From September 1, 2021, Circular 06/2021/TT-BLDTBXH amending a number of articles of Circular 59/2015/TT-BLDTBXH of the Minister of Labor, War Invalids and Social Affairs on detailed regulations and guiding the implementation of a number of articles of the Law on Social Insurance regarding compulsory social insurance which has officially taken effect (“Circular 06”).

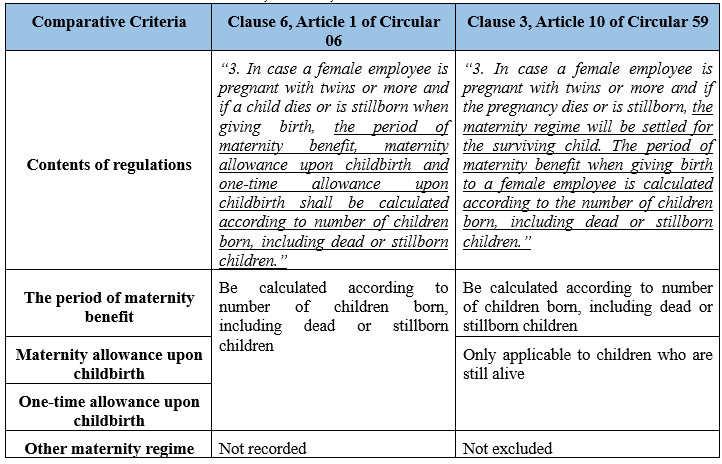

Accordingly, Circular 06 has changed the maternity regime for female employees who are pregnant with twins but due to unfavorable conditions, the child dies or is stillborn. This change is necessary in order to create better conditions and help female employees in the process of recovering their health and spirit. Specifically, in Clause 6, Article 1 of Circular 06, the first stanza has been amended, Clause 3, Article 10 of Circular 59 as follows:

Therein:

1. The period of maternity benefit (Clause 1, Article 34 of the Law on Social Insurance 2014): Female employees who give birth are entitled to take maternity leave before and after giving birth for 6 months. In case female employees have twins or more, from the second child onwards, for each child, the mother is entitled to an extra month of leave. The maximum period of maternity leave before giving birth is not more than 02 months.

2. Maternity regime (From Article 32 to Article 41 of the Law on Social Insurance 2014): Is a regulation with many contents including The period of maternity benefit; One-time allowance upon childbirth or adoption; Maternity allowance upon childbirth and other maternity benefits. Other maternity regimes such as The period of enjoying the regime during antenatal care; The period of enjoyment of the regime in case of miscarriage, curettage, abortion, stillbirth, or pathological abortion; The period of enjoying the regime when adopting a child; The period of enjoying the regime when taking contraceptive measures; Female employees go to work before the maternity leave expires; Health care and recovery after pregnancy.

3. Maternity allowance upon childbirth (Article 39 of the Law on Social Insurance 2014): Determined based on the Maternity benefit rate (x) The period of maternity benefit. In which, the 1-month Maternity benefit rate = 100% of the average monthly salary on which social insurance premiums are based for the 06 months before taking leave to enjoy the maternity regime.

4. One-time allowance upon childbirth (Article 38 of Law on Social Insurance 2014): Female employees who give birth or employees who adopt children under 6 months old are entitled to a One-time allowance for each child equal to 2 times the rate base salary in the month the female employee gives birth or the month the employee adopts a child. In case of childbirth but only the father participates in social insurance, the father is entitled to a One-time allowance equal to 02 times the basic salary in the month of childbirth for each child.

Circular 06 takes effect from September 1, 2021.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!