On October 11, 2021, the Prime Minister issued Decision No. 31/2021/QD-TTg promulgating the Regulation on management, operation, and exploitation of the National Service Portal (“The Decision 31”). The Decision 31 consists of 8 chapters and 64 articles detailing principles, powers, responsibilities, methods of management, operation, and exploitation of the National Public Service Portal.

Through this article, let’s learn together with Bizlawyer about 05 principles of management, operation, and exploitation of the National Public Service Portal under The Decision 31:

– Principle 01: The management, operation, and exploitation of the National Public Service Portal must comply with the provisions of the law on control of administrative procedures, implement the one-stop mechanism, an interconnecting door, electronic transactions, information safety, security, protection of State secrets and other relevant regulations, ensuring that the implementation of administrative procedures in the electronic environment and online public services is smooth, economical, safe and effective.

– Principle 02: The organization of information on the National Public Service Portal is user-centered. The information provided on the National Public Service Portal is accurate, clear, continuously updated, and timely in accordance with current regulations. The information is presented scientifically, accessible to users, and can be accessed and exploited at all times.

– Principle 03: The National Public Service Portal is connected smoothly and continuously with the Public Service Portal, an Electronic one-stop information system at the ministerial and provincial level, Guaranteed 24-hour operation every day of the week.

– Principle 04: Participation in the management, operation, and exploitation of the National Public Service Portal ensure proper authority and responsibility in accordance with current law provisions.

– Principle 05: The exploitation and reuse of information of organizations and individuals in performing administrative procedures and online public services must comply with the provisions of the law on information protection, personal data.

The issuance of Decision 31 has proven the efforts of the government in reforming administrative procedures and public services today. In addition, the application of modern science and technology in public administration is expected not only to improve the quality of management activities of state agencies but also to positively improve life and work. of all individuals and organizations in society.

Decision 31 will take effect from December 9, 2021.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

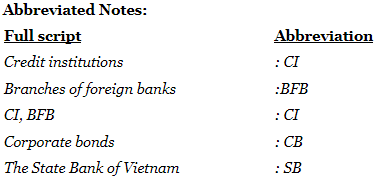

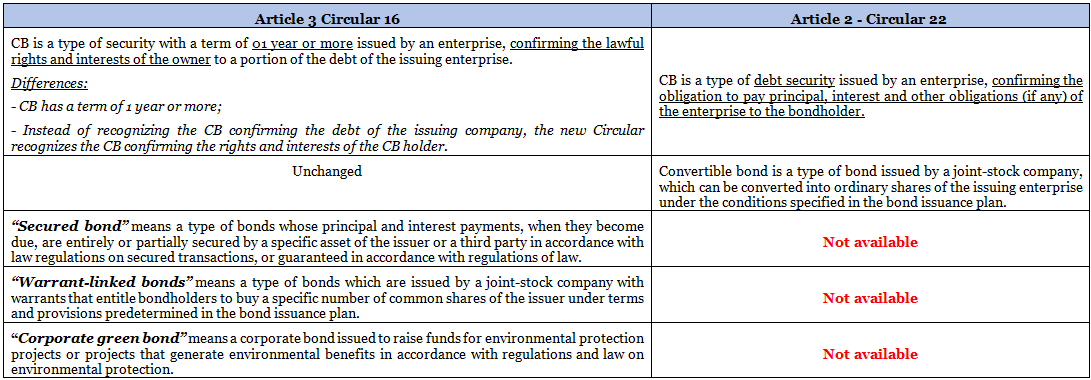

On November 10, 2021, the Governor of the State Bank of Vietnam issued Circular 16/2021/TT-NHNN on the purchase and sale of corporate bonds by credit institutions and foreign bank branches (“Circulars 16”), accordingly, Circular 16 replaces Circular No. 22/2016/TT-NHNN (“Circular 22”) and Circular No. 15/2018/TT-NHNN (“Circular 15”).

Through this article, readers, please join Bizlawyer to learn about the new point in Circular 16 compared to the previous regulations. Specifically: New terms in the purchase and sale of corporate bonds of credit institutions. Details as in the comparison table below.

The above are Bizlawyer’s updates on New terms in the purchase and sale of corporate bonds of credit institutions.

Circular 16 will take effect from January 15, 2022.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

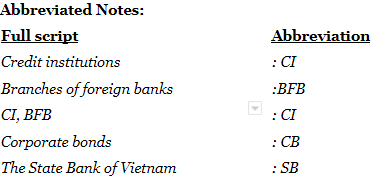

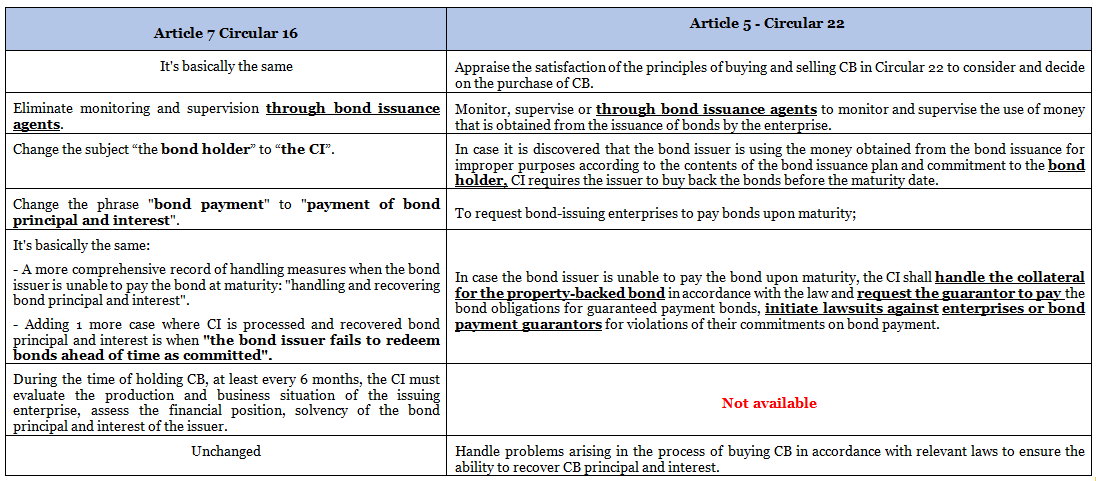

On November 10, 2021, the Governor of the State Bank of Vietnam issued Circular 16/2021/TT-NHNN on the purchase and sale of corporate bonds by credit institutions and foreign bank branches (“Circulars 16”), accordingly, Circular 16 replaces Circular No. 22/2016/TT-NHNN (“Circular 22”) and Circular No. 15/2018/TT-NHNN (“Circular 15”).

Through this article, readers, please join Bizlawyer to learn about the new point in Circular 16 compared to the previous regulations. Specifically: New adjustments on the responsibilities of CIs when buying CBs according to the new Circular. Details as in the comparison table below.

The above are Bizlawyer’s updates on New adjustments on the responsibilities of CIs when buying CBs according to the new Circular.

Circular 16 will take effect from January 15, 2022.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

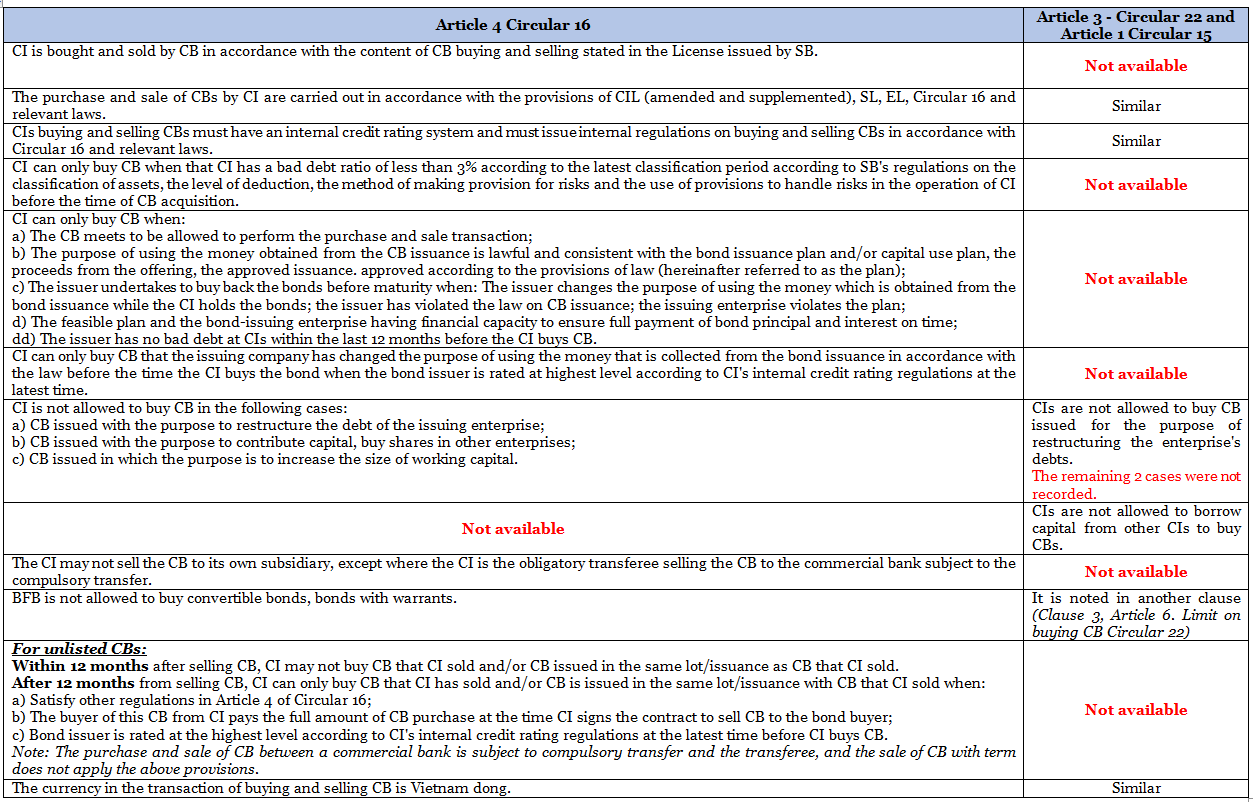

On November 10, 2021, the Governor of the State Bank of Vietnam issued Circular 16/2021/TT-NHNN on the purchase and sale of corporate bonds by credit institutions and foreign bank branches (“Circulars 16”), accordingly, Circular 16 replaces Circular No. 22/2016/TT-NHNN (“Circular 22”) and Circular No. 15/2018/TT-NHNN (“Circular 15”).

Through this article, readers, please join Bizlawyer to learn about the new point in Circular 16 compared to the previous regulations. Specifically: New principles in buying and selling CBs of CIs. Details as in the comparison table below:

The above are Bizlawyer’s updates on the new principles in buying and selling CB of CIs in Circular 16 compared to Circular 22 and Circular 15.

Circular 16 will take effect from January 15, 2022.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

On September 25, 2021, the Government issued Decree No.85/2021/ND-CP amending and supplementing a number of articles of Decree No.52/2013/ND-CP dated May 16, 2013, on the e-commerce trading floor. As for regulations on information on goods and services introduced on sales e-commerce websites, in this Decree, a number of new regulations have been added, including:

Compared with Decree No. 52/2013/ND-CP, Decree No. 85/2021/ND-CP has added conditions (2) and (3) for information about goods and services introduced on the website. Therefore, traders, organizations, and individuals with e-commerce activities need to do the following:

This Decree takes effect from January 1, 2022.

On September 25, 2021, the Government issued Decree No.85/2021/ND-CP amending and supplementing a number of articles of Decree No.52/2013/ND-CP dated May 16, 2013, on the e-commerce trading floor. Accordingly, this Decree has added new regulations on e-commerce activities of foreign traders and organizations, especially regulations on market access conditions of foreign investors in the service sector of e-commerce. Market access conditions include:

In which, a foreign investor is considered to be dominant in an enterprise providing e-commerce services according to the above regulations when it falls into one of the following cases:

(For determining the group of 05 leading enterprises in the market, it is based on the criteria of the number of visits, the number of sellers, the number of transactions, the total transaction value).

Thus, the provision of e-commerce services is a conditional market access industry for foreign investors. When foreign investors conduct investment activities in Vietnam, they must comply with the above regulations on market access conditions.

This Decree takes effect from January 1, 2022.

On September 25, 2021, the Government issued Decree No.85/2021/ND-CP amending and supplementing a number of articles of Decree No.52/2013/ND-CP dated May 16, 2013, on the e-commerce trading floor. Accordingly, this Decree has added new regulations on operation forms of e-commerce trading floors, including:

1. A website that allows its members to open booths for displaying/promoting their goods or services;

2. A website that allows its members to open accounts to carry out the conclusion of contracts with customers;

3. A website that has specific trading categories or tabs that allow its members to post listings of goods and services;

4. A social network that has one of the forms of activities as mentioned in (1), (2), (3) above and the participants directly or indirectly pay fees for the performance of such activities.

Thus, from January 1, 2022, in addition to operating forms of e-commerce trading floors through websites as before, traders and organizations will be able to conduct e-commerce activities through social networks such as Facebook, Zalo, Instagram… Then, people who directly or indirectly participate in those activities on social networking sites must pay a fee.

This Decree takes effect from January 1, 2022.

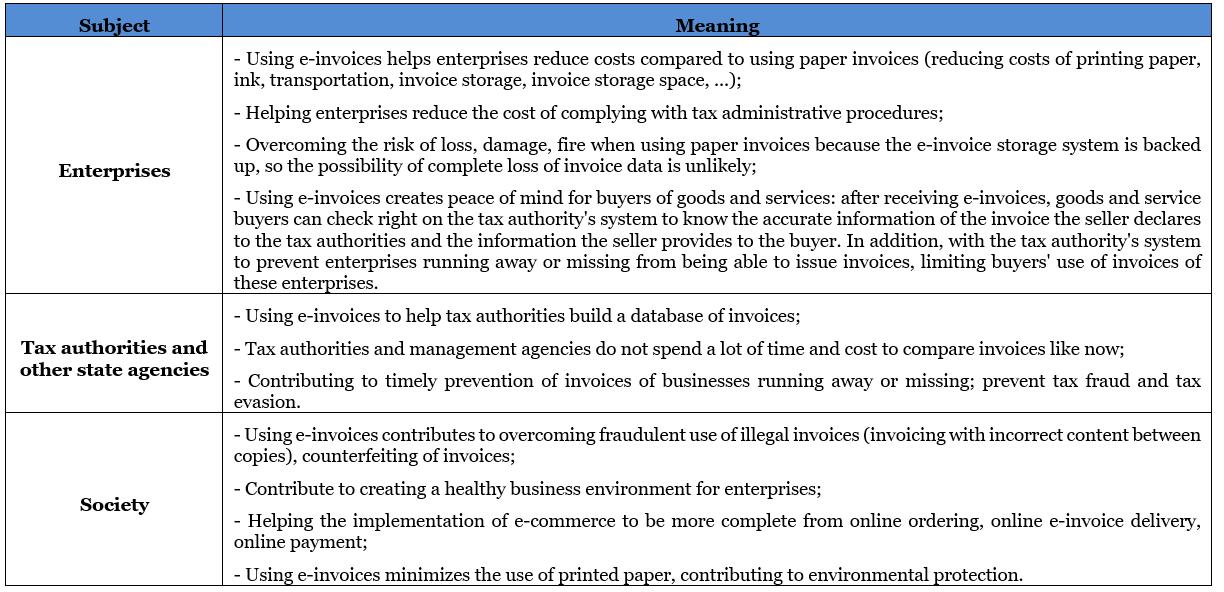

On September 20, 2021, the Ministry of Finance issued Official Letter No. 10847/BTC-TCT on coordination in deploying e-invoices in accordance with the provisions of the Law on Tax Administration No. 38/2019/QH14 and Decree No. 123/2020/ND-CP (“Official Letter 10847”), Official Letter 10847 has been sent directly to the Chairman of the People’s Committee of 06 provinces and cities: Hanoi, Ho Chi Minh, Hai Phong, Phu Tho, Quang Ninh, Binh Dinh.

Here are some typical contents of Official Letter 10847:

1. E-invoices and related laws

– Law on Tax Administration 2019;

– Decree 123/2020/ND-CP regulating invoices and documents;

– Circular 78/2021/TT-BTC guiding the implementation of the Law on Tax Administration, Decree 123/2020/ND-CP stipulating invoices and documents issued by the Minister of Finance.

In which: The Ministry of Finance emphasized: “The most important new point of Decree 123/2020/ND-CP is the regulation on management and use of e-invoices: From July 1, 2022, all enterprises, economic organizations, and business individuals make e-invoices (except for some cases where the conditions are not satisfied as prescribed), encouraging agencies, organizations and individuals to satisfy the conditions on information technology infrastructure shall apply regulations on e-invoices before July 1, 2022.”

2. Meaning of e-invoices for enterprises, management agencies, and society

3. The Ministry of Finance’s plan to deploy e-invoices

– The Ministry of Finance has planned the implementation in two phases: Phase 1 from November 2021; Phase 2 from April 2022;

– The Ministry of Finance has issued the Decision to deploy e-invoice Phase 1 in six provinces and cities: Hanoi, Ho Chi Minh City, Hai Phong, Phu Tho, Quang Ninh, and Binh Dinh. From now to November 2021, there are only two months left, while the implementation works are still many and complicated, the Ministry of Finance respectfully requests the Chairman of the People’s Committee to pay attention and coordinate in directing some key jobs in the locality when deploying e-invoices according to regulations.

For more detailed information: The Esteemed Readers can refer directly to Official Letter 10847.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

On September 17, 2021, the Ministry of Finance issued Circular 78/2021/TT-BTC guiding the implementation of the Law on Tax Administration, Decree 123/2020/ND-CP regulating invoices and documents (“Circular 78”).

One of the notable new points of Circular 78 is the provision on “Roadmap for implementing e-invoice management system of tax authorities”, here are the details.

For more detailed information: The Esteemed Readers can refer to the provisions of Article 10 of Circular 78 and other relevant provisions. Circular 78 takes effect from July 1, 2022.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!

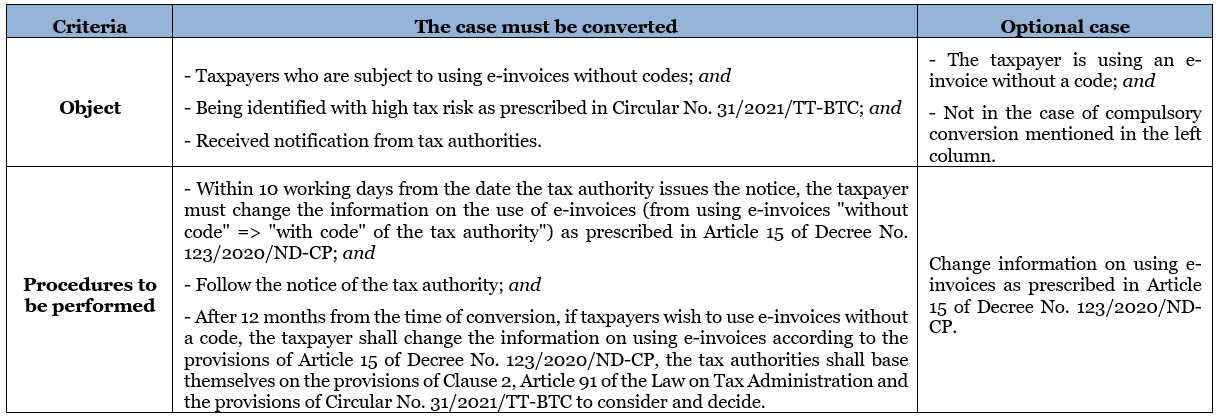

On September 17, 2021, the Ministry of Finance issued Circular 78/2021/TT-BTC guiding the implementation of the Law on Tax Administration, Decree 123/2020/ND-CP regulating invoices and documents (“Circular 78”).

One of the notable new points of Circular 78 is the provision on “Converting to apply e-invoices with tax authority’s code” (From “e-invoice without code” to “e-invoice with tax authority code”), here are the details.

For more detailed information: The Esteemed Readers can refer to the provisions of Article 5 of Circular 78 and other relevant provisions. Circular 78 takes effect from July 1, 2022.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!