On September 20, 2021, the Ministry of Finance issued Official Letter No. 10847/BTC-TCT on coordination in deploying e-invoices in accordance with the provisions of the Law on Tax Administration No. 38/2019/QH14 and Decree No. 123/2020/ND-CP (“Official Letter 10847”), Official Letter 10847 has been sent directly to the Chairman of the People’s Committee of 06 provinces and cities: Hanoi, Ho Chi Minh, Hai Phong, Phu Tho, Quang Ninh, Binh Dinh.

Here are some typical contents of Official Letter 10847:

1. E-invoices and related laws

– Law on Tax Administration 2019;

– Decree 123/2020/ND-CP regulating invoices and documents;

– Circular 78/2021/TT-BTC guiding the implementation of the Law on Tax Administration, Decree 123/2020/ND-CP stipulating invoices and documents issued by the Minister of Finance.

In which: The Ministry of Finance emphasized: “The most important new point of Decree 123/2020/ND-CP is the regulation on management and use of e-invoices: From July 1, 2022, all enterprises, economic organizations, and business individuals make e-invoices (except for some cases where the conditions are not satisfied as prescribed), encouraging agencies, organizations and individuals to satisfy the conditions on information technology infrastructure shall apply regulations on e-invoices before July 1, 2022.”

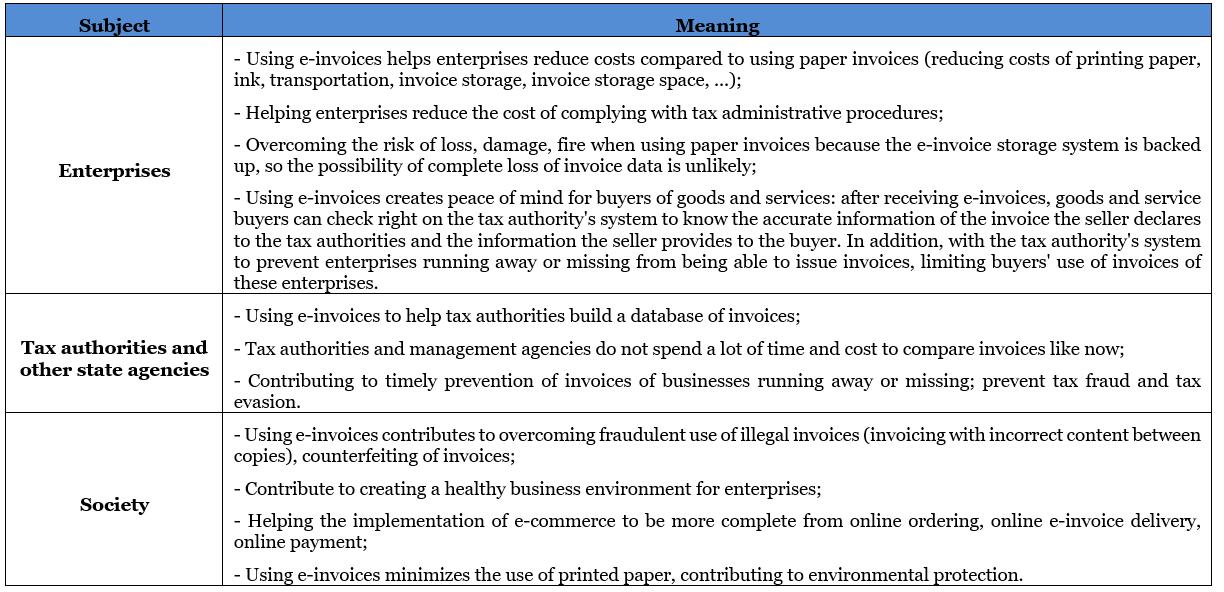

2. Meaning of e-invoices for enterprises, management agencies, and society

3. The Ministry of Finance’s plan to deploy e-invoices

– The Ministry of Finance has planned the implementation in two phases: Phase 1 from November 2021; Phase 2 from April 2022;

– The Ministry of Finance has issued the Decision to deploy e-invoice Phase 1 in six provinces and cities: Hanoi, Ho Chi Minh City, Hai Phong, Phu Tho, Quang Ninh, and Binh Dinh. From now to November 2021, there are only two months left, while the implementation works are still many and complicated, the Ministry of Finance respectfully requests the Chairman of the People’s Committee to pay attention and coordinate in directing some key jobs in the locality when deploying e-invoices according to regulations.

For more detailed information: The Esteemed Readers can refer directly to Official Letter 10847.

* This newsletter is only for informational purposes about newly issued legal regulations, not used to advise or apply to specific cases.

Hope the above information is helpful to The Esteemed Readers.

Bizlawyer is pleased to accompany The Esteemed Readers!