On September 17, 2021, the Ministry of Finance issued Circular 78/2021/TT-BTC guiding the implementation of the Law on Tax Administration, Decree 123/2020/ND-CP regulating invoices and documents (“Circular 78”).

One of the notable new points of Circular 78 is the provision on “Authorization for e-invoicing”: This means that sellers and service providers can authorize a third party to issue e-invoices for their selling goods and services. Here are the details.

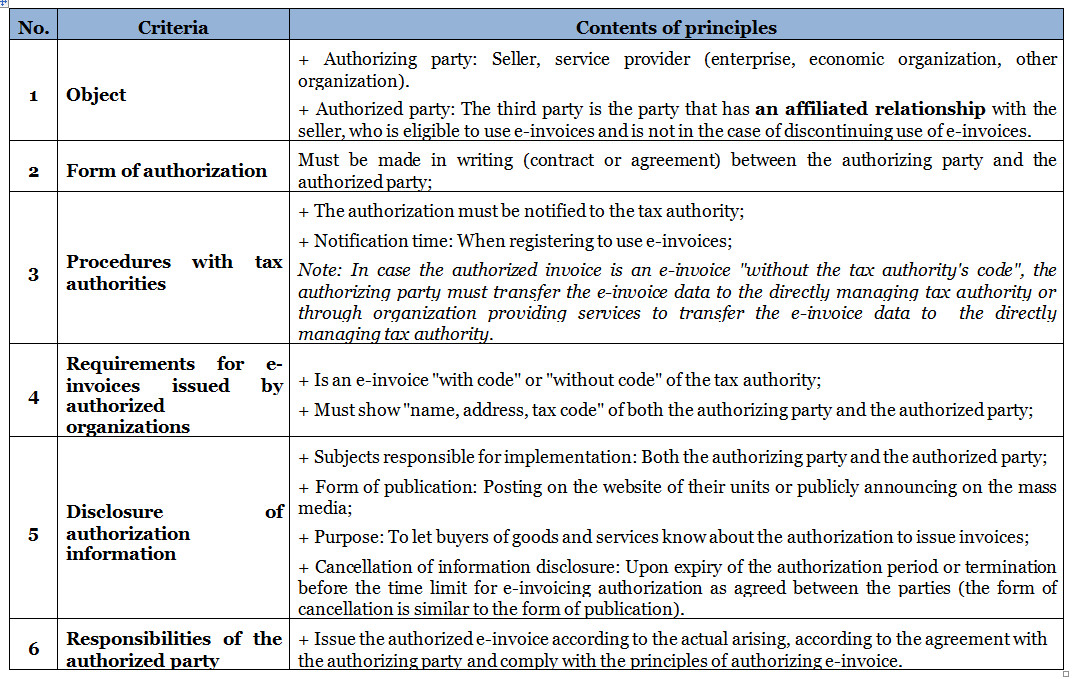

1. Principles of authorization for e-invoicing:

2. Authorization contract/Authorization agreement

– Content: Must fully show the following information:

a. Name, address, tax identification number, the ID number of the authorizing party and the authorized party;

b. Authorized e-invoices: invoice type, invoice symbol, invoice model number symbol;

c. Authorization purpose;

d. Authorization term;

e. Authorized invoice payment method (specify the responsibility to pay for goods and services on the authorized invoice);

– The authorizing party and the authorized party are responsible for storing the authorization document and presenting it when the competent authority requests it.

3. Notify the tax authority of the authorization to issue e-invoices

– The authorization is defined as the change of registration information for the use of e-invoices according to the provisions of Article 15 of Decree No. 123/2020/ND-CP. The authorizing party and the authorized party use Form No. 01DKTD/HDDT issued together with Decree No. 123/2020/ND-CP to notify the tax authority of the authorization to issue e-invoices, including the case of termination before the time limit for e-invoicing authorization as agreed between the parties;

– The authorizing party fills in the information of the authorized party, the authorized party fills in the information of the authorizing party in Form No. 01DKTD/HDDT issued together with Decree No. 123/2020/ND-CP.

Regulations on authorization to issue e-invoices have not been recorded in previous legal documents (Circular 119/2014/TT-BTC; Circular 26/2015/TT-BTC).

For more detailed information: The Esteemed Readers can refer to the provisions of Article 3 of Circular 78 and other relevant provisions. Circular 78 takes effect from July 1, 2022.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!