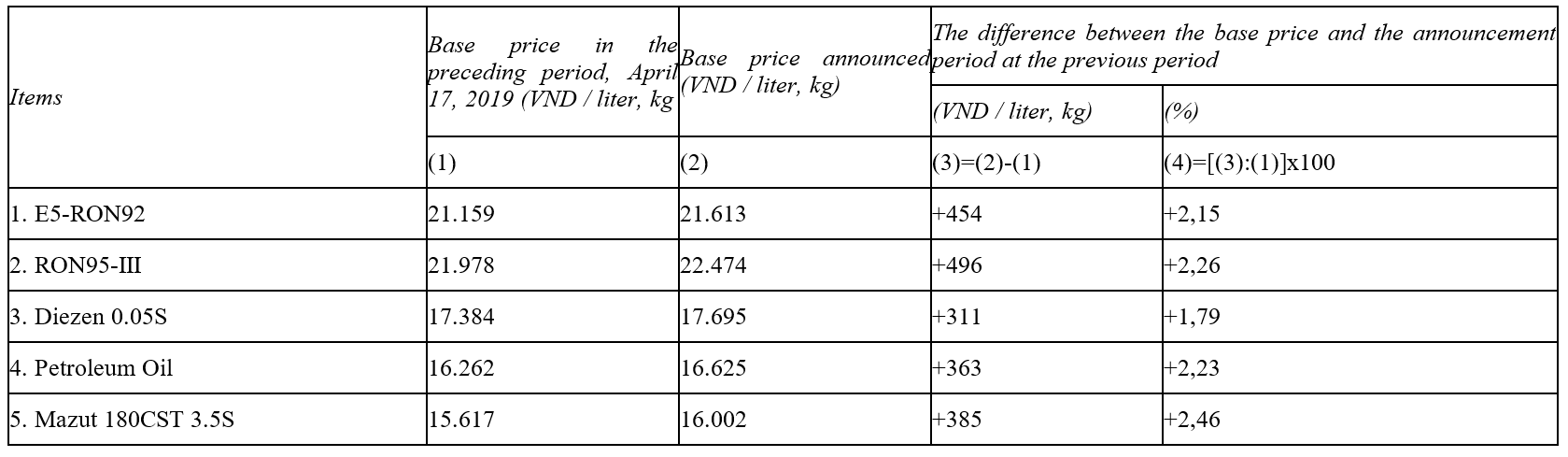

Accordingly, Official Letter No. 3006 / BCT-TTTN Adjusting the selling price of petroleum products from 02/05/2019 as follows:

According to the official dispatch, the Minis- Expenses for using petroleum price stabilization fund: E5-RON92: 925 VND / liter; RON95-III: 283 VND/liter.

Therefore, after making use of the price stabilization fund, the selling price of popular petroleum products on the market is not higher than the price:

– E5-RON92 Gas: not higher than VND 20,688 / liter;

– RON95-III Gasoline: not higher than VND 22,191 / liter;

– Diesel 0.05S: not higher than VND 17,695 / liter;

– Petroleum: not higher than VND 16,625 / liter;

– Mazut 180CST 3.5S: no higher than VND 16,002 / kg.

Appropriation and use of petroleum price stabilization fund for petroleum products: Applied from 16:00 on May 2, 2019.

Thereby, it can be seen that, from the date of May 2, 2019, the Ministry of Industry and Trade – Finance announced the basic prices of popular consumer petroleum products on the market. This regulation has affected business activities of key petroleum traders, setting a “ceiling” for selling prices of petroleum products, creating transparent and public petroleum try of Industry and Trade – Finance also decided:

Therefore, after making use of the price stabilization fund, the selling price of popular petroleum products on the market is not higher than the price:

– E5-RON92 Gas: not higher than VND 20,688 / liter;

– RON95-III Gasoline: not higher than VND 22,191 / liter;

– Diesel 0.05S: not higher than VND 17,695 / liter;

– Petroleum: not higher than VND 16,625 / liter;

– Mazut 180CST 3.5S: no higher than VND 16,002 / kg.

Appropriation and use of petroleum price stabilization fund for petroleum products: Applied from 16:00 on May 2, 2019.

Thereby, it can be seen that, from the date of May 2, 2019, the Ministry of Industry and Trade – Finance announced the basic prices of popular consumer petroleum products on the market. This regulation has affected business activities of key petroleum traders, setting a “ceiling” for selling prices of petroleum products, creating transparent and public petroleum business activities. Equal and guaranteed prices in line with developments in petroleum products in the world and economic capacity of the people.

On 29/03/2019, the Ministry of Planning and Investment has issued Circular No. 06/2019/TT-BKH of Guidance regulations and organizational activities of the consultant network, support counseling small and medium-sized enterprises through a network of consultants. Circular 06/2019 / TT-BKH will take effect from the date 05.12.2019

Accordingly, Circular 06/2019 / TT-BKH regulations on the organization of advisory support for small and medium-sized enterprises through a network of consultants as follows:

– Small and Medium Enterprises select organizations and individuals belonging to a network consultant counselor;

– Receive the application file for consulting support;

– Approving consultancy support;

– Manage, supervise and evaluate the implementation consultancy for small and medium-sized enterprises.

Besides, ministries and ministerial-level agencies will develop online software to organizations and individuals eligible to register and be recognized automatically in a network consultant.

Small and medium-sized enterprises can look up information on network consultants, include name of organization / individual counseling; registration number and consulting capacity profile at:

– The electronic information of ministries and ministerial-level agencies with counselors networks;

– National portal supports small and medium enterprises.

Thus, Circular 06/2019 / TT-BKH not the specified provisions of Article 13 of Decree 39/2018/ND-CP on advisory support for small and medium-sized enterprises, but also to create a legal corridor Standard logic for supporting small and medium enterprises. This provision facilitates maximum and priorities expressed by the State to develop this business model driven development with the economy in Vietnam.

On April 19th, 2019, the Prime Minister issued Decision No. 18/2019/QD-TTg regulating the import of used machinery, equipment and technology lines. This decision takes effect from June 15th, 2019.

Accordingly, Decision No. 18/2019/QD-TTg has specified the Import Criteria for used technological lines, which are allowed to be imported when meeting the following criteria:

1. Produced according to standards:

a) Compliance with regulations of national technical regulations (QCVN) on safety, energy saving and environmental protection;

b) In case there is no national technical regulation (QCVN) related to imported technology lines, the technological line must be produced according to standards in accordance with the technical criteria of the national standard ( TCVN) of Vietnam or the national standard of one of G7 and South Korea countries on safety, energy saving and environmental protection.

2. Capacity (in terms of the number of products produced by the technology line in a unit of time) or the remaining efficiency must be 85% or more of the design capacity or efficiency.

3. The consumption of raw materials, materials and energy must not exceed 15% of the design.

4. Technology of technological lines not on the list of technologies banned from transfer and the list of technologies subject to transfer restriction specified in Decree No. 76/2018 / ND-CP detailing and guiding the implementation of one Number of articles of the Law on Technology Transfer.

5. Technology of technology lines must be used in at least 03 production facilities in the Organization of Economic Cooperation and Development (OECD).

Thereby, it can be seen that, from the date of June 15th, 2019, the Prime Minister has clearly defined import criteria for used technology lines and import permits.

This regulation has contributed to solving problems of investors when they have a need to import used technology chains, facilitating investors to import according to clear and transparent criteria and contribute part to promote industrial production, reduce the cost of investment for investors and businesses.

On March 11th, 2019, the Ministry of Industry and Trade issued Circular No. 05/2019/TT-BCT amending the Circular No. 16/2017/TT-BCT regulating the project development and the model electricity purchase and sale contract for solar power project. The circular takes effect from April 25th, 2019.

Accordingly, the electricity purchase price of the solar roof project is revised and supplemented, as following:

Before January 1, 2018, the purchase and sale price of electricity was VND 2,086 / kWh (excluding value-added tax, equivalent to 9.35 UScents / kWh, according to the central exchange rate of Vietnam dong against the dollar. The US announced by the State Bank of Vietnam on April 10, 2017 is VND 22,316 / USD;

As of January 1, 2018, the electricity purchase and sale price applicable under the provisions of Clause 1 of this Article shall be adjusted according to the central exchange rate of Vietnam dong against the US dollar announced by the State Bank of Vietnam. on the date of the last rate announcement of the previous year;

Add content of sample electricity purchase contract for rooftop solar power projects specified in the Appendix of this Circular.

Thus, the amendment and supplement of electricity trading price of the solar roof project is in line with the development trend of the society.

On December 28th, 2018, the Ministry of Finance issued Circular No. 136/2018/TT-BTC on amending and supplementing a number of articles of Circular 13/2017/TT-BTC dated February 15th, 2017 on managing cash revenues and expenditures through the State Treasury system.

Accordingly, from the date of April 1, 2019, when the circular takes effect, the collection and spending, the use of cash through the State Treasury system will be managed more closely than the previous time.

Besides, enterprises and economic organizations having accounts at commercial banks will pay the state budget by non-cash payment or by cash at commercial banks for remittance. into the State Treasury account. As a rule, since April 1, 2019, all economic organizations have been established and operated in accordance with the laws of Vietnam including enterprises, cooperatives, cooperative unions and other organizations conducting other business investments will not use cash when performing activities to submit to the State budget.

In addition, cash withdrawals and expenditures of organizations using the state budget are also limited and limited. Under the new rules in effect, units using the state budget will not be allowed to use more than VND 100,000,000 in cash for each transaction.

Thus, with the promulgation of the Circular No. 136/2018 above, the Ministry of Finance responded proactively and positively to the Government’s guidance in improving transparency and efficiency of revenue and expenditure, Using the State Budget, contributing to repress corruption and negative effects.

On March 20th, 2019, the Ministry of Finance issued Decree No. 29/2019/ND-CP stipulating details on the licensing of labor sublease activities, the deposit and work list to be performed labor sublease takes effect on May 5th, 2019.

Accordingly, Decree No. 29/2019 / ND-CP has the following outstanding contents:

One of the conditions for enterprises to be licensed to sublease labor is the enterprise that has made a deposit of 2,000,000,000 dong (two billion Vietnam dong) at a commercial bank or a foreign bank branch. established and legally operated in Vietnam.

The enterprise sends a set of documents as prescribed to the Department of Labor, War Invalids and Social Affairs of the province or city under central authority (hereinafter referred to as the Department of Labor – Invalids and Social Affairs) where the enterprise places its head office. Head office to apply for a license. The Chairman of the provincial People’s Committee considers and grants a license to the enterprise.

Issued 20 job portfolios for sublease.

Thus, Decree No. 29/2019/ND-CP has detailed regulations on the licensing of labor sublease activities, the deposit and the list of jobs to be subleased.

On January 22rd, 2019, the Government issued Decree No. 05/2019/ND-CP on internal audit. The Decree takes effect from April 1, 2019.

Accordingly, the Decree stipulates that enterprises must perform internal audit, including:

Listed company;

Enterprises where the State owns more than 50% of charter capital are parent companies operating under the model of parent company – subsidiary companies;

State-owned enterprises in which the parent company operates according to the parent-subsidiary company model.

These enterprises can hire an independent auditing organization to qualify for audit activities in accordance with the law to provide internal audit services. The hiring of internal audits of enterprises of the Ministry of Defense and the Ministry of Public Security shall comply with the regulations of the Minister of Defense and the Minister of Public Security.

In summary, Internal auditing helps enterprises achieve their goals through a systematic and disciplined approach to assess and improve the effectiveness of risk management, control systems and management processes, value protection for businesses.

On April 19th, 2019, the Prime Minister issued Decision No. 18/2019/QD-TTg stipulating the import of used technological line machines, Decision 18/2019/QD-TTg will effective from May 16, 2019

Accordingly, Decision 18/2019/QD-TTg regulates the import of used line machinery as follows:

Age of equipment does not exceed 10 years; For machinery and equipment in some specific areas, it may be over 10 years but not exceeding 15 years or 20 years;

Produced according to standard;

Compliance with QCVN regulations on safety, energy saving and environmental protection;

In case there is no related QCVN, the imported machinery and equipment must be: Manufactured in accordance with the Vietnamese technical standards of Vietnam or the national standard of one of G7 countries and Korea Safe, energy saving and environmental protection. training courses to start business, business administration and intensive business administration.

Thus, Decision 18/2019/QD-TTg provides more detailed age of equipment for machinery and equipment in some specific fields than Circular 23/2015/TT-BKHCN dated 13/11/2015) create favorable conditions and a clear legal mechanism for importing machinery and equipment for businesses when they want to import used machinery and equipment into Vietnam.