On July 30, 2021, the State Bank of Vietnam (SBV) issued Circular No. 11/2021/TT-NHNN stipulating the classification of assets, the level of deduction, the method of making provision for risks, and the use of the provision to handle risks in the operation of credit institutions, foreign bank branches. This document takes effect from October 1, 2021.

Accordingly, in principle, the circular stipulates that all outstanding debts of a customer at a credit institution or foreign bank branch must be classified into the debt group. Credit institutions classify debt into 5 groups: (i) Group 1: Qualified debt; (ii) Group 2: Debts needing attention; (iii) Group 3: Subprime debt; (iv) Group 4: Doubtful debts; (v) Group 5: Debts likely to lose capital. Specific provisioning rates for each debt group are as follows: (i) Group 1: 0%; (ii) Group 2: 5%; (iii) Group 3: 20%; (iv) Group 4: 50%; (v) Group 5: 100%.

The level of general provision to be deducted is determined at 0.75% of the total balance of debts from group 1 to group 4. Besides, credit institutions use provisions to deal with risks in the following cases: Customers is an organization that is dissolved or goes bankrupt; an individual is dead or missing; Debts are classified into the group of debts that are likely to lose capital.

After a period of at least 5 years from the date of using provisions to deal with risks and after taking all measures to recover but not being able to recover, the credit institution may decide to pay the debt that has already been treated from abroad.

Compared with Circular No. 02/2013/TT-NHNN dated January 21, 2013, Circular 09/2014/TT-NHNN dated March 18, 2014, Circular No. 11/2021/TT-NHNN provided a legal framework for stricter management on debt classification and provisioning in accordance with the outbreak of the epidemic which makes banks’ potential bad debts likely to increase sharply in the next few years.

On August 26, 2021, the Government issued Decree No. 80/2021/ND-CP detailing and guiding the implementation of a number of articles of the Law on Supporting SMEs (“Decree No. 80”). Decree No. 80 replaces Decree No. 39/2018/ND-CP dated March 11, 2018, of the Government.

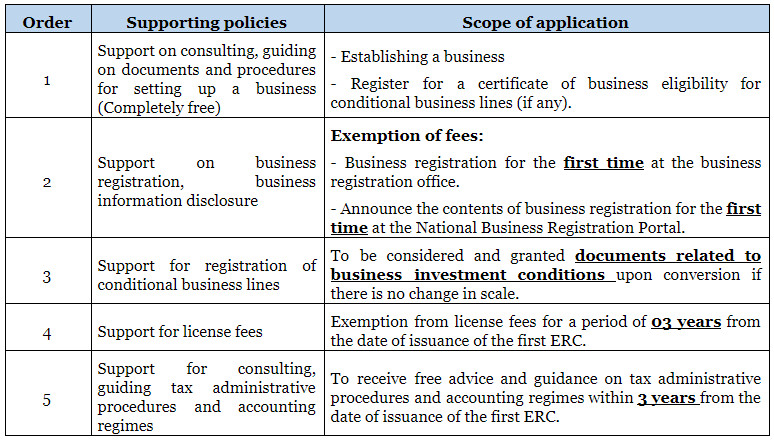

In the following, the article will review the “exclusive” support policies for SMEs converted from business households in Decree No. 80, specifically as follows:

For details: Refer to the provisions from Article 15 to Article 19 of Decree No. 80.

Decree No. 80 takes effect from October 15, 2021.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

On September 24, 2021, the Government issued Resolution No. 116/NQ-CP on policies to support employees and employers affected by the Covid-19 pandemic from The Unemployment Insurance Fund.

Accordingly, this Resolution has set out support policies for employees and employers, specifically as follows:

For employees

– The applicable subjects are employees who are participating in unemployment insurance as of September 30, 2021 (does not apply to employees working at state agencies, political organizations, socio-political organizations, people’s armed forces units, and public non-business units whose recurrent expenditures are guaranteed by the state budget) and Employees who have temporarily stopped participating in unemployment insurance due to the termination of their labor contracts or working contracts for the period from January 1, 2020, to September 30, 2021, have the time to pay unemployment insurance with contribution periods are reserved (except monthly old-age pensioners).

– The support level will be from 1,800,000 VND/person to 3,300,000 VND/person depending on the period of paying unemployment insurance, specifically: (i) paying unemployment insurance premiums for less than 12 months will support 1,800,000 VND/person; (ii) payment of unemployment insurance from full 12 months to less than 60 months, support 2,100,000 VND/person; (iii) pay unemployment insurance from full 60 months to less than 84 months, support 2,400,000 VND/person; (iv) pay unemployment insurance from full 84 months to less than 108 months, support 2,650,000 VND/person; (v) pay unemployment insurance from full 108 months to less than 132 months, support 2,900,000 VND/person; (vi) pay unemployment insurance for 132 months or more, support VND 3,300,000/person.

– The time to implement the support for employees is from October 1, 2021, and will be completed by December 31, 2021, at the latest.

For employers

– Applicable subjects are employers participating in unemployment insurance such as enterprises, cooperatives, households, business households, cooperative groups, other organizations, and individuals that hire and employ employees according to their requirements employment contract or employment contract.

– The support policy is to reduce the contribution to the Unemployment Insurance Fund for employers affected by the Covid pandemic, specifically: Employers are entitled to reduce the contribution rate from 1% to 0% of the monthly salary fund of employees participating in unemployment insurance (defined in Article 43 of the Employment Law)

– The time to reduce the payment is 12 months from October 1, 2021, to the end of September 30, 2022.

It can be seen that the purpose of the issuance of this Resolution is to show State’s concern for employees and employers affected by the Covid pandemic, and at the same time, contribute to supporting employees to overcome difficulties in their lives, help employers reduce costs, maintain production and business, create jobs for employees, on the other hand, also promote the role of unemployment insurance policy as a support for employees and employers.

Resolution No. 116/NQ-CP takes effect from September 24, 2021.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

From September 1, 2021, Circular 06/2021/TT-BLDTBXH amending a number of articles of Circular 59/2015/TT-BLDTBXH of the Minister of Labor, War Invalids and Social Affairs on detailed regulations and guiding the implementation of a number of articles of the Law on Social Insurance regarding compulsory social insurance which has officially taken effect (“Circular 06”).

Circular 06 has added regulations to clarify conditions for convalescence and health recovery after maternity for female employees that have not been clarified before in Article 41 of the Law on Social Insurance 2014 and Article 13 of Circular 59. As follows:

1. Female employees who have not yet recovered their health after enjoying the maternity regime, within the first 30 working days after their health has not recovered, are entitled to convalescence and health recovery from 05 days to 10 days. The period of the first 30 working days is explained by Circular 06: It is a period of 30 working days from the date of expiry of the maternity leave period but the employee’s health has not yet recovered.

2. In addition, Circular 06 adds: Female employees who go to work before the maternity leave expires are “not entitled” to the convalescence and health recovery regime after the period of maternity leave.

Note: Female employees go to work before the maternity leave period expires as prescribed in Article 40 of the Law on Social Insurance 2014, specifically, female employees go to work before the maternity leave period expires and must meet all 02 of the following conditions:

– After taking leave for at least 04 months;

– Must be notified in advance and agreed to by the employer.

Circular 06 takes effect from September 1, 2021.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

From September 1, 2021, Circular 06/2021/TT-BLDTBXH amending a number of articles of Circular 59/2015/TT-BLDTBXH of the Minister of Labor, War Invalids and Social Affairs on detailed regulations and guiding the implementation of a number of articles of the Law on Social Insurance regarding compulsory social insurance which has officially taken effect (“Circular 06”).

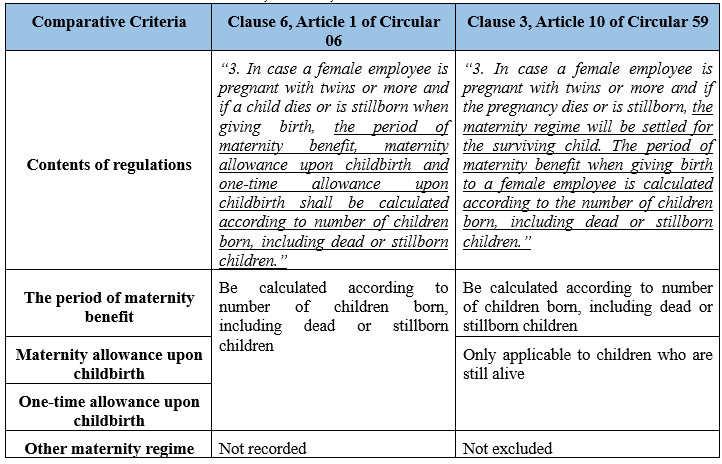

Accordingly, Circular 06 has changed the maternity regime for female employees who are pregnant with twins but due to unfavorable conditions, the child dies or is stillborn. This change is necessary in order to create better conditions and help female employees in the process of recovering their health and spirit. Specifically, in Clause 6, Article 1 of Circular 06, the first stanza has been amended, Clause 3, Article 10 of Circular 59 as follows:

Therein:

1. The period of maternity benefit (Clause 1, Article 34 of the Law on Social Insurance 2014): Female employees who give birth are entitled to take maternity leave before and after giving birth for 6 months. In case female employees have twins or more, from the second child onwards, for each child, the mother is entitled to an extra month of leave. The maximum period of maternity leave before giving birth is not more than 02 months.

2. Maternity regime (From Article 32 to Article 41 of the Law on Social Insurance 2014): Is a regulation with many contents including The period of maternity benefit; One-time allowance upon childbirth or adoption; Maternity allowance upon childbirth and other maternity benefits. Other maternity regimes such as The period of enjoying the regime during antenatal care; The period of enjoyment of the regime in case of miscarriage, curettage, abortion, stillbirth, or pathological abortion; The period of enjoying the regime when adopting a child; The period of enjoying the regime when taking contraceptive measures; Female employees go to work before the maternity leave expires; Health care and recovery after pregnancy.

3. Maternity allowance upon childbirth (Article 39 of the Law on Social Insurance 2014): Determined based on the Maternity benefit rate (x) The period of maternity benefit. In which, the 1-month Maternity benefit rate = 100% of the average monthly salary on which social insurance premiums are based for the 06 months before taking leave to enjoy the maternity regime.

4. One-time allowance upon childbirth (Article 38 of Law on Social Insurance 2014): Female employees who give birth or employees who adopt children under 6 months old are entitled to a One-time allowance for each child equal to 2 times the rate base salary in the month the female employee gives birth or the month the employee adopts a child. In case of childbirth but only the father participates in social insurance, the father is entitled to a One-time allowance equal to 02 times the basic salary in the month of childbirth for each child.

Circular 06 takes effect from September 1, 2021.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

From September 1, 2021, Circular 06/2021/TT-BLDTBXH amending a number of articles of Circular 59/2015/TT-BLDTBXH of the Minister of Labor, War Invalids and Social Affairs on detailed regulations and guiding the implementation of a number of articles of the Law on Social Insurance regarding compulsory social insurance which has officially taken effect (“Circular 06”).

Accordingly, Circular 06 has clarified the condition that male employees are entitled to a one-time allowance when their wives give birth, which is stipulated in Article 38 of the Law on Social Insurance. Specifically, Clause 5, Article 1 of Circular 06 stipulates:

“In case the mother participates in social insurance but is not eligible to receive maternity benefits when giving birth, while the father has enough time to pay insurance then the father is entitled to a one-time allowance according to the statutory rate.”

Inside:

The mother participates in social insurance but is not eligible to receive maternity benefits: are the following cases (Not satisfying Article 31 of the Law on Social Insurance).

• Female workers giving birth; surrogacy and ask for surrogacy; Adoption of a child under 6 months of age paying social insurance premiums for less than 6 months during the 12 months before giving birth or adopting a child.

• Female employees who give birth while pregnant must take time off work to take care of the pregnancy under the direction of a competent medical examination and treatment facility paying social insurance premiums for less than 3 months in the 12 months before giving birth.

Time to pay insurance: Male employees must pay social insurance premiums for full 06 months or more within 12 months before giving birth; The husband of the mother who asks for surrogacy must pay social insurance premiums for full 06 months or more within 12 months up to the time of receiving the child.

The statutory rate: 02 times the base salary in the month of childbirth for each child.

Circular 06 takes effect from September 1, 2021.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

On August 24, 2021, the Vietnam General Confederation of Labor issued Decision No. 3089/QD-TLD in 2021 on support meals for union members and employees who are doing “3 on-the-spot” activities of enterprises in the provinces and cities that implement social distancing in the whole province and city according to Directive 16/CT-TTg. Accordingly, this Decision stipulates the specific meal support level as follows:

• Objects entitled to suppor: Union members and employees working at enterprises paying trade union fees, doing “3-on-the-spot” for production.

• Support level: 1,000,000 VND/person, 1 time support.

• Time to implement support: Calculated from the effective date of the Decision – August 24, 2021

• Funding for implementation:

1. Support is provided to the grassroots trade union by the direct superior trade union from the unit’s accumulated financial resources. In case the immediate superior trade union does not have enough resources to provide support, then the Labor Confederation of provinces and cities; Central trade union and equivalent; Corporation’s Trade Union under the General Confederation shall cover.

2. The Labor Confederation of provinces and cities; Central trade union and equivalent; Corporation’s Trade Union under the General Confederation provide support to the superior trade union directly from the entity’s accumulated financial resources still in use at the time of grant. The case of The Labor Confederation of provinces and cities; Central trade union and equivalent; Corporation’s Trade Union under the General Confederation do not have enough resources to supply it, the General Confederation shall compensate for it so that The Labor Confederation of provinces and cities; Central trade union and equivalent; Corporation’s Trade Union under the General Confederation shall provide enough for the direct superior trade union.

• Implementation:

1. Report the number of union members and employees mobilized by the enterprise to carry out “3-on-the-spot” maintenance of production:

The grassroots trade union reports the quantity to the immediate superior trade union at the grassroots level for funding appraisal;

In case the enterprise has paid trade union fees but has not organized a trade union, the immediate superior trade union working with the enterprise shall check and determine the number of union members and employees.

2. Request for support:

The immediate superior Trade Union at the grassroots level proposes the Provincial and City Labor Confederation; Central trade union and equivalent; The Corporation’s Trade Union under the General Confederation provides support when the source cannot be balanced.

Labor Confederation of provinces and cities; Central trade union and equivalent; The Corporation’s Trade Union under the General Confederation requests the General Confederation to provide support when the source cannot be balanced.

3. On the basis of the proposal of union members and employees, the grassroots trade union (The immediate superior Trade Union for enterprises without a trade union) agree with the business owner on the method of organization, meals, transfer funds to support enterprises to organize meals according to the general policies of enterprises; at the same time, the grassroots trade union (The immediate superior Trade Union for enterprises without a trade union) supervises the organization of meals and makes them public to union members and employees.

This decision takes effect from August 24, 2021.

On July 15, 2021, the Government issued Decree 69/2021/ND-CP on renovation and reconstruction of apartment buildings (“Decree 69”), this Decree replaces Decree 101/2015/ND-CP on renovation and reconstruction of apartment buildings (“Decree 101”).

The introduction of Decree 69 is expected to overcome the difficulties and backlogs that have not been resolved during the implementation of Decree 101 which have been raised by the Ministry of Construction in Official Dispatch No. 159/BXD-QLN dated June 28, 2019. Specifically:

“The Ministry of Construction still receives many opinions from businesses, associations, the press and especially the opinions of National Assembly deputies and voters nationwide regarding the implementation of renovation and reconstruction of old apartments in most localities, it is still slow, leading to the situation that many households are still living in severely damaged and in danger of collapse, do not guarantee the safety of the owners and users of the old apartment building.”

Following are the highlights of Decree 69:

1. Firstly, Decree 69 clearly stipulates the cases in which the apartment building “must” be demolished to rebuild the apartment building or build other works according to the planning (Article 5 of Decree 69).

2. Second, Decree 69 stipulates more clearly on compensation, support, resettlement, and arrangement of temporary accommodation for owners and users of apartment buildings. In which, there is a separate section to specify relevant regulations (From Article 20 to Article 24 of Decree 69):

– Principles and content of compensation, support, resettlement, and temporary accommodation arrangements for owners and users of the apartment building.

– Compensation, support, and resettlement plans for houses and construction works not under state ownership.

– Compensation, support, and resettlement plans for houses and construction work under state ownership.

– A plan for temporary accommodation for owners and users of the apartment building.

– Sign contracts to buy, rent, lease-purchase houses, and construction works for resettlement.

Decree 69 takes effect from September 1, 2021.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

On August 23, 2021, the Governor of the State Bank of Vietnam issued Circular No. 13/2021/TT-NHNN amending and supplementing a number of articles of Circular No. 26/2013/TT-NHNN on the Service Fee Schedule for payment via the State Bank of Vietnam. Accordingly, this Circular stipulates the reduction of specific payment fees as follows:

50% discount on payment fees at 02 services in the Schedule “Transaction fees for payment via Interbank Electronic Payment System” from September 1, 2021, to the end of June 30, 2022, including:

• Charge for payment transactions performed via the high-value payment subsystem, specifically:

Applied to any payment order that the payment system receives before 3:30 pm every day: Reduce from 0.01% to 0.005% of the amount paid (1,000 VND/item at a minimum; 25,000 VND/item at maximum).

Applied to any payment order that the payment system receives from 3:30 pm to the time when the payment system stops receiving payment orders in a day: Reduce from 0.02% to 0.01% of the payment amount (2,000 VND/item at a minimum; 50,000 VND/item at maximum).

• Charge for payment transactions performed via the low-value payment subsystem is reduced from 2,000 VND/item to 1,000 VND/item.

This Circular takes effect from September 01, 2021.

On June 30, 2021, the Ministry of Natural Resources and Environment issued Circular No. 09/2021/TT-BTNMT amending some Articles of circulars elaborating and proving guidelines for Land Law. This document takes effect from September 1, 2021.

Accordingly, cases of transferring land-use rights without obtaining permission from competent state agencies but must register fluctuations include:

• Repurposing of land for annual plant farming land into other types of agriculture land, namely: Land for construction of greenhouses and other housing for crop production; land for construction of housing for livestock, poultry, and other lawful animals; and land for aquaculture for the purposes of study, research and experimentation;

• Repurposing of other lands for annual plant farming land farming and land for aquaculture into land for perennial plant farming;

• Repurposing of land for perennial plant farming into land for aquaculture and land for annual plant farming;

• Repurposing of residential land into non-agricultural land which is not the residential land;

• Repurposing of land for trading, service activities into land for non-agricultural business which is not the land for non-agricultural production base (Amendments); Repurposing of land for non-agricultural business which is not the land for non-agricultural production base and land for non-agricultural business into land for construction of non-business works.

Accordingly, Circular 09/2021/TT-BTNMT has removed the case “Repurposing of land for trading, service activities into land for non-agricultural production base” from the list of cases that do not require permission but must register fluctuations at Clause 1, Article 12 of the previous Circular 33/2017/TT-BTNMT, this adjustment is consistent with point g, Clause 1, Article 57 of the Land Law 2013.