On May 14, 2020, the Ministry of Information and Communications (“MIA”) issued Circular 11/2020/TT-BTTTT regulating the List of goods likely to cause unsafety under the management of Ministry of Information and Communications (“Circular 11/2020/TT-BTTTT”).

The list is divided into 2 groups:

1. Groups of goods compulsory to be conducted with regulation conformity certification (RCC) and regulation conformity announcement (RCA) include:

– Radio telecommunications terminal equipment;

– Radio transmitters, receivers – transmitters with a frequency band of between 9 kHz and 400 GHz and with a output capacity of 60 mW or more;

– Radio transmitters and transceivers with short distance;

– Radio communication equipment

2. Groups of goods compulsory to be conducted with RCA include:

– Information technology equipment (PC, laptop, tablet);

– Radio and television equipment;

– Radio communication equipment (cordless telephone equipment – subscription extension type)

– Radio transmitters and receivers with a frequency band of between 9 kHz and 400 GHz and with a output of 60 mW or more (Not in the case specified in Section 1).

– Short-range radio transmitter and receiver (Not in the case specified in Section 1).

– Lithium battery for handheld device.

Note: Products and goods subject to the application of two or more national technical regulations must carry out RCC and RCA according to the provisions of such national technical regulations.

This Circular takes effect from July 1, 2020 and invalidates Circular 05/2019/TT-BTTTT.

On May 14, 2020, the Ministry of Industry and Trade issued Circular No. 09/2020/TT-BTC providing the roadmap for the application of border gates of import and export for the following goods: temporarily imported or re-exported goods; transported goods from border gate to border gate; temporarily imported or re-exported goods at bonded warehouses (“Circular No. 09/2020/TT-BTC”). The article would like to go through some main contents as follows:

Those directly affected by Circular No. 09/2020/TT-BTC:

Traders engaged in business activities of temporary import, re-export, border-gate transfer or bonded warehouse.

Organizations and agencies managing business activities of temporary import, re-export, border-gate transfer or bonded warehouse.

Agencies, organizations and individuals involved in activities of temporary import, re-export, border-gate transfer or bonded warehouse.

Main content of Circular No. 09/2020/TT-BTC:

For the goods of temporary import or re-export or border-gate transfer, if imported into or re-exported out of Vietnam across the land border, the import or re-export for these goods may only be carried out through international border gates, main border gates (bilateral border gates) opened in accordance with the Government’s Decree No. 112/2014/ND-CP dated November 21, 2014 on the management of land border gates.

This regulation is also applicable to the goods at bonded warehouses if such goods are imported into or re-exported from Vietnam across the land border.

Time for applicating the regulations of Circular No. 09/2020/TT-BTC: From 00:00 on January 1, 2021.

To attract foreign investors into Vietnam to perform a business project, the state has issued a lot of different incentives policy. When executing investment projects in the sectors eligible for incentives or implemented in geographical areas eligible for investment incentives according to the provisions of law, foreign investors are entitled to certain forms of incentives.

The Law on Investment in 2014 and Decree No. 118/2015/ND-CP detailing and guiding a number of articles of the Investment Law stipulate many preferential policies, investment incentive industries and areas. enjoy investment incentives. On March 30, 2020, the Government issued Decree No. 37/2020/ ND-CP supplementing the List of industries and trades eligible for investment incentives attached to Decree 118/2015/ ND-CP guiding the Law on investment, effective from May 15, 2020. Accordingly, the following industries have been added to the Appendix of the List of industries and trades eligible for investment incentives, including:

Business investment for product distribution chains of small and medium enterprises;

Business investment for basic establishment of small and medium enterprises;

Business investment for technical assistance for small and medium enterprises;

Business investment for common workplace for start-up small and medium enterprises.

These are industries related to business investment activities in accordance with the Law on Supporting Small and Medium Enterprises. It is one of the policies that the State has encouraged to create conditions for small and medium-sized enterprises to have the opportunity to promote their business activities, to promote businesses to grow more and more.

Environmental issues are always concerned by the authorities and people. The increasing development of factories, manufacturing enterprises, discharges a lot of waste into the environment, causing serious impacts on the environment. From the above issues, the authorities are required to strengthen the control and minimize the harmful effects on the environment and people’s lives. One of the many measures applied is to pay environmental protection fees from organizations, individuals and households themselves when discharging wastewater into the environment. However, in certain cases organizations and individuals are still free of environmental protection.

On May 5, 2020 the Government issued Decree No. 53/2020/ND-CP stipulating environmental protection fee for wastewater taking effect from July 1, 2020. Accordingly, this Decree provides for cases of free environmental protection for wastewater. As follows:

Free domestic wastewater in 3 cases:

Domestic wastewater of organizations, households and individuals in communes;

Daily-life waste water of organizations, households and individuals in wards and townships without clean water supply systems;

Daily-life waste water of households and individuals not doing business in wards and townships already having clean water supply systems and using water by themselves.

In addition, this Decree stipulates a number of other cases that are free of charge:

Water discharged from hydroelectric plants;

Seawater used to produce salt is discharged;

Cooling water (in accordance with the law on environmental protection) is not directly in contact with pollutants and has its own outlet;

Waste water from rainwater naturally overflows;

Waste water from fishing means of fishermen;

Wastewater of centralized waste water treatment systems in urban areas is treated up to environmental standards and technical regulations as prescribed before being discharged into receiving sources.

In order to support people facing difficulties due to the impact of the Covid -19 pandemic, the State has issued many urgent measures to limit difficulties for production and business activities, ensuring social security and quality life. Accordingly, for businesses heavily affected by the Covid epidemic – 19, the Ministry of Labor – Invalids and Social Affairs issued Official Dispatch No. 1511 / LDTBXH-BHXH 2020 on guiding the temporary suspension of payment to the fund retirement and survivors on May 4, 2020.

In the Official Dispatch, it is clearly stated that, in case the Employer has to suspend production and business for 01 month or more due to difficulty in changing structure, technology or due to crisis, economic recession or to implement State policies when restructuring the economy or fulfilling international commitments; Employers who are in difficulties due to natural disasters, fires, epidemics or crop failures will be temporarily suspended to contribute to the retirement and survivorship fund.

However, the employer in the above cases may only temporarily suspend the payment to the retirement and survivorship fund when satisfying one of the following conditions:

The quantity of suspended employees who have social insurance is at least 50% of total number of employees before the suspension.

The loss caused by the natural disaster, fire, epidemic or crop failure is over 50% of total assets (excluding land);

Accordingly, the period of temporary suspension of payment to the retirement and survivorship fund for the two above cases is counted from the month the employer issues a written request but not more than 12 months.

Social insurance premiums have been fully paid by the end of January 2020 and the quantity of employees who have social insurance is decreased by at least 50% over the period from January 2020 to the date of application. The employees only includes those who have indefinite-term employment contracts, fixed-term employment contracts, employment contracts with a term of from 1 to less than 12 months; hired managers of enterprises and cooperatives. In this case, the period of temporary suspension of payment to the retirement and survivorship fund is calculated from the month the employer issues a written request and does not exceed the time limit of June or December 2020.

At the end of the suspension period, the employer and the employee continue to contribute to the retirement and survivorship fund and at the same time make compensation for the suspension period (for both employees stopped paying wages), The amount of compensation payment is not subject to late payment interest. If, during this period, the employee is eligible for retirement, survivorship or termination of the labor contract, the employer shall make payment to compensate for the suspension period. regime for employees. The provisions of this Official Letter will officially take effect from May 4, 2020.

On April 9, 2020 the Government issued Decree No.46/2020/ND-CP, effective from 1/6/2020 providing regulations on customs procedures, customs inspection and supervision of goods. transit through the ASEAN customs transit system to implement Protocol 7 on the customs transit system

Protocol 7 on the Customs Transit System was developed with the overall goal of simplifying and harmonizing regulations on movement, trade and customs; establish an effective, optimal and integrated transit system in ASEAN.

This Decree details the goods in transit through the ACTS system. Can understand the ACTS system as follows: “ACTS” means the integrated information technology system developed by Member States of ASEAN for the purposes of connecting and exchanging information to carry out electronic transit procedure, control the movement of goods across the territory of Contracting Parties, assisting customs authorities of Contracting Parties in calculating customs duties and guarantee amounts, and exchanging information for recovery of customs debts under Protocol 7 on Customs Transit System (hereinafter referred to as “Protocol 7”

The transit of goods through the ACTS system must comply with the following provisions:

1. Goods placed under the ACTS procedure which are transported from Vietnam across the territory of a Contracting Party must comply with the provisions on management of goods in transit of that Contracting Party.

2. Goods placed under the ACTS procedure which are transported across the territory of a Contracting Party and imported to Vietnam must comply with the provisions on management of goods in transit of that Contracting Party and the relevant provisions on management of imports of Vietnam.

3. Goods placed under the ACTS procedure which are transported across the territory of Vietnam must comply with the provisions on management of goods in transit laid down in relevant laws.

4. Based on the result of classification of customs declarations on the ACTS and provided information relating to the goods in transit (if any), Directors of Customs Sub-departments shall decide to carry out the examination of customs dossiers and/or the physical inspection of goods. The physical inspection of goods shall be carried out with machinery and other technical devices. If the Customs Sub-department does not have sufficient machinery and technical devices or the inspection of goods by using machinery and technical devices is not sufficient for determining the actual conditions of goods or any violations are suspected, the customs officials shall carry out the physical inspection of goods.

5. Charges which may be incurred in Vietnam in respect of goods placed under the ACTS procedure shall be paid in accordance with regulations of the law on fees and charges.

In addition, this Decree prescribes the priority regime for enterprises conducting goods transit through the ACTS System such as:

1. Free many journeys

2. Exemption from the requirement to present the TAD and the goods at the customs authority, except for the case of the ACTS failure.

3. Exemption from the examination of customs dossiers and physical inspection of goods at the customs authority of departure, except for the cases of suspected violations.

4. Use of the special seal approved by the customs authority.

5. The validity period of authorisations shall be 36 months from the date of issue of the decision on recognition of authorized transit trader status.

Decree No. 46/2020/ND-CP was issued, contributing to creating a legal basis for implementing the application of customs modernization for goods in transit between ASEAN countries and Vietnam, while contributing to reducing spending fees and facilitate businesses in the transit of goods between Vietnam and ASEAN member countries, ensuring the requirements of administrative procedure reform and customs modernization.

On May 25th, 2020, the Government issued Decree 57/2020/ND-CP amending and supplementing a number of articles of Decree No.122/2016/ND-CP dated September 1st, 2016 of the Government on the Export tax, preferential import tariff, list of goods and absolute tax rates, mixed tariffs, and non-quota import tax and Decree No. 125/2017/ND-CP dated November 16th, 2017 amending and supplementing a number of articles of Decree No.122/2016/ND-CP.

Accordingly, the preferential import tax rates for raw materials, supplies and components for production, processing (assembly) of industrial products support development priority for the automobile manufacturing and assembly industry. the period from 2020 to 2024 (hereinafter referred to as the preferential program for automobile industry tax) is prescribed as follows:

– Preferential import tax rate of 0% for domestically unavailable raw materials, supplies and components for production, processing (assembly) of products aided by development priorities for manufacturing industry, automobile assembly (hereinafter referred to as automobile supporting products).

a) At the time of registration of the declaration, the declarant shall declare and calculate tax on imported raw materials, supplies and components at the normal import tax rates or preferential import tax rates. Preferential import tax rates or special preferential import tax rates as prescribed, the tax rate of 0% has not yet been applied.

b) The application of the preferential import tax rate of 0% to raw materials, supplies and components of the automobile industry tax incentives program shall comply with the following principles:

(i) Ensuring the right subjects of application: Enterprises manufacturing, processing (assembling) automobile components and spare parts; Enterprises manufacturing and assembling automobiles produce and assemble automobiles by themselves (assemble).

(ii) Ensure the Applicable Conditions

(iii) Guarantee for the tax incentive review period: The tax incentive review period must not exceed 6 months from January 1 to June 30 or from July 1 to December 31 every year.

(iv) Ensuring sufficient documents and procedures for registering to participate in the Preferential tax program for automobile industry

(v) Implement customs declaration procedures in accordance with the law

(vi) Manufacturing, processing (assembling) establishments of enterprises participating in the automotive tax incentives program must meet the conditions prescribed by law.

(vii) Provide complete documents and carry out procedures to apply the preferential tax rate of 0%

The State Bank of Vietnam has just issued Decision 920/QĐ-NHNN on the maximum short-term loan interest rate in Vietnam dong as prescribed in Clause 2, Article 13 of Circular 39/2016/TT-NHNN of December 30th, 2016. 2016 and takes effect from the date of signing, and this Decision also replaces Decision 420/QĐ-NHNN issued by the State Bank of Vietnam on March 16th, 2020.

Accordingly, the regulation on interest rates for short-term loans are as follows:

Credit institutions and foreign bank branches (except people’s credit funds and microfinance institutions) shall offer short-term loans in Vietnam Dong with the maximum interest rate of 5.0%/year (0.5% / year lower than before)

People’s credit funds and microfinance institutions shall offer short-term loans in Vietnam Dong with the maximum interest rate of 6.0%/year (0.5% / year lower than before)

The interest rate applicable to credit contracts and loan agreements signed before May 13th, 2020 is continued to be implemented according to signed contracts and agreements in accordance with the provisions of law at the time of signing.

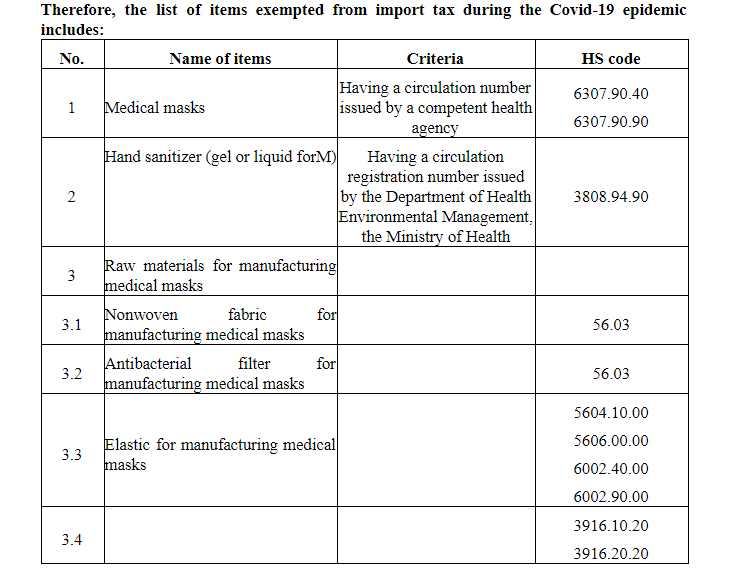

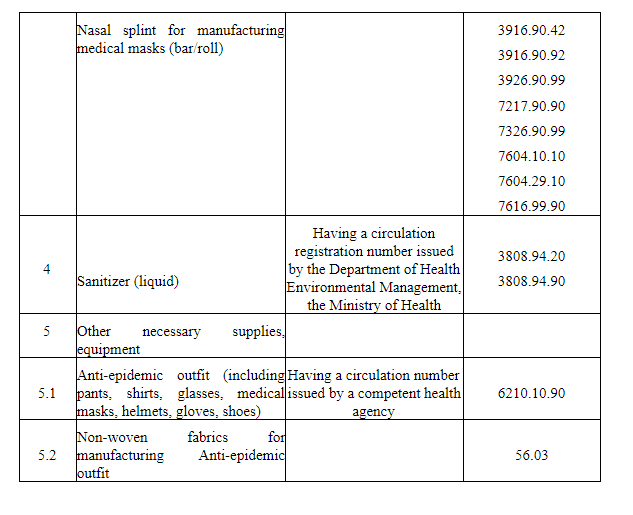

On February 7, 2020, the Prime Minister issued Official Letter No. 197/TTg-KTTH of exempting import tax on medical masks and hand sanitizer; raw materials for the production of masks, antiseptic water, necessary supplies and equipment in service of the prevention and control of acute respiratory infections caused by corona virus.

On February 7, 2020, the Ministry of Finance issued Decision No. 155/QD-BTC on the list of items exempted from import tax for the prevention and control of acute respiratory infections caused by corona virus.

On March 27, 2020, the Ministry of Finance issued Decision No. 436/QD-BTC to supplement items exempted from import tax to the list in the previous Decision No. 155/QD-BTC.