On July 29, 2022, the Government issued Decree 49/2022/ND-CP amending Decree 209/2013/ND-CP guiding the Law on Value Added Tax (“Decree 49”).

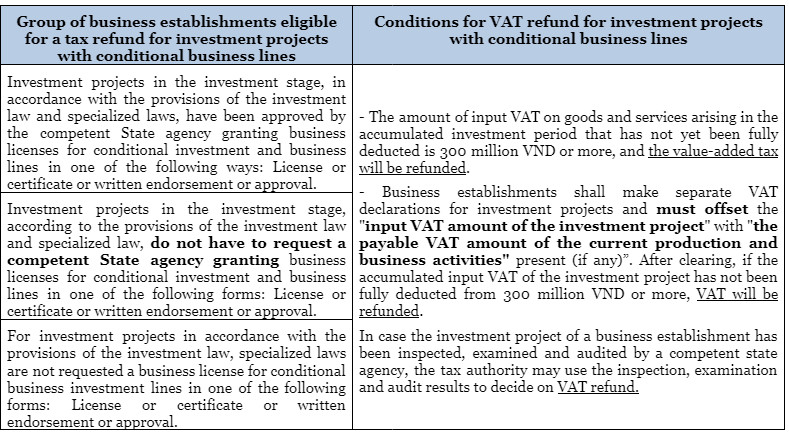

Conditions for VAT refund for “investment projects with conditional business lines” have not been specifically recorded in legal documents before, which creates many difficulties not only for With investors, even policy-implementing agencies face many difficulties in the process of implementing and interpreting the law.

Decree 49 issued by the Government is considered to have made necessary additions and amendments, thereby removing the legal bottlenecks on conditions for VAT refund for investment projects that have conditional lines of business.

Through this article, let’s learn with Bizlawyer the new regulations on conditions for VAT refund for investment projects with conditional business lines under Decree 49.

Above are some studies on conditions for VAT refund for investment projects with conditional business lines under Decree 49.

Decree 49 will take effect from September 12, 2022.

* This newsletter is for informational purposes only on newly issued legal regulations, not for advice or application to specific cases.

I hope the above information is helpful to readers.

Bizlawyer is pleased to accompany readers!

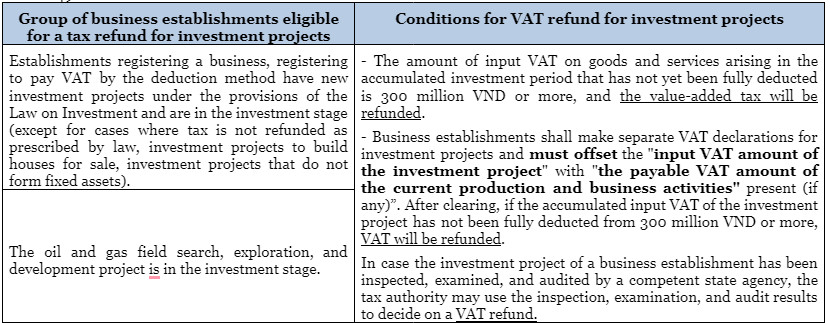

On July 29, 2022, the Government issued Decree 49/2022/ND-CP amending Decree 209/2013/ND-CP guiding the Law on Value Added Tax (“Decree 49”).

Conditions for VAT refund for investment projects is one of the legal issues that many investors pay special attention to, but they face many difficulties and obstacles in practice due to regulations. Before that was not really specific, or clear. Decree 49, issued by the Government, is considered to have been supplemented and amended in a more specific and detailed direction, removing the current bottleneck on conditions for VAT refund for investment projects.

Through this article, let’s learn with Bizlawyer the new regulations on conditions for VAT refund for investment projects under Decree 49.

Above are some studies on conditions for VAT refunds for investment projects under Decree 49.

Decree 49 will take effect from September 12, 2022.

* This newsletter is for informational purposes only on newly issued legal regulations, not for advice or application to specific cases.

I hope the above information is helpful to readers.

Bizlawyer is pleased to accompany readers!

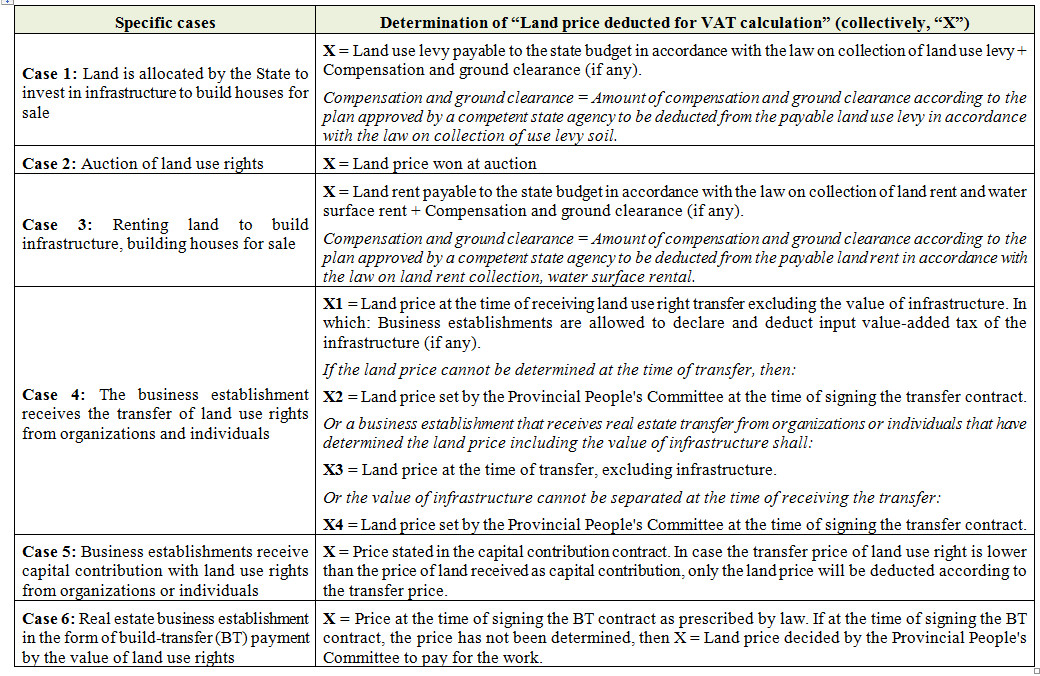

On July 29, 2022, the Government issued Decree 49/2022/ND-CP amending Decree 209/2013/ND-CP guiding the Law on Value Added Tax (“Decree 49”). Through this article, let’s learn about new guidance with Bizlawyer related to 06 cases of the land price being deducted for calculating value-added tax (“VAT”) under Decree 49.

For real estate transfer, VAT calculation price = Real estate transfer price (-) Land price is deducted for VAT calculation. In, the land price to be deducted for VAT calculation is determined by Decree 49 in 06 specific cases as follows:

In addition, in the case of construction, infrastructure business, or construction of houses for sale, transfer or lease, the VAT calculation price is the amount collected according to the project implementation progress/collection schedule stated in the contract (-) The land price is deducted in proportion to the percentage of the collected amount on the total contract value.

Above are some studies on 06 cases where the land price is deducted for VAT calculation under Decree 49.

Decree 49 will take effect from September 12, 2022.

* This newsletter is for informational purposes only on newly issued legal regulations, not for advice or application to specific cases.

Hope the above information is useful to readers.

Bizlawyer is pleased to accompany readers!

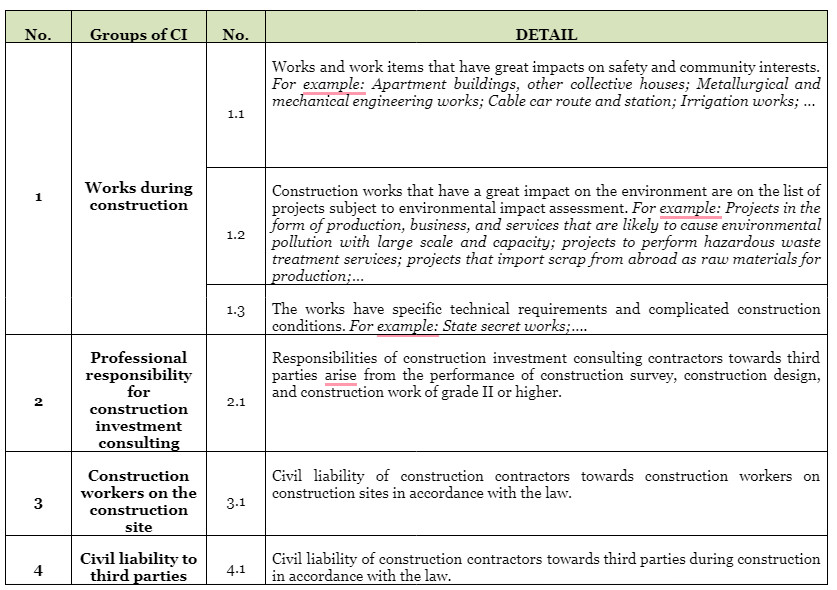

On August 11, 2022, the Minister of Finance issued Circular 50/2022/TT-BTC guiding Decree 119/2015/ND-CP and Decree 20/2022/ND-CP on compulsory insurance in construction investment activities (“Circular 50”).

In this newsletter, let’s learn about compulsory insurance in construction investment activities (“CI”) with Bizlawyer.

Above are some studies on the types of compulsory insurance in construction investment activities according to Circular 50.

Circular 50 will take effect from September 1, 2022.

* This newsletter is for informational purposes only on newly issued legal regulations, not for advice or application to specific cases.

I hope the above information is useful to your readers.

On June 29, 2022, the Government issued Decree 44/2022/ND-CP on the construction, management, and use of information systems in the housing and real estate market. In this Decree, there are a number of new regulations on the form of exploitation and use of databases in the housing and real estate market, specifically as follows:

1. Through the portal of the information system on the housing and real estate market (http://www.batdongsan.xaydung.gov.vn); Portal of the Department of Construction;

2. Approval of the request form or written request;

3. By contract between the agency managing the information system on housing and real estate market and the party exploiting and using data on housing and real estate market in accordance with the law.

Accordingly, Decree 44/2022/ND-CP only stipulates 03 forms of exploitation and use of the database on the housing and real estate market (compared to the current law, there are 05 mining forms).

At the same time, organizations and individuals wishing to register for the grant of the right to exploit and use information and data on housing and the real estate market must send a request form to the agency or unit assigned to manage it, providing information and data on housing and real estate market to consider granting access rights to exploit, use information, data on housing and real estate market,

This Decree takes effect from August 15, 2022.

This newsletter is for informational purposes only on newly issued legal regulations, not for advice or application to specific cases.

I hope the above information is helpful to readers.

Bizlawyer is pleased to accompany readers!

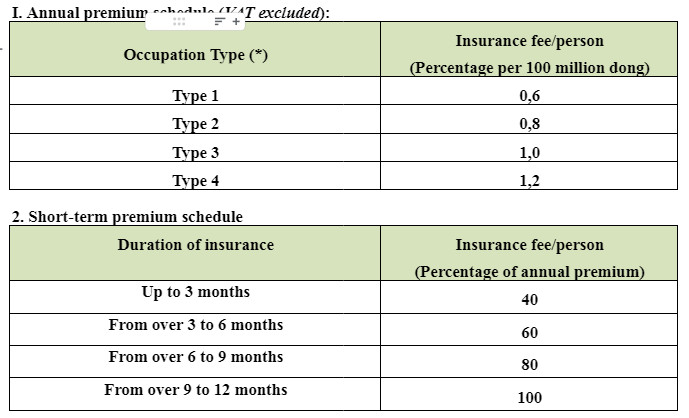

On August 11, 2022, the Minister of Finance issued Circular 50/2022/TT-BTC guiding Decree 119/2015/ND-CP and Decree 20/2022/ND-CP on compulsory insurance in construction investment activities (“Circular 50”).

In this newsletter, let’s find out with Bizlawyer about the latest compulsory insurance premium schedule for construction workers on the construction site under Circular 50.

(*) Occupation classification:

Type 1: Indirect labor, working mainly in offices, desks or other similar jobs with little travel. For example: accountant, administrative staff.

Type 2: Occupations that are not manual labor but have a greater risk than type 1, require a lot of travel, or include manual but infrequent and light manual labor. For example, civil engineers, and managers often come to the construction site.

Type 3: Occupations where the work is mainly manual labor and jobs with a higher level of risk than type 2. For example: include mechanical engineers, electrical engineers, and workers on construction sites.

Type 4: Occupations that are dangerous, prone to accidents, and are not specified in the above three types of occupations.

Above are some studies on the latest compulsory insurance premium schedule for construction workers on the construction site according to Circular 50.

Circular 50 will take effect from September 1, 2022.

* This newsletter is for informational purposes only on newly issued legal regulations, not for advice or application to specific cases.

Hope the above information is useful to you readers.

On April 21, 2022, the General Department of Customs issued Official Letter 1400/TCHQ-TXNK 2022 on the tax treatment of goods rented and borrowed from export processing enterprises (“Dispatch 1400”).

Accordingly, Dispatch 1400 has recorded the guidance of the General Department of Customs related to tax treatment in case imported goods are not re-exported in the form of temporary import for re-export:

– A domestic enterprise that rents or borrows goods from an export processing enterprise under a lease or loan contract to serve production shall, after the lease or loan term expires, the domestic enterprise must re-export the number of rented or borrowed goods.

– In case the enterprise fails to re-export the rented or borrowed goods, immediately after the end of the lease or loan term, a new customs declaration must be registered and full payment of taxes and fines (if any) in accordance with regulations. determined. In case of failure to declare and pay all taxes at the end of the lease or loan term, the customs authority shall impose tax according to the provisions of Clause 4, Article 17 of Decree No. 126/2020/ND-CP dated 19 October 2020 of the Government.

Dispatch 1400 takes effect from April 21, 2022.

* This newsletter is only for information about newly issued legal regulations, not used to advise or apply to specific cases.

I hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

On April 21, 2022, the General Department of Customs issued Official Letter 1400/TCHQ-TXNK 2022 on the tax treatment of goods rented and borrowed from export processing enterprises (“Dispatch 1400”).

Accordingly, Dispatch 1400 has recorded the guidance of the General Department of Customs related to handling overpaid tax amounts for goods rented or borrowed from export processing enterprises, the following will be detailed:

Subjects of application: Goods leased or borrowed by domestic enterprises from export processing enterprises in the form of temporary import for re-export to serve processing and production for export.

– In case an enterprise is entitled to additional declaration due to incorrect declaration of taxable value, resulting in the amount of tax paid being greater than the amount of tax payable, the overpaid tax amount will be refunded when the taxpayer no longer owes tax, late payment interest, fines.

– The customs authority shall check the reasons for additional declarations, customs declarations, relevant vouchers, and documents to determine the customs value and tax policy in accordance with regulations.

Dispatch 1400 takes effect from April 21, 2022.

* This newsletter is only for information about newly issued legal regulations, not used to advise or apply to specific cases.

I hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

On April 21, 2022, the General Department of Customs issued Official Letter 1400/TCHQ-TXNK in 2022 on tax treatment of goods rented and borrowed from export processing enterprises (“Dispatch 1400”).

Accordingly, Dispatch 1400 has recorded the guidance of the General Department of Customs related to additional declarations for goods rented or borrowed from export processing enterprises, the following will be detailed information:

Conditions for additional declaration according to regulations:

(1) Rented or borrowed goods are on temporary import declarations registered from October 15, 2019 (the effective date of Circular No. 60/2019/TT-BTC) and have not been re-exported; and

(2) The renting or borrowing enterprise determines that there is an error in the customs value declaration; and falls into the cases where it is allowed to make additional customs declarations according to the dutiable value of the rented or borrowed goods specified in Clause 9 Article 1 of Circular 60/2019/TT-BTC dated August 30, 2019, of the Ministry of Finance.

– The customs authority shall check the conditions for additional declaration, the customs value of additional declaration, tax policy, and regulations on the additional declaration for handling according to rules.

Dispatch 1400 takes effect from April 21, 2022.

* This newsletter is only for information about newly issued legal regulations, not used to advise or apply to specific cases.

I hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

On April 21, 2022, the General Department of Customs issued Official Letter 1400/TCHQ-TXNK in 2022 on tax treatment of goods rented and borrowed from export processing enterprises (“Dispatch 1400”).

Accordingly, Dispatch 1400 has recorded the guidance of the General Department of Customs related to VAT for goods rented or borrowed from export processing enterprises, the following will be detailed:

Subjects of application: Goods rented or borrowed by domestic enterprises from export processing enterprises in the form of temporary import for re-export to serve processing and production for export.

– Domestic enterprises that have registered declarations under the form of temporary import are not subject to VAT.

– In case the lease or loan term has expired, but the domestic enterprise continues to use it and does not re-export, immediately after the lease or loan term expires, the domestic enterprise must declare and pay VAT together with the import tax on the new customs declaration as prescribed in Clause 12, Article 1 of Decree No. 59/2018/ND-CP dated April 20, 2018 of the Government.

– In case the rental or borrowed goods are damaged in the course of use, cannot be re-exported, must be destroyed, and have been destroyed according to the provisions of law, the domestic enterprise is not required to declare and pay tax VAT for this number of leased or borrowed goods.

Dispatch 1400 takes effect from April 21, 2022.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!